“`html

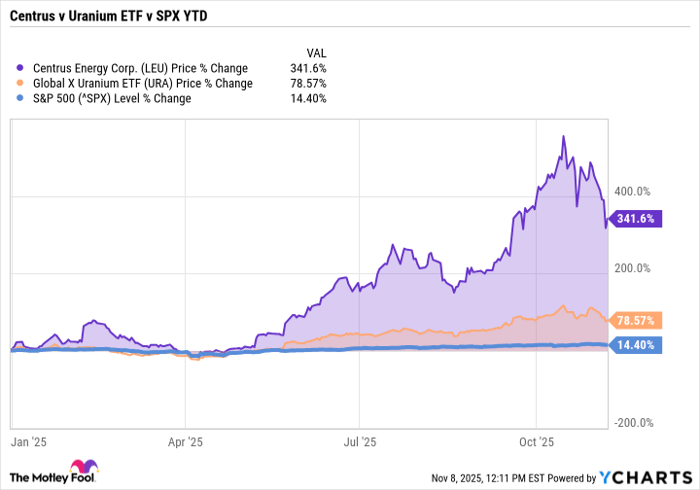

Centrus Energy (NYSEMKT: LEU), a supplier of nuclear fuels based in Bethesda, Maryland, experienced a 30% sell-off last month but rebounded by 6% during the first week of November. As of now, it has risen over 340% year-to-date, despite recent volatility.

In its third-quarter earnings report, Centrus reported sales of $74.9 million, representing a 30% increase year-over-year but falling short of analysts’ expectations by $5 million. The company also posted a GAAP EPS of $0.19, surpassing the anticipated $0.08, yet down nearly 90% from the previous quarter.

Centrus has a market value near $5 billion with a 23% short interest, indicating skepticism amid its high valuation metrics. Analysts project revenues of $451 million for FY 2025, and EPS estimates indicate potential growth to $16.80 by 2030, contingent on continued demand for nuclear energy.

“`