On January 2, 2026, Freedom Capital Markets initiated coverage of Betterware de México, S.A.P.I. de C.V. (NYSE:BWMX) with a “Buy” recommendation, forecasting a 21.20% upside. As of December 21, 2025, the average one-year price target for BWMX is $19.12 per share, with estimates ranging from $15.15 to $23.62, up from its latest closing price of $15.78.

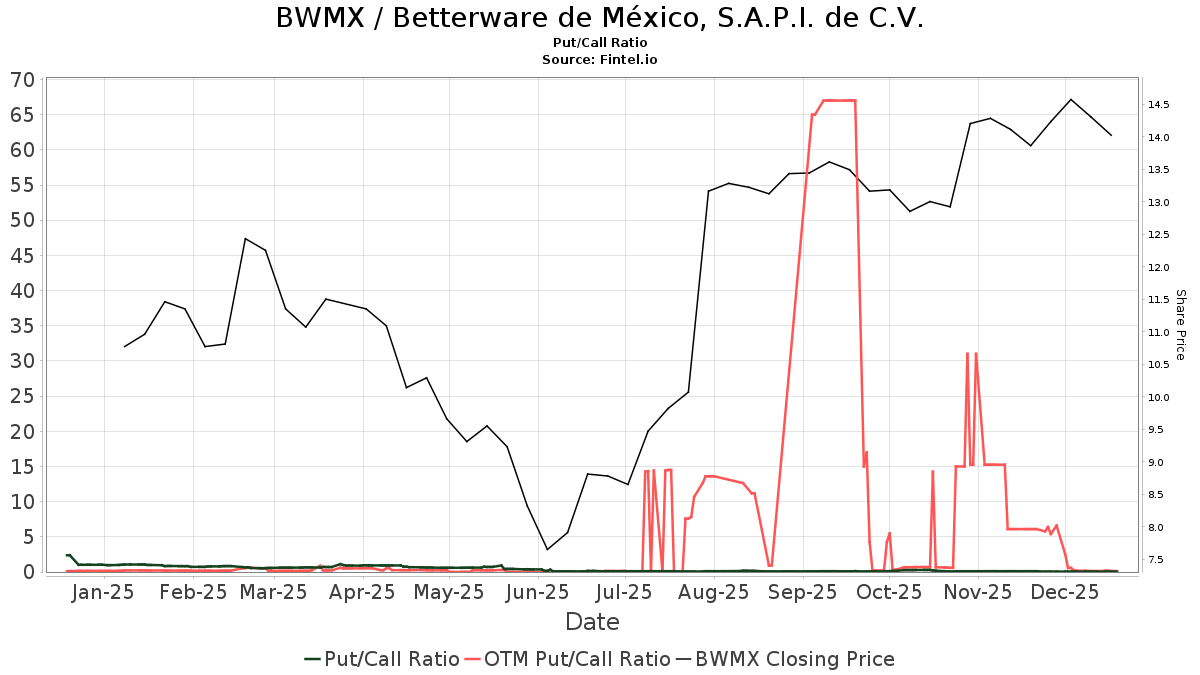

As of the last quarter, 38 funds reported positions in Betterware, a rise of 11.76%. Total institutional shares owned decreased by 18.95% to 4,852K shares, while the average portfolio weight of those funds dedicated to BWMX increased by 16.64% to 0.13%. The put/call ratio stands at 0.02, indicating a bullish outlook.

Key shareholders include Mmbg Investment Advisors with 4,102K shares (11.02% ownership) and an increase in portfolio allocation by 36.97%. Additional increases were noted from Millennium Management and Goldman Sachs, both of which raised their holdings significantly.