“`html

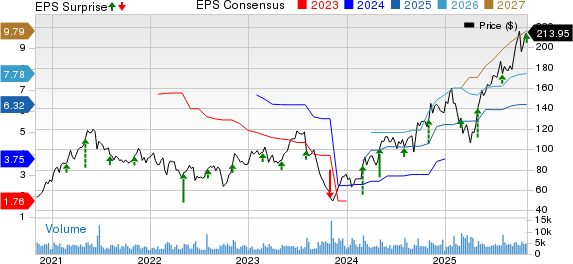

Fortinet (FTNT) has seen a 14.6% stock decline over the past three months, notably underperforming the Zacks Security industry, which grew by 11%. The stock, which peaked at $114.82 in February 2025, has since fallen to the low-$80s, marking a 52-week low of $70.12. This volatility was largely due to disappointing guidance related to the FortiGate firewall upgrade cycle, leading to a 22% drop in one day in August.

Despite the recent downturn, Fortinet’s full-year 2025 guidance indicates strong growth potential, with projected billings between $7.325 billion and $7.475 billion (13% increase) and revenues ranging from $6.675 billion to $6.825 billion. Non-GAAP earnings per share are expected between $2.47 and $2.53, with a Zacks Consensus Estimate for 2025 earnings at $2.52 per share, reflecting a 6.33% year-over-year growth.

Competitive pressures persist as CrowdStrike (CRWD) shares have risen over 19.6% in the same period, while Zscaler (ZS) is up 14.9%. Fortinet’s current Price-to-Book ratio stands at 31.31x, indicating a significant premium compared to its industry peers, which may limit immediate investment upside despite robust innovation and strategic growth initiatives.

“`