Technology & Communications: Stocks Sputter

As the clock ticks towards the afternoon, Technology & Communications stocks are veering off course, displaying a 0.9% loss. Among the giants stumbling in this arena are Adobe Inc (Symbol: ADBE) and ServiceNow Inc (Symbol: NOW), both showing discouraging drops of 14.3% and 4.4%, respectively. Within the tech ETF realm, the Technology Select Sector SPDR ETF (Symbol: XLK) is not faring any better, down 1.5% for the day but managing to eke out a meager 6.82% year-to-date gain. Sadly, Adobe Inc has tumbled 18.02% year-to-date, while ServiceNow Inc struggles to stay afloat with a modest 5.52% uptick for the year. Together, ADBE and NOW compose around 3.8% of the holdings under XLK.

Healthcare Sector: Ailing Performance

Joining the bleak landscape of underperformance is the Healthcare sector, showcasing a 0.3% loss. Standing out amidst the turmoil are Abbott Laboratories (Symbol: ABT) and West Pharmaceutical Services, Inc. (Symbol: WST), sporting drops of 4.8% and 2.5%, respectively. Stepping into the ETF arena, the Health Care Select Sector SPDR ETF (XLV) is feeling the pressure, down 0.5% midday but managing to hold on to a modest 6.50% year-to-date increase. Abbott Laboratories is clawing its way up with a 3.33% year-to-date gain, while West Pharmaceutical Services, Inc. remains resilient with a 10.67% uptick for the year. Combined, ABT and WST account for approximately 4.2% of the holdings within XLV.

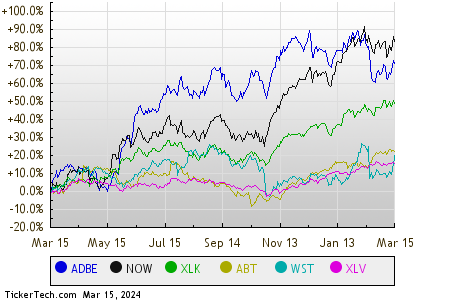

Analysis of the stock and ETF performance over the trailing twelve months reveals a visual representation of the relative stock price changes. Each symbol is denoted by a distinct color, as illustrated in the legend at the base of the chart.

Examining the pulse of the S&P 500 components across various sectors during afternoon trading on Friday portrays a mixed bag of results. While three sectors are enjoying an upswing, four sectors are grappling with downward trends.

| Sector | % Change |

|---|---|

| Materials | +0.6% |

| Consumer Products | +0.4% |

| Energy | +0.3% |

| Utilities | 0.0% |

| Financial | 0.0% |

| Services | -0.2% |

| Healthcare | -0.3% |

| Industrial | -0.3% |

| Technology & Communications | -0.9% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Additional Resources:

EDGE Price Target

Funds Holding NMMC

IBM RSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.