Fortinet and Cisco: Analyzed for Investment Potential and Growth

Fortinet (FTNT) and Cisco Systems (CSCO) are prominent names in the network security industry. They both provide enterprise-level cybersecurity solutions and network infrastructure. Fortinet specializes solely in security, while Cisco offers a blend of security and broader networking products.

According to a report by Mordor Intelligence, the network security market is projected to reach $24.95 billion by 2025, with an anticipated compound annual growth rate (CAGR) of 11.47%, bringing it to $42.93 billion by 2030. Both FTNT and CSCO are well-positioned to leverage this significant growth in the market.

This article examines the fundamentals of both stocks to assess which one has greater upside potential.

Analyzing FTNT’s Performance

Fortinet showcased impressive momentum in network security during the first quarter of 2025. The company retained its status as the top global firewall vendor, recording double-digit growth in FortiGate hardware revenues, primarily driven by large enterprise customers upgrading their infrastructure.

A key factor behind Fortinet’s success is its unified Secure Access Service Edge (SASE) platform. In the latest quarter, the company reported an 18% year-over-year increase in unified SASE billings, with large enterprise SD-WAN penetration hitting 73% and a nearly 10 percentage point rise in FortiSASE adoption from the previous quarter. Unique to Fortinet, all core SASE capabilities are developed within a single operating system, FortiOS, enhancing user experience while simplifying operations and reducing costs.

The introduction of the FortiGate 700G series enhances Fortinet’s competitive advantage, offering 5x to 10x performance improvements over competitors through its proprietary FortiASIC technology. The company has secured significant contracts in sectors like government and education, featuring eight-figure SASE deployments and seven-figure SD-WAN deals with multinational firms.

Additionally, Fortinet’s sovereign SASE solution caters to highly regulated industries, including finance and healthcare. This offering allows for full data control on-premise or within a specific country, ensuring compliance without sacrificing performance. Consequently, Fortinet’s secure networking business is steadily gaining market traction due to its high performance and cohesive security approach.

Insights on CSCO’s Growth

Cisco’s network security division produced strong results in the third quarter of fiscal 2025, bolstered by product innovations and increasing customer demand. Security orders grew in the high double digits year over year, with notable contributions from offerings like Splunk, SASE, and new products such as Secure Access, XDR, and Hypershield. Cisco added over 370 new customers across these platforms, many of whom bundled Hypershield with the Cisco N9300 Smart Switch to integrate security seamlessly into the network fabric.

The company has also seen continued strength in its enterprise networking portfolio. Strategic partnerships—such as those with Nvidia—enable Cisco to expand AI-ready secure infrastructure across various sectors, reinforcing its status as a trusted provider in sovereign and enterprise cloud solutions globally.

However, Cisco’s networking growth faces challenging year-over-year comparisons and remains below historical highs. Although AI infrastructure orders surpassed $600 million in the latest quarter, most revenues from these orders are yet to materialize. Cisco also acknowledged uncertainties related to tariffs and macroeconomic conditions that could potentially affect margins, particularly in timing for global public sector and enterprise deployments.

Comparing Stock Performance and Valuation of FTNT and CSCO

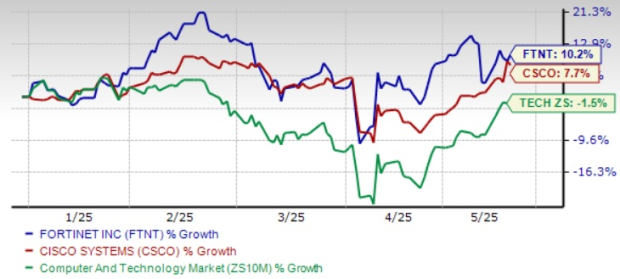

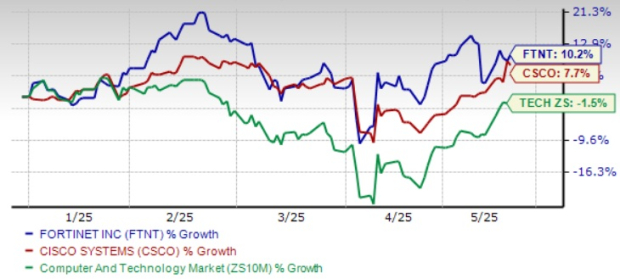

This year, FTNT shares have returned 10.2%, outperforming CSCO’s 7.7% gain, while the Zacks Computer and Technology sector has declined by 1.5%. Fortinet’s edge stems from strong demand for its SASE and firewall solutions.

Stock Performance of FTNT and CSCO YTD

Image Source: Zacks Investment Research

In terms of valuation, FTNT’s forward 12-month price-to-sales (P/S) ratio stands at 11.16X, which is significantly higher than CSCO’s 4.38X. This premium reflects investor confidence in Fortinet’s growth prospects, although it indicates a more cautious sentiment surrounding Cisco’s near-term performance.

Valuation Overview of FTNT and CSCO

Image Source: Zacks Investment Research

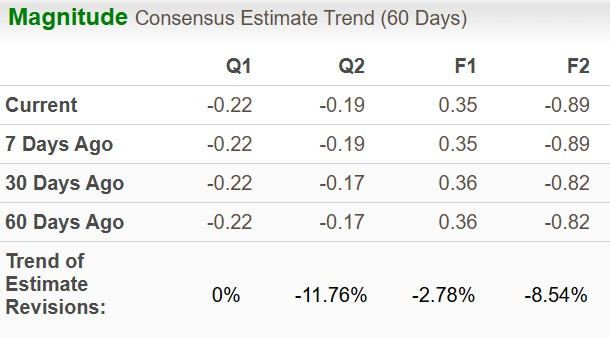

Earnings Estimates for FTNT and CSCO

The Zacks Consensus Estimate for FTNT’s earnings in 2025 is $2.47 per share, revised up by 3 cents in the last 60 days. This reflects a 4.22% increase compared to the previous year. The revenue estimate for 2025 stands at $6.75 billion, suggesting a 13.36% growth year over year.

Price and Consensus for Fortinet, Inc.

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

The Zacks Consensus Estimate for CSCO’s fiscal 2025 earnings is $3.73 per share, with a slight upward revision of one penny over the last 60 days, indicating no change year over year. Revenue estimates for 2025 are projected at $56.43 billion, reflecting a 4.89% year-over-year increase.

Price and Consensus for Cisco Systems, Inc.

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

Fortinet: A Stronger Investment Choice

Fortinet presents a more compelling investment case for 2025, driven by steady double-digit revenue growth, increasing SASE adoption, and leading market position in firewall deployments. The company’s integrated platform, ASIC-driven performance, and momentum in regulated markets like government and finance bolster investor confidence.

Though Cisco shows promise through its AI infrastructure initiatives and Splunk integration, it continues to confront challenges related to delayed revenue recognition and macroeconomic uncertainty.

# Fortinet vs. Cisco: Comparing Network Security Strategies and Outlooks

Fortinet’s slower growth in core security products makes its near-term outlook less attractive when compared to Cisco’s focused and robust strategy in network security. Both companies currently hold a Zacks Rank #3 (Hold).

Market Performance and Prospects

Fortinet’s recent performance indicates a need for improvement in its core offerings. On the other hand, Cisco has managed to leverage its strengths effectively, resulting in a compelling growth trajectory in network solutions. The financials from both entities suggest investor caution as they navigate this evolving landscape.

Industry Trends

As the demand for security solutions escalates, especially amidst growing cyber threats, both companies are well-positioned to adapt. However, Cisco’s strategy focuses on high growth, enabling it to capitalize on market needs more effectively than Fortinet at this time.

The current market dynamics necessitate that investors closely assess the strategies of these players, particularly as industry requirements evolve. Fortinet must revitalize its core offerings to remain competitive.

While both companies share a Zacks Rank #3, the market’s momentum may favor Cisco in the near future due to its focused strategy and robust growth.

Source and More Information: For additional insights, you can view a range of stock analyses on platforms that track these companies closely.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.