Franklin Resources, Inc. BEN reported its preliminary assets under management (AUM) of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month’s level.

The decline in AUM balance was primarily due to the impact of negative markets and long-term net outflows, including $5.9 billion related to the $25 billion AUM received from the Great-West Lifeco acquistion.

BEN recorded equity assets of $564.4 billion, which declined 4.8% from the previous month. Further, fixed income AUM of $559.6 billion at the end of April 2024 decreased 2.1% from the previous month. Multi-asset AUM and alternative assets were $162.6 billion and $255 billion, respectively, which decreased marginally from March 2024.

However, the cash management balance was $62.2 billion, up nearly 1% from the prior month’s level.

The month of April was a challenging period for Franklin, largely due to weaker markets and long-term net outflows. Nonetheless, increased cash management, along with BEN’s efforts to grow inorganically, supported its financials.

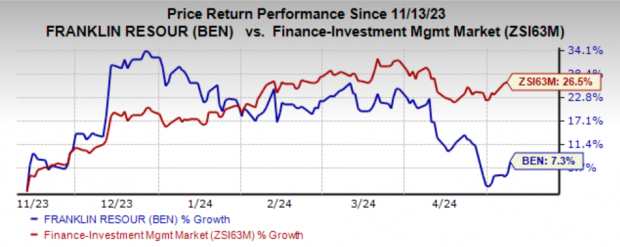

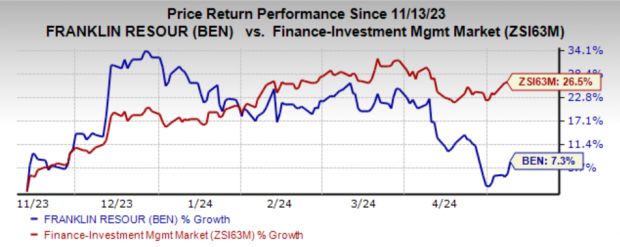

Over the past six months, shares of BEN have gained 7.3% compared with the industry’s 26.5% growth.

Image Source: Zacks Investment Research

Currently, BEN carries a Zacks Rank # 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Virtus Investment Partners, Inc. VRTS recorded a sequential decline of nearly 5.2% in its preliminary AUM balance for April 2024. The company reported a month-end AUM of $170.06 billion, down from the Mar 31, 2024 level of $179.31 billion.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

Victory Capital Holdings, Inc. VCTR reported AUM of $163.6 billion for April 2024. This reflected a 4% decline from $170.3 billion as of Mar 31, 2024.

By asset class, VCTR’s U.S. Mid Cap Equity AUM declined 5.8% from the March level to $31.02. The U.S. Small Cap Equity AUM of $15.18 billion decreased 6.8%. The Global/Non-U.S. Equity AUM declined 2.2% to $17.8 billion. The U.S. Large Cap Equity AUM dropped 5.5% to $13.13 billion.

Free Report – The Bitcoin Profit Phenomenon

Zacks Investment Research has released a Special Report to help you pursue massive profits from the world’s first and largest decentralized form of money.

No guarantees for the future, but in the past three presidential election years, Bitcoin’s returns were as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts another significant surge. Click below for Bitcoin: A Tumultuous Yet Resilient History.

Download Now – Today It’s FREE >>

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.