Palantir Stock Declines 37%: Is It Time to Buy or Sell?

As of this writing, Palantir (NASDAQ: PLTR) Stock has dropped 37% from its high of approximately $125 reached on February 18. This decline marks a concerning shift for a company previously favored by investors, thanks in part to two major trends: generative AI and the election of Donald Trump.

This article will examine whether this downturn represents a buying opportunity or a warning sign about increasing volatility in the tech sector.

Where to invest $1,000 right now? Our analyst team just revealed what they consider the 10 best stocks to buy currently. Learn More »

What Has Changed for Palantir?

Since its initial public offering (IPO) in October 2020, Palantir has cultivated a dedicated following. The company initially gained recognition by assisting government and military clients with big data analytics, notably aiding the U.S. in locating Osama Bin Laden in 2011 during the War on Terror.

However, upon becoming publicly traded, Palantir’s performance was fueled more by hype than by solid fundamentals. After a peak in IPO enthusiasm, the stock underperformed for around four years until interest was reinvigorated by the generative AI trend. Many anticipated that generative AI would enhance Palantir’s data analytics capabilities, providing real-time insights for fast-paced environments like battlefields or law enforcement activities.

The connection seems logical. Large language models (LLMs) require vast amounts of data, which Palantir is well-equipped to manage. The incorporation of general AI is expected to augment the company’s ability to help organizations improve operations, detect fraud, and fulfill critical missions.

A Story of Hype Over Fundamentals

Despite the potential synergies with generative AI, Palantir has not demonstrated explosive growth. The company’s revenue increased by 47% in 2020, but projections for 2024 indicate a slowing growth rate at 29%, suggesting that generative AI may not be the transformative factor many hoped for.

In comparison, Nvidia, recognized as a significant player in AI, experienced revenue growth soaring from 53% to 114% in the same period.

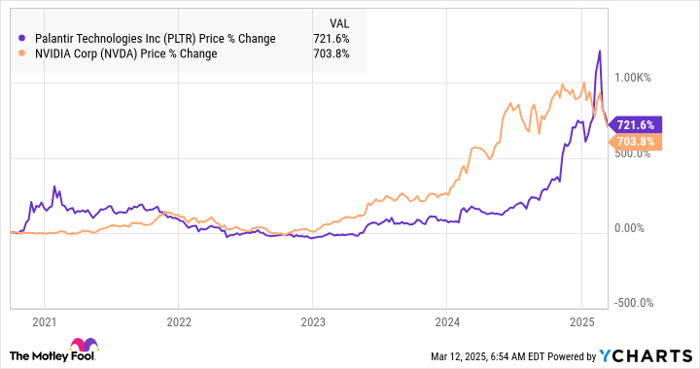

Although Palantir’s stock price increased by 722% over the last five years, exceeding Nvidia’s 704% rise, this divergence indicates substantial hype surrounding Palantir’s valuation.

PLTR data by YCharts

The company’s financials reveal further issues. Although Palantir reports adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $379.5 million, this figure includes $281.8 million in Stock-based compensation, which dilutes the equity of existing shareholders.

Does Palantir Have a Trump Card?

Palantir’s stock saw a boost following Trump’s election (growing over 60% since November 5). However, similar to the AI boom, this does not provide significant long-term advantages. Trump’s administration has aimed to reduce federal spending, and under Defense Secretary Pete Hegseth, the Pentagon is set to decrease its budget by 8%, or approximately $50 billion annually, for the next five years.

In 2024, U.S. government clients comprised roughly 42% of Palantir’s revenue. With projected cuts to federal spending, the company may face financial strain ahead.

Compounding these challenges are international clients, such as the Ukrainian armed forces, who utilize Palantir’s software amid the conflict with Russia. As Trump works to diminish this conflict, Palantir could potentially lose a vital revenue source.

Stock chart.” src=”https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F810906%2Fman-shocked-at-Stock-prices-investor-analyst.jpg&w=700″>

Image source: Getty Images.

Palantir Stock: A Strong Sell

With a forward price-to-earnings (P/E) ratio of 135, Palantir’s stock price fails to reflect the many challenges ahead. Although its revenue growth is relatively steady, it is far from impressive. Additionally, burdensome Stock-based compensation affects profitability, and the potential changes under the Trump administration pose further risks.

After a 37% drop from its peak, it appears that more declines could be on the horizon.

Should You Invest $1,000 in Palantir Technologies Right Now?

Before you decide to buy Stock in Palantir Technologies, consider the following:

The Motley Fool Stock Advisor analyst team recently identified the 10 best stocks for immediate investment, and Palantir Technologies was not included. The stocks chosen have the potential for significant returns in the future.

For reference, when Nvidia was included in this list on April 15, 2005, a $1,000 investment at that time would be worth $745,726!*

Stock Advisor offers investors a straightforward path to success with insights on portfolio development, regular analyst updates, and two new Stock picks every month. Since 2002, the Stock Advisor service has outperformed the S&P 500 by more than four times. Join today to access the latest top 10 list.

See the 10 stocks »

*Stock Advisor returns as of March 14, 2025

Will Ebiefung holds no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.