Fidelity MSCI Consumer Staples ETF Shows Promising Analyst Upside Potential

At ETF Channel, our analysis of ETFs revealed significant insights regarding their underlying holdings. We compared the trading price of each ETF holding against the average 12-month forward target price set by analysts. For the Fidelity MSCI Consumer Staples Index ETF (Symbol: FSTA), we determined that the implied analyst target price is $55.99 per unit based on its underlying assets.

Currently, FSTA is trading at approximately $49.39 per unit. This indicates a potential upside of 13.36% from the analysts’ average target price for the ETF. Notably, within FSTA’s underlying portfolio, three companies stand out for their projected upside: Herbalife Ltd (Symbol: HLF), PriceSmart Inc (Symbol: PSMT), and Albertsons Companies Inc (Symbol: ACI). At a recent trading price of $8.22 per share, HLF’s average analyst target sits 27.74% higher at $10.50 per share. Similarly, PSMT shows an upside potential of 18.54%, given its recent share price of $85.62 and an analyst target of $101.50. Additionally, ACI is expected to reach a target price of $23.75 per share, representing a 14.13% increase from its current price of $20.81.

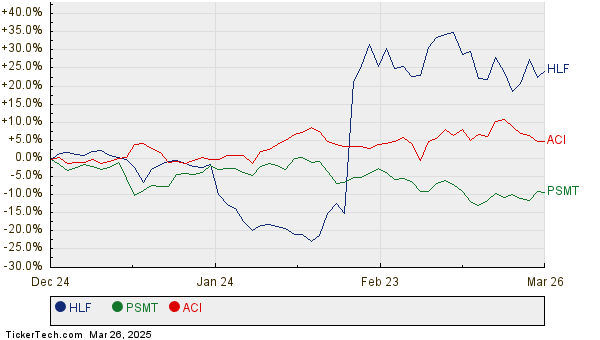

Below is a twelve-month price history chart that compares the stock performance of HLF, PSMT, and ACI:

Here’s a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Consumer Staples Index ETF | FSTA | $49.39 | $55.99 | 13.36% |

| Herbalife Ltd | HLF | $8.22 | $10.50 | 27.74% |

| PriceSmart Inc | PSMT | $85.62 | $101.50 | 18.54% |

| Albertsons Companies Inc | ACI | $20.81 | $23.75 | 14.13% |

These projected price targets raise important questions. Are analysts justified in their predictions, or are they perhaps too optimistic regarding where these stocks might trade in the next twelve months? Investors should consider whether analysts’ justifications are based on solid data or whether they are lagging behind significant recent developments within the companies and their respective industries.

High price targets relative to a stock’s current trading price can indicate future optimism. However, they may also foreshadow potential downgrades if such targets do not align with evolving market conditions. These are critical factors that warrant further investor investigation.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding XFIV

• OHPA YTD Return

• CWF Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.