Strong Upside Potential for WisdomTree U.S. MidCap Earnings Fund ETF

Analysis reveals that analysts believe the WisdomTree U.S. MidCap Earnings Fund ETF (EZM) has significant upside based on its underlying holdings.

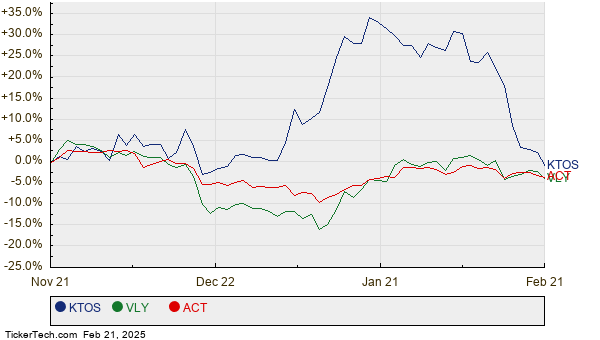

The weighted average implied target price for the ETF is calculated at $74.33 per unit. Currently, EZM trades at approximately $64.01, indicating a potential increase of 16.12% according to analyst estimates. Notably, three of its underlying stocks—Kratos Defense & Security Solutions, Inc. (KTOS), Valley National Bancorp (VLY), and Enact Holdings Inc (ACT)—show promising upside potential as well. KTOS has a recent trading price of $25.99, with an average analyst target of $30.82, reflecting an upside of 18.58%. VLY, trading at $9.84, has a target price of $11.67, suggesting an increase of 18.56%. Similarly, ACT, priced at $33.18, projects a target of $38.60, which is 16.34% higher. Below is a chart highlighting the twelve-month price performance of KTOS, VLY, and ACT:

Here’s a summary table of the aforementioned analysts’ target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. MidCap Earnings Fund ETF | EZM | $64.01 | $74.33 | 16.12% |

| Kratos Defense & Security Solutions, Inc. | KTOS | $25.99 | $30.82 | 18.58% |

| Valley National Bancorp | VLY | $9.84 | $11.67 | 18.56% |

| Enact Holdings Inc | ACT | $33.18 | $38.60 | 16.34% |

Investors may wonder if analysts’ targets are justified or overly ambitious. Are these projections well-founded, or are they based on outdated information? High targets can imply positive expectations but may result in price downgrades if market conditions change. Potential investors should conduct further research to determine the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Reading:

• REITs Dividend Stocks

• Funds Holding RYU

• Top Ten Hedge Funds Holding HRZN

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.