Co-authored with “Hidden Opportunities.”

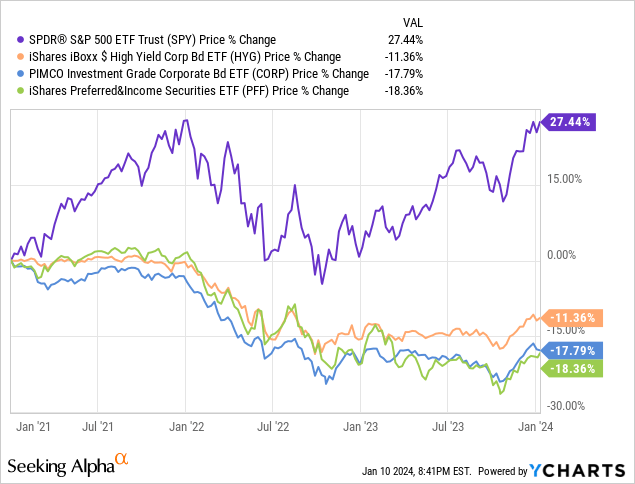

The economy continues to show signs of decelerating inflation, revealing clearer insight into the Fed’s future rate policy. Equities are on the rise, and fixed-income securities, despite being in prime position, remain significantly undervalued, offering substantial potential gains due to impending rate cuts.

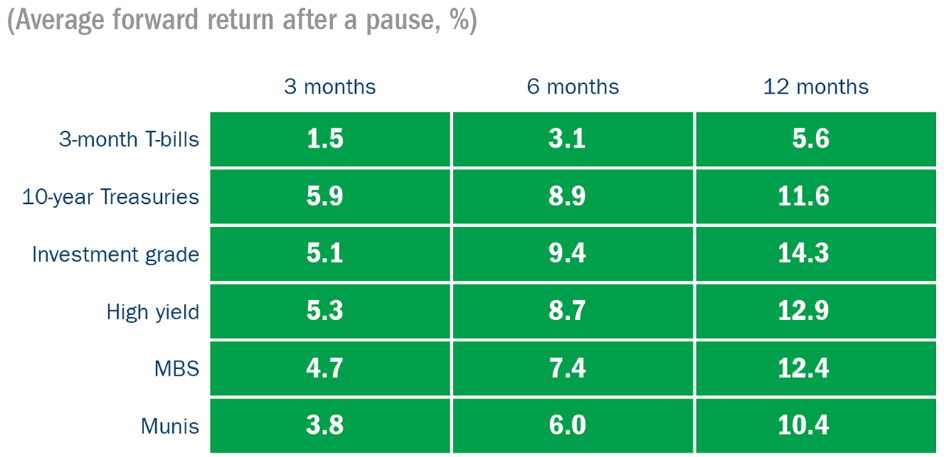

Analyzing historical performance, it is evident that investment-grade and high-yield fixed-income securities tend to yield exceptional returns in the months following the Fed’s rate pause. Source.

“Investors should be getting ready to get out of cash and into the fixed income space, as equities are in all-time highs” – Sonal Desai, Chief Investment Officer at Franklin Templeton Fixed Income.

It isn’t just Franklin Templeton. Other leading firms are recommending the same approach.

“Get out of cash now, take advantage of some of these incredible things in the fixed income markets, especially in the belly of the curve. Take advantage of the companies that are still available to you at reasonable prices.” – Gargi Chaudhuri, head of investment strategy at BlackRock iShares Americas.

Fixed-income securities, namely baby bonds and preferred stock from investment-grade issuers, present an attractive “baby step” from cash equivalents. Their default risk is low, they maintain good liquidity levels, and investors expect significant capital upside in addition to the high current yields. Corporate fundamentals have remained strong to satisfy the obligations to their fixed-income securities.

Examining the data from the Investment Company Institute on money market assets, there are signs of institutional capital moving out while retail investors continue to flock to these guaranteed instruments.

It is only a matter of time before the record cash position moves into quality yields, and for the discounts to vanish. We have two quality preferred picks lined up for you to get ahead of Wall Street on this before it is too late.

Let’s delve into the first pick!

A Gem in the Rough: ESGR Preferreds Offering Up to 7% Yields

Companies, regardless of their size, often undergo significant changes such as mergers, acquisitions, divestitures, spinoffs, and bankruptcies. Moreover, upon completing such a transaction, there arises a need to protect against liabilities and claims from the old business. For instance, if a physician closes their practice, what happens to future claims of medical malpractice for the treatments previously performed?

Runoff insurance, also known as closeout insurance, provides coverage for claims made against companies that have been acquired, merged, or have ceased operations. This insurance is purchased by the acquiring company as part of the closing transaction to seek indemnity from lawsuits.

The duration of the runoff policy is typically set for several years, ensuring constant premiums for the underwriting firm. This longevity of cash flows makes runoff insurance a lucrative business.

Enstar Group Limited (ESGR) takes the lead in this domain with over 30 years of operations, a dominant global presence, and extensive experience in runoff insurance. The company has successfully executed over 117 deals since its establishment.

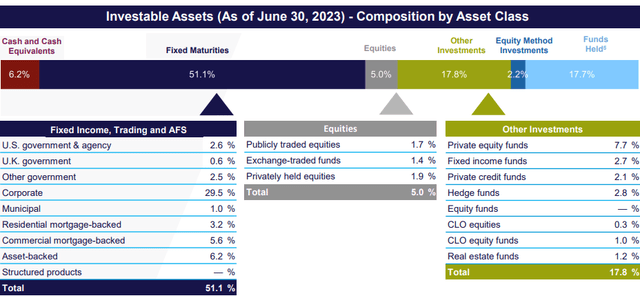

Similar to any insurance company, ESGR invests its holdings in secure financial instruments while securing a high yield, thanks to elevated interest rates. Source.

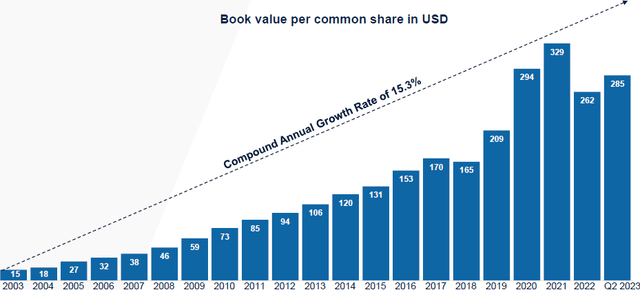

During the third quarter, ESGR recorded a robust net investment income of $143 million, largely driven by a year-over-year improvement in the investment portfolio, supported by higher interest rates. The company also achieved year-to-date growth in book value per share of 7.7%. ESGR has a remarkable track record of book value growth, with a compounded annual growth rate of 15.3% over the past two decades.

During the quarter, ESGR also agreed to repurchase $191 million worth of ordinary shares from CPP Investments and its affiliate and from the Trident V Funds managed by Stone Point Capital LLC at a price per share of $227.18 (a 5% discount at the time of the conference call).

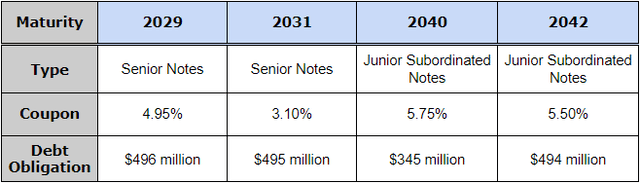

At the end of Q3, the company held $1.2 billion in cash, cash equivalents, and restricted cash, along with an unused $800 million credit facility capacity. ESGR also possesses solely fixed-rate debt with staggered maturities commencing in 2029. The company is well-prepared to navigate this high-interest environment, even with a prolonged period of elevated rates. ESGR’s senior notes hold an investment-grade rating of BBB+.

ESGR offers two attractively priced preferred securities.

-

7.00% Series E, Non-Cumulative Fixed Rate Redeemable Perpetual Preferred Shares (ESGRO)

-

7.00% Series D, Non-Cumulative Fixed-to-Float Redeemable Achieving Sustainability (ESGRP) is well-equipped to meet future interest rate challenges. Through a combination of innovative policy features, consistent investment income, and strategic capital management, ESGR provides a robust opportunity for investors to benefit from fixed-income securities, ensuring a steadfast return in today’s uncertain economic landscape. Now is the time to seize this potential.

Perpetual Preferred Shares: A Haven of Yield Amidst Market Volatility

The world of investments is roiling, with the market’s tempestuous waves causing unease among investors. In such turbulent times, opportunities for stable and bountiful yields are as scarce as hen’s teeth. But fear not, intrepid investor! Enter the realm of perpetual preferred shares – the port in the storm, the savior of the seas, and the harbingers of handsome yields!

ESGR Preferred Shares – Yield 7%

ESGR, in the eye of this investment storm, offers a sailor’s respite – a 7% yield! As the intellectual winds shift, causing ripples and troughs, these preferred shares stand steadfast, their value modestly discounted, yet their dividends qualified, bringing tax benefits to those fortunate enough to partake. In the fiscal year’s nine months, ESGR proved its mettle, expending $27 million on preferred dividends and $67 million on interest expenses, all while setting sail on a share repurchase voyage totaling $340 million. The company’s net earnings, a handsome $483 million, speak to its robust profitability and extraordinary potential for growth. These are not merely shares; they are the treasure chest hidden in plain sight, awaiting the discerning eye of the intrepid investor!

SYF Preferred – Yield 8.2%

Synchrony Financial (SYF), a behemoth in store-branded credit cards, beckons with an 8.2% yield on its preferred stock. As the winds of fortune blow, carrying the ship of investment on a turbulent but lucrative journey, SYF has embarked on a voyage of share repurchases, already reducing its outstanding share count by 5.6%. While navigating the treacherous waters of potential charge-offs, SYF’s investment-grade ratings and robust payout ratios mirror the steadfastness of a seasoned navigator guiding their vessel through tumultuous seas.

Conclusion: The Siren Song of Higher Yields

Amidst the cacophony of market volatility, the allure of fixed-income securities is stronger than ever. The Federal Reserve’s hawkish stance has elevated yields to levels not witnessed in decades, creating an unmissable opportunity for investors to secure substantial long-term returns. In this tempest-tossed investment landscape, the resolute nature of discounted asset classes presents a beacon of hope, illuminating the path toward substantial capital upside.

In the realm of retirement, the quest for a robust income stream demands a diversified and resilient portfolio. The allure of fixed-income yields offers a haven of stability amidst the uncertainties of market fluctuations. By casting our investing nets wide, we can navigate the turbulent seas, safe in the knowledge that our income stream will weather the storms and lead us to tranquil financial shores.

The beauty of income investing lies in its unwavering steadiness, akin to a lighthouse guiding ships through the darkest nights, and it beckons earnestly to those wise enough to heed its call. The future belongs to the long-term thinkers; those who chart their course wisely, with an eye on the boundless horizon, and secure their financial stability amidst the ebb and flow of market tides.