Utilities and Consumer Products Struggle in Friday’s Trading Session

During afternoon trading on Friday, Utility stocks lagged behind, up just 0.6%. Notably, Consolidated Edison Inc (Symbol: ED) and Eversource Energy (Symbol: ES) experienced losses of 2.6% and 0.6%, respectively. In the exchange-traded fund (ETF) space, the Utilities Select Sector SPDR ETF (Symbol: XLU) saw a slight increase of 0.7% for the day, while it has gained 5.98% year-to-date. For context, Consolidated Edison Inc boasts a year-to-date increase of 23.84%, while Eversource Energy’s year-to-date gain stands at 3.61%. Together, these two companies account for approximately 5.0% of XLU’s holdings.

The Consumer Products sector follows as the next weakest area, increasing by 1.0%. Within this sector, key players like Hershey Company (Symbol: HSY) and Conagra Brands Inc (Symbol: CAG) reported declines of 3.2% and 1.7%, respectively. The iShares U.S. Consumer Goods ETF (IYK), which tracks Consumer Products stocks, was relatively flat, posting a 0.1% rise during midday trading, with a year-to-date increase of 7.76%. Hershey Company saw a decrease of 3.69% year-to-date, while Conagra Brands Inc dropped 11.84% over the same period. Combined, HSY and CAG represent about 1.6% of IYK’s underlying holdings.

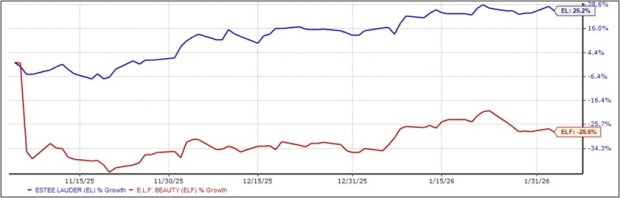

For a broader perspective, a trailing twelve-month performance chart compares these stocks and ETFs, displaying each symbol in a distinct color as labeled in the provided legend.

| Sector | % Change |

|---|---|

| Industrial | +2.2% |

| Financial | +2.1% |

| Technology & Communications | +2.0% |

| Materials | +1.7% |

| Services | +1.6% |

| Energy | +1.5% |

| Healthcare | +1.3% |

| Consumer Products | +1.0% |

| Utilities | +0.6% |

![]() 10 ETFs With Stocks That Insiders Are Buying »

10 ETFs With Stocks That Insiders Are Buying »

Related Insights:

• GGR Stock Predictions

• Institutional Holders of RSSY

• NEP Stock Predictions

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.