In 2023, the S&P 500 fell nearly 19% before recovering to just below its February peak. Notably, Tesla (NASDAQ: TSLA) experienced more volatility, with shares dropping over 50% from late last year to April, followed by a 62% rebound and another nearly 20% decline.

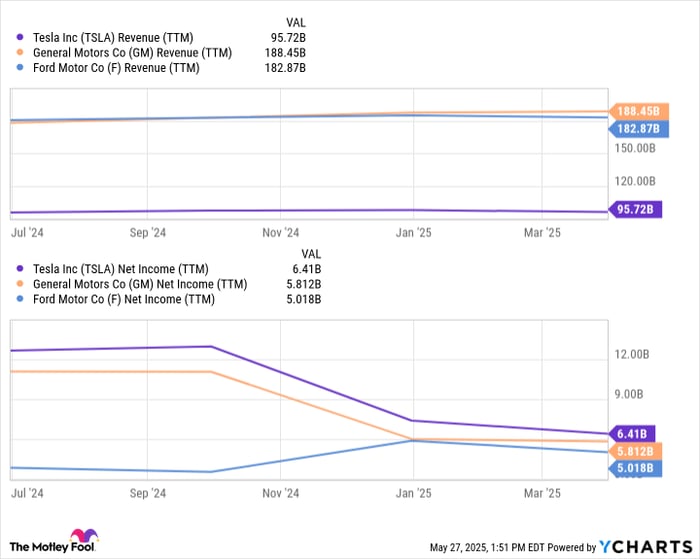

The recovery has been attributed to Elon Musk’s return as CEO, yet his recent political controversy has raised concerns among investors. In April, Tesla’s sales in the E.U. plummeted nearly 50% year over year, against a 34% increase in overall E.U. EV sales. Musk’s brand controversies and increasing competition, especially from companies like BYD in China, have pressured Tesla’s sales and profitability. The company’s net income fell by over 70% year over year in the last two quarters.

Looking toward the future, Tesla’s potential growth is uncertain. Analysts highlight that, while Tesla could innovate and capture market share, its recent stagnant performance raises caution, especially considering its high valuation with a price-to-earnings ratio exceeding 160 as revenue stagnates.