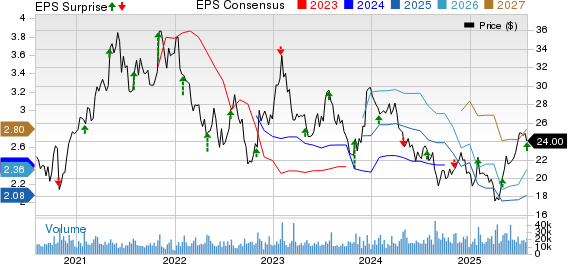

Franklin Resources Inc. (BEN) reported third-quarter fiscal 2025 adjusted earnings of 49 cents per share, exceeding the Zacks Consensus Estimate of 48 cents but down from 60 cents in the same quarter the previous year. The company’s net income on a GAAP basis was $92.3 million, a decrease of 46.9% year over year, and total operating revenues fell 2.8% to $2.06 billion, although it surpassed expectations of $2 billion.

As of June 30, 2025, Franklin’s total assets under management (AUM) rose 4.6% sequentially to $1.61 trillion, despite long-term net outflows of $9.3 billion for the quarter. Average AUM was slightly down, at $1.57 trillion. Total operating expenses increased to $1.91 billion due to rising costs in various sectors, with an operating margin of 7.5%, down from 10.5% year over year. Following the earnings announcement, shares of BEN are down 2.5% in early trading.

For the quarter, Franklin repurchased 7.3 million shares for $157.4 million, with cash and cash equivalents plus investments totaling $6.8 billion and total stockholders’ equity at $13.1 billion.