FuboTV’s Future: Merger with Hulu and Its Implications

As of 2025, FuboTV (NYSE: FUBO) was struggling in the crowded streaming landscape. Attempting to establish an independent service, FuboTV faced stiff competition from major content producers like Walt Disney (NYSE: DIS). With less than 1.7 million subscribers and significant financial losses, the company’s future appeared uncertain. However, a recent deal with Disney regarding Hulu looks set to change FuboTV’s trajectory. What will this mean for FuboTV in the next three years?

FuboTV’s Achievements

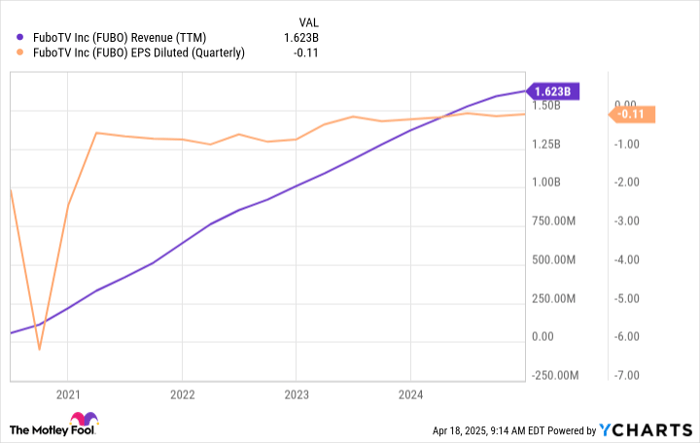

Despite being overshadowed by larger players, FuboTV has garnered a dedicated subscriber base, which has generated a steady income stream. Over the past five years, its revenue has shown consistent growth. Yet, building a sustainable media business is challenging. The increase in revenue hasn’t translated into profitability, as FuboTV has not reached the scale required to compete effectively. Additional investments, particularly in content, are essential for future success. Based on its current standing, FuboTV may not represent a compelling investment opportunity currently.

FUBO Revenue (TTM) data by YCharts

However, the landscape shifted at the start of 2025 when FuboTV and Disney announced a merger with Hulu. FuboTV will manage the combined operations, yet preserve both brands separately. This merger is projected to increase FuboTV’s subscriber base to approximately 6.2 million once finalized.

FuboTV Enters the Major League

The merger will significantly expand FuboTV’s scale, complemented by an influx of about $220 million in capital. Additionally, there’s the potential for a loan of $145 million from Disney, positioning FuboTV with substantial resources for its enhanced operations. For context, FuboTV ended 2024 with about $160 million in cash, a decline from $245 million the previous year.

Looking forward, one pressing question arises: What will FuboTV’s structure be three years from now? Following the Hulu deal, Disney is expected to own 70% of FuboTV’s stock and appoint a majority of its board of directors. Furthermore, the company will owe Disney a significant loan.

In three years, FuboTV may no longer operate as a truly independent entity. While it will remain publicly traded, the influence of Disney’s ownership and control will loom large. This situation raises concerns about FuboTV’s autonomy and financial strategies in the future.

Potential Outcomes of the Merger

Some analysts express caution regarding the Hulu merger. There’s a possibility that Disney could prioritize its profit motives over FuboTV’s growth. Consequently, although FuboTV may gain traction through the deal, it is uncertain whether this will translate into significant financial returns—at least for FuboTV itself.

Investment Considerations for FuboTV

Before deciding to invest in FuboTV, it’s essential to weigh the following:

According to recent assessments, FuboTV was not included among the “10 best stocks” currently recommended by analysts. Investors seeking high returns might consider other opportunities.

Consideration of Track Records: Some companies highlighted in the past have yielded substantial returns, such as Netflix recommended on December 17, 2004, which turned a $1,000 investment into $594,046, and Nvidia, which similarly produced remarkable gains.

Reuben Gregg Brewer holds no positions in the stocks mentioned. It is also noted that the analysis team has positions in and recommends Walt Disney and FuboTV.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.