Gulf Nations Shift Focus from Oil to AI Infrastructure Investments

This week, significant developments in the AI sector may have gone unnoticed amidst the market’s other distractions, such as Moody’s debt downgrade.

As financial markets react to ongoing political issues, leading tech companies have quietly finalized major AI infrastructure deals with several countries in the Middle East.

These agreements involve billions of dollars for advancements in cloud computing, chip allocations, model training centers, and AI hubs in the region.

This move signals a strategic shift; the Gulf nations are positioning themselves to embrace a technological transition focused on artificial intelligence.

The Gulf’s $3 Trillion Shift to AI Infrastructure

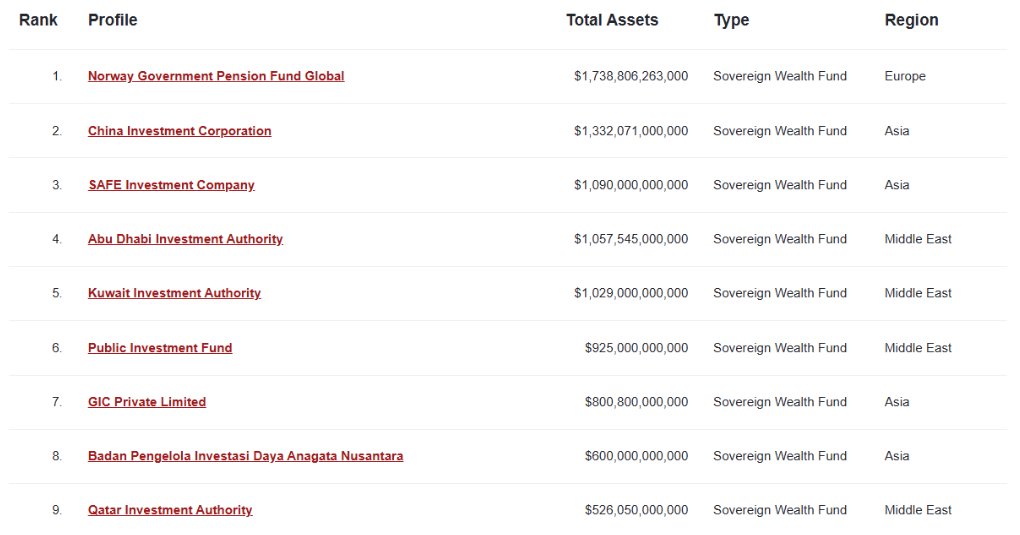

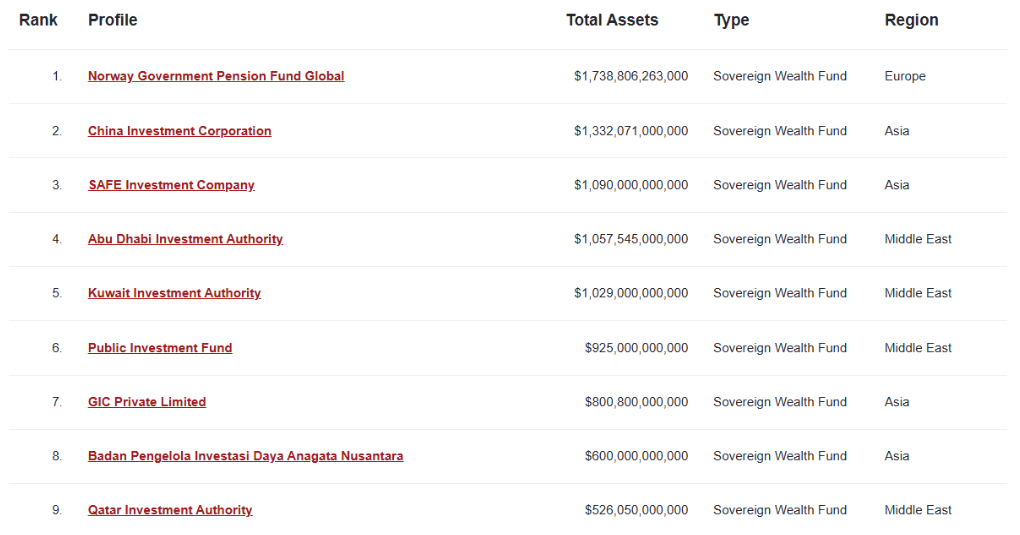

Boasting a war chest of over $3 trillion in sovereign wealth primarily generated from oil revenues, the Gulf region is poised for a significant pivot:

- Saudi Arabia’s Public Investment Fund (PIF): Approximately $900 billion in assets

- UAE’s ADIA and Mubadala: Roughly $2 trillion combined

- Qatar Investment Authority: About $500 billion

These funds are not earmarked for oil but are being redirected toward AI.

These countries aim to transform their economies, significantly investing in AI technologies that will define their future.

Recent AI Investments in the Gulf

In the past two weeks, several key initiatives have emerged:

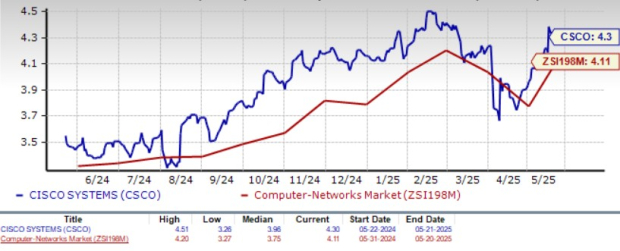

- Microsoft (MSFT): Finalized a multi-billion-dollar deal with G42, an Abu Dhabi-based AI leader, focusing on data centers and GPU clusters.

- Amazon Web Services (AWS): Announced an expansion into Saudi Arabia and the UAE, emphasizing comprehensive AI support.

- Nvidia (NVDA): Collaborating with regional sovereign funds to develop AI chip infrastructure, along with shipping hundreds of thousands of AI chips annually.

- AMD (AMD): Engaged in a $10 billion joint venture with Saudi startup Humain to enhance AI infrastructure development.

- OpenAI and Anthropic: Both exploring strategic collaborations for language model development in the Middle East.

This activity indicates sharp investments from some of the biggest financial players, demonstrating a serious pivot from oil toward AI advancements.

Gulf Nations’ Drive Toward AI Adoption

The Gulf region aims to avoid the missteps it made during previous technological shifts. In the early 2000s, for example, Saudi Arabia and the UAE were slow to embrace the internet due to limited infrastructure and strict government controls.

The same trend continued with mobile and cloud computing, where these nations lagged while relying on imported technologies.

Even in the cryptocurrency realm, while they entered early, many initiatives were overly ambitious without sufficient foundational support.

Now with AI, they are determined to be proactive.

Rather than just investing in existing technologies, Gulf nations are focused on owning the infrastructure that powers AI, which includes building data centers, acquiring GPU clusters, and developing local AI technologies.

This strategic approach is about building data sovereignty and computational dominance for their future economic models.

As these nations ramp up their AI investments, companies and investors in the AI sector should monitor these developments closely.

# Sovereign Wealth Pushes AI Toward a New Investment Era

Recent trends indicate that capital inflow into the AI sector is gaining momentum, not solely from corporations or retail enthusiasm, but also due to significant geopolitical factors.

An Overlooked Catalyst: Sovereign Wealth Driving the Next AI Growth Cycle

Nation-states are increasingly backing the AI boom, suggesting a bullish outlook for several key sectors:

- Nvidia and other AI chipmakers, as heightened investments signal a surge in demand for advanced processors to support complex AI models.

- Major cloud providers like Microsoft, Amazon, and Google, which will have growing infrastructure demands for AI training and implementation.

- Enterprise software companies such as Snowflake, Palantir, and Crowdstrike, as expanded access to AI drives greater adoption of smart tools in businesses and governmental organizations.

- Robotics innovators like Tesla and Figure, as increased regional interest in automation elevates the need for AI-enhanced systems.

When wealthy nations pivot their investments toward semiconductors and software, it signals a long-term commitment to the AI sector.

This shift may catalyze a prolonged rally in AI investments. Many countries are making strategic bets on AI, planning for their future economies as they would once have with oil.

Such developments represent a significant trend that investors should closely monitor.

Expect more GPU investments backed by sovereign wealth funds, partnerships between U.S. technology firms and Gulf states, funding for humanoid robotics, and data training efforts. Nation-specific large language models (LLMs) in languages such as Arabic and Hindi are also on the horizon.

Yet, these shifts remain largely unrecognized by the broader market. While Wall Street focuses on interest rates and inflation, a notable capital rotation occurs right before their eyes.

Why AI Stocks May Benefit Most from This Trillion-Dollar Shift

We are at the beginning of a historic wealth reallocation—from oil fields to data centers and from energy exports to intelligence infrastructure.

Big Oil is now embracing Big AI.

This significant pivot could positively impact investor portfolios.

Investors should remain undeterred by macroeconomic distractions or the prevailing news cycle.

Stay attuned to companies shaping the AI landscape, especially those backed by governmental investments.

The infusion of sovereign wealth into this sector is significant, and it is critical to listen and adapt.

One promising area for investment is AI 2.0 stocks, focusing on companies that develop the next generation of intelligent humanoid robots.

Historically, many overlooked the transformative potential of internet pioneers like Microsoft and Amazon, viewing them merely as tools for niche markets.

Those who recognized the broader implications of these firms enjoyed substantial financial gains.

Investing in robotics could likewise prove to be highly lucrative.

If you require guidance on which companies to prioritize, resources are available to assist in your investment journey.