Utilities Lag in Afternoon Trading, Healthcare also Struggles

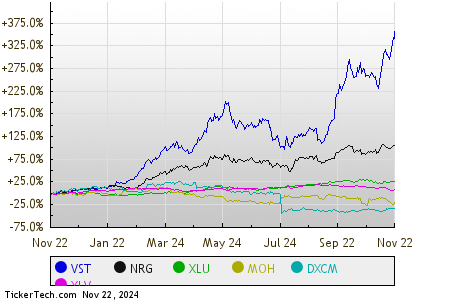

On Friday afternoon, the Utilities sector showed the largest losses, down 0.1%. Among the major companies in this sector, Vistra Corp (Symbol: VST) fell by 2.6%, while NRG Energy Inc (Symbol: NRG) dropped by 1.5%. In the world of utility-focused ETFs, the Utilities Select Sector SPDR ETF (Symbol: XLU) decreased by 0.2% for the day, but it has gained 31.63% year-to-date. Notably, Vistra Corp has surged 323.09% so far this year, and NRG Energy Inc is up 87.79%. Together, these two companies constitute about 6.2% of XLU’s holdings.

Healthcare stocks are also facing challenges, with the sector up 0.4%. Molina Healthcare Inc (Symbol: MOH) and DexCom Inc (Symbol: DXCM) stand out as underperformers, decreasing by 2.6% and 2.2% respectively. The Health Care Select Sector SPDR ETF (XLV) is slightly up by 0.1% during midday trading, but it has risen only 6.95% in 2023. Molina Healthcare has experienced a decline of 20.21% year-to-date, while DexCom is down 41.32%. Combined, these two companies account for approximately 0.9% of XLV’s holdings.

For a better understanding of their performance, below is a chart showcasing the stock price movements of these companies and their associated ETFs over the past twelve months:

This snapshot illustrates how the sectors within the S&P 500 are performing during Friday’s trading session, with eight sectors advancing while only one is declining.

| Sector | % Change |

|---|---|

| Consumer Products | +1.2% |

| Technology & Communications | +1.0% |

| Industrial | +1.0% |

| Services | +0.9% |

| Financial | +0.9% |

| Materials | +0.6% |

| Healthcare | +0.4% |

| Energy | +0.4% |

| Utilities | -0.1% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Also see:

- JWN market cap history

- Institutional Holders of KSCD

- Top Ten Hedge Funds Holding ACU

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.