Zoom’s Q4 Results Show Mixed Growth Amid Market Concerns

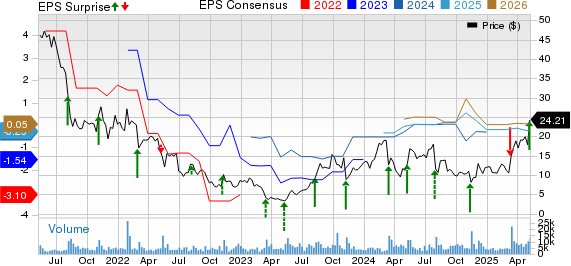

Zoom Communications (NASDAQ:ZM) recently unveiled its results for the fourth quarter of fiscal 2025, which concluded in January. The company reported adjusted earnings of $1.41 per share, surpassing analysts’ estimates of $1.35 per share. Revenue for the quarter reached $1.18 billion, aligning with projections. A notable aspect of the report was a 3.3% increase in revenue year-over-year, primarily driven by a 5.9% rise in enterprise revenue to $707 million. However, online sales exhibited a slight decline of 0.4%, settling at $477 million.

During the pandemic, Zoom saw a significant surge in users, but with a shift in work arrangements away from hybrid models, the long-term sustainability of video conferencing demand is in question. This concern is evident in the 13% year-over-year decrease in enterprise customers, reducing the total to 192,600 in the latest quarter. For those seeking a steadier investment, the High-Quality portfolio has outperformed the S&P 500, achieving returns of over 91% since its inception.

Image by Biljana Jovanovic from Pixabay

The company’s operating margin improved by 80 basis points year-over-year, reaching 39.5% for Q4. Despite the increase in revenues and modest improvement in margins, earnings per share fell by one cent from the same quarter last year, now at $1.41. This decline is partly attributed to a 1% rise in outstanding shares.

Looking ahead, Zoom anticipates sales of $1.16 billion for the next quarter with expected earnings of approximately $1.30 per share. These figures are slightly lower than market forecasts of $1.17 billion and $1.31 respectively.

Future Outlook: Is Zoom Stock Fairly Valued at $75?

After the earnings announcement, ZM Stock experienced an 8% decline. Over the past four years, ZM has consistently underperformed compared to the broader market, recording returns of -45% in 2021, -63% in 2022, +6% in 2023, and +13% in 2024.

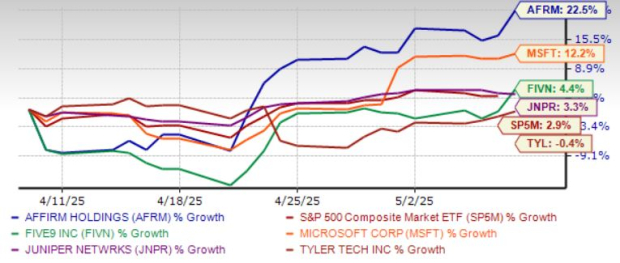

In contrast, the Trefis High Quality (HQ) Portfolio, composed of 30 diverse stocks, has exhibited significantly less volatility. This portfolio has consistently outperformed the S&P 500 over the past four years. The appeal of the HQ Portfolio lies in its capacity to produce better returns with lower risk compared to benchmark indices, avoiding the extreme fluctuations seen in ZM stock.

Given the current unpredictable macroeconomic conditions, including discussions of rate cuts and ongoing trade tensions, ZM might face similar challenges as seen in previous years, potentially underperforming the S&P 500 over the next twelve months. However, from a valuation standpoint, there seems to be some potential for growth.

At its current price of $75, ZM Stock is valued at 5.1 times trailing revenues, which is below its four-year average price-to-sales ratio of 7.2. Although some reduction in valuation multiple is justified due to decelerating revenue growth and a dwindling customer base, the existing gap indicates a potential for share price appreciation.

While ZM Stock presents potential for positive movement, examining Zoom Communications’ Peers on relevant metrics is advised. For additional comparisons across industries, the Peer Comparisons section offers valuable insights.

| Returns | Feb 2025 MTD [1] |

Since start of 2024 [1] |

2017-25 Total [2] |

| ZM Return | -15% | 3% | 9% |

| S&P 500 Return | 1% | 28% | 173% |

| Trefis Reinforced Value Portfolio | -7% | 15% | 677% |

[1] Returns as of 2/26/2025

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

see all Trefis Price Estimates

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.