AI Market Growth Sparks Potential Rivalries for Nvidia’s Dominance

While the excitement surrounding artificial intelligence (AI) continues to rise, experts indicate that this revolution is still in its infancy. Current estimates place the AI market at $189 billion in 2023, with projections from the United Nations forecasting it to reach a staggering $4.8 trillion by 2033.

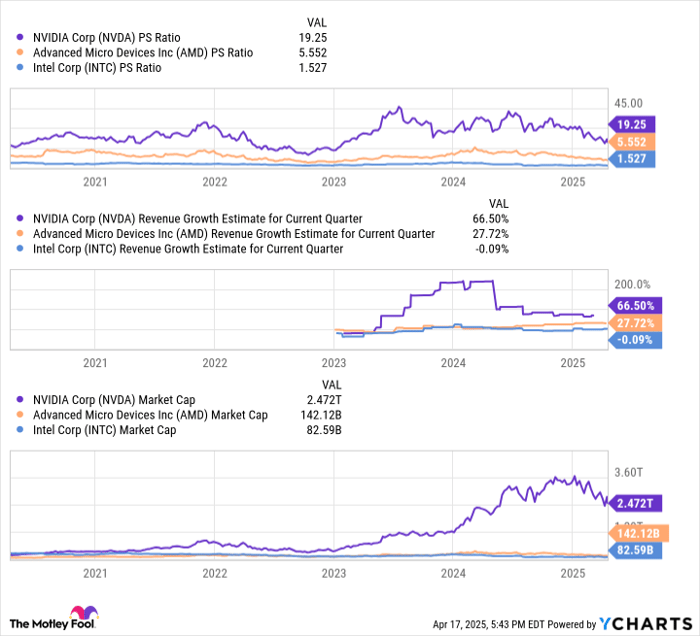

Nvidia has already capitalized on this growth, elevating its market capitalization into the multitrillion-dollar range. However, several other AI firms are trading at mere fractions of that value. Patience may lead investors to see one of these stocks surpass Nvidia’s market cap, yielding considerable returns.

Nvidia’s Competitive Edge in AI

Currently, estimates suggest that Nvidia holds between 70% and 95% of the AI graphics processing unit (GPU) market. GPUs are essential components for training and executing AI models, as well as enabling a variety of machine learning tasks. Without GPUs, the AI revolution would not be gaining such momentum. Nvidia stands out for its dominance in AI-specific GPU sales.

What distinguishes Nvidia’s GPUs in the market? Two key factors: early investments and vendor lock-in through its developer suite called CUDA.

In 2006, Nvidia’s leadership recognized the significance of programmable infrastructure. They understood that developers would require the ability to customize their chips to optimize for specific parameters, enhancing speed and efficiency compared to a traditional GPU. In response, Nvidia launched Compute Unified Device Architecture (CUDA), unlocking the potential of parallel computing. This development made its chips more appealing for performance optimization.

Today, many customers remain loyal to Nvidia products due to CUDA. By tailoring their setups around Nvidia’s hardware, a phenomenon known as “vendor lock-in” has emerged, resulting in Nvidia securing an 80% to 95% market share of AI-related GPUs. Competing against this advantage will be challenging. However, other chipmakers may eventually make headway, with the following companies being solid contenders.

Two Companies Set to Challenge Nvidia

The journey to surpassing Nvidia is not simple. However, in the years to come, Intel (NASDAQ: INTC) and Advanced Micro Devices (NASDAQ: AMD) may rise to the challenge.

AMD appears to be well-positioned to potentially rival Nvidia’s AI dominance in the next five years. Recent benchmark tests show AMD’s latest GPUs competing effectively against Nvidia’s Blackwell chips. Compounding this, Nvidia is struggling to produce enough chips to meet demand, causing shipment delays that allow AMD to cater to growing demand with a faster supply chain, despite having less vendor lock-in.

Currently, Intel trails AMD in the race to match Nvidia. Intel’s market cap stands at about $80 billion, significantly lower than AMD’s at $140 billion. Furthermore, Intel’s shares are priced at just 1.5 times sales, while AMD’s trade at 5.6 times sales. Despite being a long shot, many investors are considering Intel’s capacity to reach Nvidia’s valuation by 2030. The company is making substantial investments to boost its chip competitiveness and manufacturing capabilities. It recently secured a multibillion-dollar contract for AI chips from Amazon and another from the U.S. military.

As for my current preference in this competition, I choose AMD. Its superior chip performance and manufacturing capabilities place it ahead of Intel in the AI GPU sector. With 52% of revenue stemming from data centers compared to just 25% for Intel, AMD is more aligned with the AI economy. While Nvidia’s CUDA architecture will remain a significant barrier for competitors in the near future, both AMD and Intel offer attractive valuations for speculative investments, even if overtaking Nvidia’s position by 2030 seems uncertain.

Is Investing $1,000 in Advanced Micro Devices a Good Idea?

Before committing to advanced micro devices stock, it’s crucial to consider this:

According to analysts, the Motley Fool recently outlined what they believe are the 10 top stocks for investors to buy now—Advanced Micro Devices did not make the list. The selected stocks are positioned for potentially impressive returns in the near future.

For instance, when Netflix was recommended on December 17, 2004, an investment of $1,000 would have grown to $561,046!*

Similarly, a $1,000 investment in Nvidia after its recommendation on April 15, 2005, could be worth $606,106 today!

It’s worth mentioning that Stock Advisor provides an average total return of 811%—significantly outpacing the 153% return of the S&P 500. Join Stock Advisor for the full list of top recommendations.

*Stock Advisor returns as of April 21, 2025

Ryan Vanzo does not hold any positions in the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia. The Motley Fool also recommends shorting May 2025 $30 calls on Intel. A disclosure policy is available.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.