Federal Reserve Wraps Up 2024 with Final Interest Rate Cut

The end of the year is here, and as people rush to finish their holiday preparations, the Federal Reserve has wrapped up its own important business. This week marked the final Federal Open Market Committee (FOMC) meeting of 2024, where a key interest rate decision was made.

Reflecting on a Year of Rate Cuts

The Fed concluded 2024 by implementing one last interest rate cut, which was expected by many investors. However, the year did not begin with such certainty. Initially, experts predicted that the first cut would arrive in the spring, but persistent inflation delayed this timeline.

It wasn’t until September that the Fed lowered rates for the first time since March 2020, offering a significant 0.5% cut. Although prices remained above the Fed’s 2% inflation target, signs showed weakening in the labor market, prompting another reduction on November 7, after the election, this time by 0.25%.

The Latest FOMC Meeting

In this week’s December meeting, the Fed officially cut rates by 0.25% again, bringing the new range to 4.25% to 4.5%. Notably, this decision was not unanimous; Cleveland Fed President Beth Hammack voiced dissent, marking the second dissenting vote in FOMC meetings since 2005.

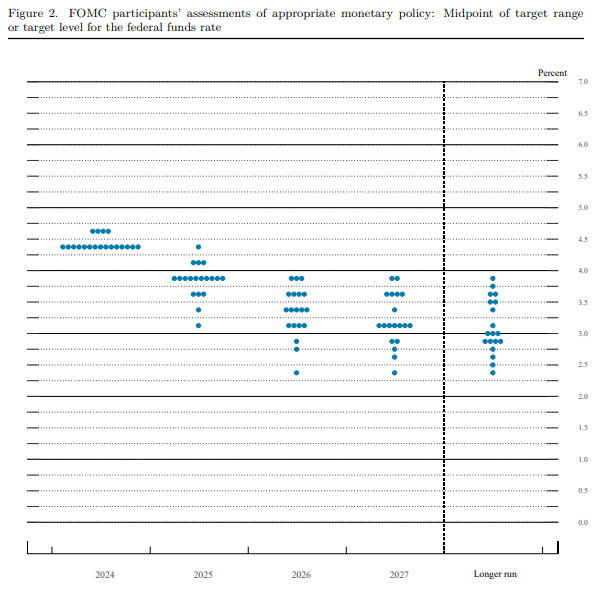

Perhaps most revealing was the latest “dot plot” summary, which suggests a consensus for only two rate cuts in 2025, a significant decrease from September’s forecast of four cuts.

At the press conference, Fed President Jerome Powell emphasized the focus on achieving both maximum employment and stable prices, acknowledging the risks associated with these goals. He noted that the pace of future cuts will depend on data rather than a pre-set plan.

Our monetary policy actions are guided by our dual mandate to promote maximum employment and stable prices for the American people.

Market Response and Economic Outlook

The market reacted negatively to the Fed’s announcement, likely due to concerns raised by the dot plot that suggested a slowdown in rate cuts. Investors are wary about how the Fed will navigate economic conditions in 2025, particularly with inflation remaining a challenge.

While some caution is warranted, there is no need for panic. The Fed’s decisions are often about responding to current economic data, which in turn can be influenced by global economic factors. For instance, Europe is currently experiencing a significant recession, leading to expectations of multiple rate cuts by the European Central Bank next year, which may lessen pressure on U.S. Treasury yields.

Preparing for 2025 and Beyond

As we look toward 2025, it’s essential to strategize your investment portfolio. Seeking out stocks that perform well in varied market conditions—those that “zig” while others “zag”—can provide greater stability. This strategy is at the core of my approach in Growth Investor.

Stocks in my Growth Investor service have shown impressive metrics, with an average annual sales growth of 23.6% and earnings growth of 515.9%. With anticipated earnings growth picking up even more in the new year, I’m optimistic about a strong market start in 2025.

Subscribers to Growth Investor will have access to my predictions for the coming year and insights into two new stock buys with solid fundamentals.

Sincerely,

Louis Navellier

Editor, Market 360

P.S. In a recent initiative, Eric Fry and Luke Lango joined me to develop a portfolio highlighting the top AI stocks as the industry rapidly evolves.

Investing in companies leveraging AI technology now stands as a crucial opportunity. We’ve also produced a special broadcast to share insights with everyday investors.

Click here to watch our special broadcast now.