Key Points

-

Oklo has received substantial backing from the federal government for its nuclear energy technology.

-

The Department of Energy (DOE) has set a target for Oklo to achieve criticality by July 4, 2026.

-

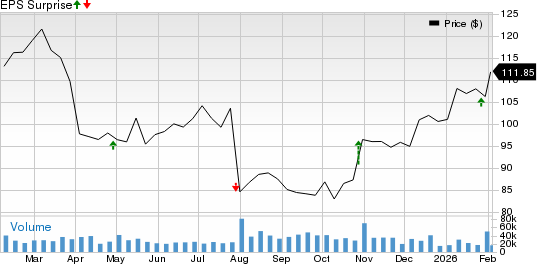

Oklo’s stock surged 238% in 2025, reaching an all-time high of $193.84, but is currently trading 60% below that peak.

Oklo Inc. (NYSE: OKLO) experienced a rapid increase in stock value in 2025, attributing its success to partnerships with the DOE and strategic initiatives, including groundbreaking at the Idaho National Laboratory for its Aurora powerhouses. Despite being a pre-revenue company, the stock peaked during the year after being selected for multiple DOE projects.

In early 2026, Oklo secured funding from tech giant Meta to develop a 1.2-gigawatt nuclear energy campus in Ohio, further solidifying its commercial prospects. If the company can meet its July 2026 target to achieve operational stability in its reactors, analysts anticipate a potential rebound in its stock value.