FTI Consulting, Inc. FCN reported impressive first-quarter 2024 results, with both earnings and revenues beating the Zacks Consensus Estimate.

The stock has gained 2% since the earnings release on Apr 25, in response to the better-than-expected results. Shares have gained 18.8% in the past year, outperforming the 16.3% rally of the industry it belongs to.

Quarterly earnings per share of $2.23 surpassed the Zacks Consensus Estimate by 26.7% and increased 66.4% on a year-over-year basis. Total revenues of $928.6 million beat the consensus mark by 4.9% and increased 15.1% from the year-ago quarter.

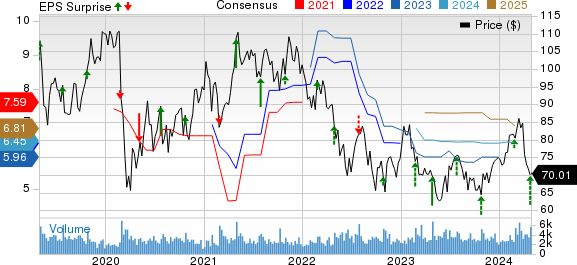

FTI Consulting, Inc. Price, Consensus and EPS Surprise

FTI Consulting, Inc. price-consensus-eps-surprise-chart | FTI Consulting, Inc. Quote

All Segments Grow Double Digits

Technology revenues increased 11% year over year to $100.7 million and outpaced our anticipation of $96.9 million. The uptick was due to higher demand for M&A-related “second request” and information governance, and privacy & security services.

Economic Consulting revenues jumped 20.6% from the year-ago quarter to $204.5 million, surpassing our estimate of $192.5 million. Higher financial economics, non-M&A related antitrust and international arbitration revenues led to this growth.

Corporate Finance & Restructuring revenues gained 16% year over year to $366 million and outpaced our estimate of $336.3 million. The upward movement was due to higher restructuring, business transformation & strategy and transactions revenues.

Strategic Communications revenues climbed 11.1% year over year to $81.2 million and lagged our prediction of $82.2 million. The increase was primarily due to a surge in demand for corporate reputation and Public Affairs services.

Forensic and Litigation Consulting revenues rose 11.6% year over year to $176.1 million, beating our estimate of $163.6 million. The uptick was backed by higher demand for investigations and dispute services.

Margins Expand

Adjusted EBITDA came in at $111.1 million, up 41.6% on a year-over-year basis. This beat our estimate of $100.2 million, up 27.8% year over year. Adjusted EBITDA margin climbed 230 basis points year over year to 12%. This compared favorably with our expectation of 11.5%.

Key Balance Sheet and Cash Flow Figures

FTI Consulting exited the quarter with cash and cash equivalents of $244 million compared with the prior quarter’s $303.2 million. The company had a long-term debt of $205 million at the end of the quarter. FCN used $274.8 million of cash in operating activities in the quarter. The capital expenditure was $4.6 million.

The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots of Some Business Service Stocks

Omnicom OMC reported impressive first-quarter 2024 results, wherein both earnings and revenues beat the Zacks Consensus Estimate.

OMC’s earnings of $1.67 per share beat the consensus estimate by 9.9% and increased 7.1% year over year. Total revenues of $3.6 billion surpassed the consensus estimate by 1.6% and increased 5.4% year over year.

Equifax EFX reported mixed first-quarter 2024 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

EFX’s adjusted earnings were $1.5 per share, ahead of the Zacks Consensus Estimate by 4.2% and up 4.9% from the year-ago quarter. Total revenues of $1.4 billion missed the consensus estimate by a slight margin but increased 6.7% from the year-ago quarter.

ManpowerGroup MAN reported mixed first-quarter 2024 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Quarterly adjusted earnings of 94 cents per share surpassed the consensus mark by 4.4% but declined 41.6% year over year. Revenues of $4.4 billion lagged the consensus mark by 0.6% and fell 7% year over year.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.