Fastly (FSLY) reported its Security segment generated revenues of $26.4 million in Q1 2025, marking a 7% increase year-over-year and accounting for 18% of the company’s total revenue. The growth reflects a heightened demand for real-time edge security solutions by enterprises.

The Security portfolio includes offerings such as Client-Side Protection and DDoS detection, aimed at providing automated, low-latency protection. Fastly’s security enhancements, including real-time insights and upgraded bot detection, are gaining traction among enterprise infrastructure teams.

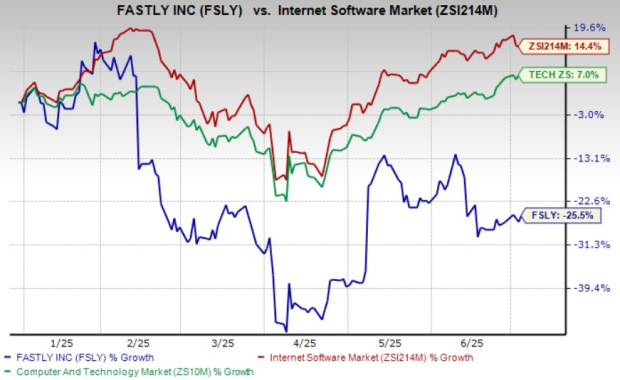

Year-to-date, FSLY’s shares have declined by 25.5%, contrasting with a 7% increase in the broader Zacks Computer & Technology sector. The Zacks Consensus Estimate for FSLY’s Q2 loss is 5 cents per share, indicating a potential improvement of 28.57% compared to the previous year.