Shopify’s Surge: Can It Compete with Amazon in the Long Run?

Shopify (NYSE: SHOP) stock appears to be on the path to recovery. A strong third-quarter earnings report on Nov. 12 lifted the software-as-a-service company’s stock to its highest level since early 2022. Even though it still sits 38% lower than its peak in 2021, the 21% boost during the trading session after the announcement indicates a positive shift in investor sentiment.

Shopify is often viewed as the most significant e-commerce stock in North America, second only to Amazon (NASDAQ: AMZN). Currently, Amazon remains far ahead, with a market capitalization exceeding $2.2 trillion compared to Shopify’s approximate $140 billion.

Understanding Their Markets

It’s important for investors to recognize that Shopify and Amazon operate in different roles. Shopify provides an e-commerce platform and tools for online retailers, allowing them to sell independently. In contrast, Amazon’s primary revenue is generated from selling goods directly and managing its own logistics.

Shopify previously tried to enter the logistics market but ultimately decided against it, refocusing on its software offerings. The section of Amazon that competes more directly with Shopify is its third-party seller services, which enable retailers to sell through Amazon’s platform while paying fees, sometimes encouraging merchants to consider creating their own independent websites.

Despite Shopify’s advantageous positioning, it remains significantly smaller than Amazon. Shopify’s revenue for the first nine months of 2024 reached $6.1 billion, marking a 23% increase from the previous year. Meanwhile, Amazon reported revenue of $371 billion across North America and internationally during the same period, growing by just 10%.

Shopify also reported an operating margin of approximately 10%. In contrast, Amazon’s various segments maintained margins below 5%. This suggests Shopify has a more efficient cost structure compared to Amazon.

The Edge of Amazon

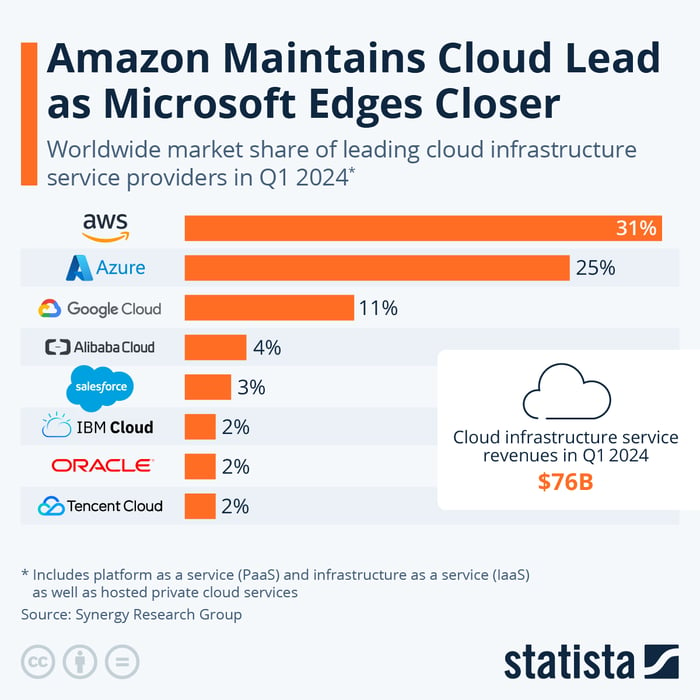

When comparing these two companies, Amazon’s cloud computing division, AWS, is a critical differentiator. AWS has significantly influenced the tech industry and maintains the largest market share in the cloud sector despite competition from giants like Microsoft and Alphabet.

Image source: Statista.

The rise of artificial intelligence (AI) has only solidified this advantage for Amazon. Despite substantial investment in AI, AWS efficiently runs AI-driven workloads, connecting it to a rapidly-evolving industry.

In the first nine months of 2024, AWS generated nearly $79 billion in revenue with a solid operating margin of 38%. This contributed $29 billion to Amazon’s overall operating income of $47 billion.

Considering the total operating margins, Amazon’s stands at 11%, marginally ahead of Shopify’s 10%. Thus, Amazon’s much larger scale is allowing it to maintain momentum, even as it incurs higher operational costs.

Shopify and Amazon’s Future: A 2035 Outlook

While Shopify’s impressive growth trends can be noted, it is unlikely to surpass Amazon’s market cap by 2035.

Although Shopify can potentially grow faster percentage-wise due to its smaller base and may see quicker stock price increases over the next decade, Amazon’s existing size—almost 16 times larger by market cap—will provide it with a significant buffer. Additionally, the expansion of AWS is expected to contribute immensely to Amazon’s growth, making the gap even wider.

Investment Considerations for Shopify

Before investing in Shopify, here are some important points:

The Motley Fool Stock Advisor team has identified what they consider the 10 best stocks to buy right now, and Shopify is notably absent from that list. The ten selected stocks have the potential to offer significant returns in the years ahead.

Take Nvidia, for example: if you had invested $1,000 when it was recommended on April 15, 2005, that investment would now be worth $900,893!*

Stock Advisor provides a user-friendly investment strategy, with ongoing analyst updates and new stock picks every month. Since its inception in 2002, it has surpassed the S&P 500’s performance by more than four times.*

Discover the 10 stocks »

*Stock Advisor returns as of November 18, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has positions in Shopify. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Shopify. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.