Fusion Pharmaceuticals FUSN recently inked a deal with AstraZeneca AZN, where AstraZeneca will acquire all outstanding shares of Fusion at $21 per share in cash, totaling $2.0 billion. Existing Fusion shareholders will also receive a non-tradeable contingent value right (CVR) per share, allowing them to earn an additional $3 per share linked to a regulatory milestone. Combining the upfront and potential contingent value payments, shareholders stand to gain up to $2.4 billion.

Fusion Pharmaceuticals, a clinical-stage oncology company renowned for developing next-gen radiopharmaceuticals as precision medicines, boasts a rich pipeline of targeted alpha therapy (TAT) programs.

A Strategic Partnership For Innovative Radiopharma Therapies

This strategic acquisition extends a collaboration initiated in 2020 between AstraZeneca and Fusion to advance and market novel radiopharma therapies targeting cancer indications. Among these initiatives, the companies are progressing with a phase I study of the novel TAT candidate, FPI-2068, focusing on solid tumors carrying EGFR-cMET.

The acquisition also includes Fusion’s prime asset, FPI-2265, tailored to target the prostate-specific membrane antigen (PSMA) expressed in prostate cancer cells. FPI-2265 is presently under evaluation in a phase II study encompassing patients with metastatic castration-resistant prostate cancer (mCRPC).

Besides FPI-2265, Fusion is exploring additional investigational therapies in distinct early-stage studies that target solid tumors. Notably, FPI-1434 is engineered to target tumors expressing IGF-1R, while FPI-2059 focuses on those expressing NTSR1.

Positive Market Response and Strategic Outlook

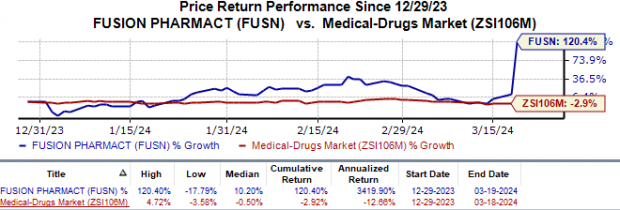

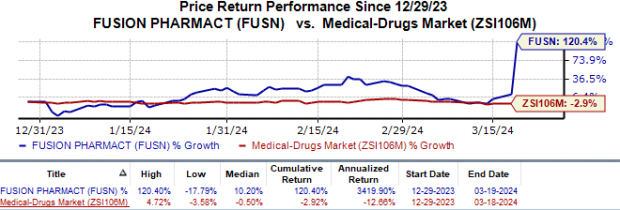

The market responded positively to this news, propelling Fusion’s shares by 99.1% on Mar 19. Year-to-date, Fusion’s stock has surged by an impressive 120.4%, a stark contrast to the industry’s 2.9% decline.

Image Source: Zacks Investment Research

Fusion, lacking a steady revenue stream due to a lack of approved drugs, relies heavily on its pipeline candidates for growth. AstraZeneca’s acquisition offers a gateway to hasten the development of these pipelines. With AstraZeneca’s deep cash reserves and oncology expertise, Fusion stands to benefit from enhanced resources once its pipeline candidates gain regulatory approval for marketing.

AstraZeneca’s Expansion and Diversification Plans

AstraZeneca anticipates that this acquisition will diversify its oncology portfolio, enabling entry into the radiopharmaceutical drugs market. The deal is set to enhance AstraZeneca’s manufacturing capabilities for radiopharmaceuticals and bolster its supply of radioactive materials.

This notable transaction occurs in the wake of several high-profile acquisitions in the radiopharma arena by renowned pharmaceutical giants like Eli Lilly LLY and Bristol Myers BMY. Notable among these was Eli Lilly’s and Bristol Myers’ buyout offers for POINT Biopharma and RayzeBio last year, designed to compete with Fusion Pharmaceuticals in the radiopharma sphere. While Eli Lilly finalized its acquisition in December, Bristol Myers concluded its offer just last month.

Fusion Pharmaceuticals Inc. Price

Fusion Pharmaceuticals Inc. price | Fusion Pharmaceuticals Inc. Quote

Zacks Rank

Fusion currently holds a Zacks Rank #3 (Hold). For more top-rated stocks, explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

Discover a new chip stock with exponential growth potential, dwarfing even the meteoric rise of NVIDIA by more than +800%. With expanding customer bases and robust earnings growth, this stock is primed to meet the escalating demand for Artificial Intelligence, Machine Learning, and Internet of Things technologies. Global semiconductor manufacturing is projected to boom from $452 billion in 2021 to $803 billion by 2028.

Unlock this Stock’s Potential Now for Free >>

Looking for fresh investment insights? Get instant access to the 7 Best Stocks for the Next 30 Days today. Click here to download.

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Fusion Pharmaceuticals Inc. (FUSN) : Free Stock Analysis Report

Access the full article on Zacks.com by clicking here.

The opinions expressed are solely those of the author and do not reflect the views of Nasdaq, Inc.