Investing Insights: Top Stocks to Watch in 2025

Hello, Reader.

The legendary investor Peter Lynch once said, “Know what you own, and why you own it.”

Building wealth involves more than just stock selection; it calls for a deep understanding of the companies behind your investments.

As the New Year unfolds, I’m eager to share three companies poised for significant growth in 2025…

And why they should be on your radar.

Three Promising Stocks for 2025

No. 1

My first recommendation is not widely recognized in the United States, but in South Korea, it’s a household name and leads the e-commerce landscape.

The founder, Bom Suk Kim, made headlines when he left Harvard Business School 14 years ago to establish his competitor to Amazon back home.

This journey required substantial capital. Kim secured billions from venture firms, including Softbank Group and Sequoia Capital, to create a comprehensive e-commerce and logistics framework in South Korea.

In 2015, SoftBank invested $1 billion, marking this start-up as Korea’s first “unicorn.” In late 2018, they invested another $2 billion.

Now, Coupang Inc. (CPNG) stands as the dominant player in South Korean e-commerce. Its innovative delivery service, Rocket Delivery, ensures that 99% of orders reach customers within 24 hours, with same-day options for many products.

Coupang also runs Coupang Eats for food delivery and Rocket Fresh for groceries. The latter has emerged as Korea’s largest online grocer, with delivery volumes increasing by 70% year-over-year in Q1 of fiscal year 2024.

The company further diversifies its offerings with Coupang Play, a streaming service, and Coupang Pay, providing efficient payment solutions across its platforms.

With rapid growth in both market share and profitability, I anticipate Coupang’s stock will yield strong returns in the years ahead.

No. 2

The second company on my list is a powerhouse in digital payments.

Its origins date back to 2000 when Elon Musk combined his online bank, X.com, with Peter Thiel’s company, Confinity. This merger quickly paid off, leading to the sale of their venture to eBay Inc. (EBAY) for $1.5 billion just two years later.

In 2015, eBay separated the company, allowing it to flourish independently. Notably, 2015 also marked the year Musk and Thiel co-founded OpenAI, creators of ChatGPT.

Today, PayPal Holdings Inc. (PYPL) boasts 429 million active accounts, processing a staggering $1.5 trillion in payments each year.

The company’s stronghold in the “branded checkout” market is a major growth driver, as seen with the PayPal/Venmo options available on 75% of North America’s and Europe’s top 1,500 retailers’ online stores.

PayPal is not resting on its laurels. It is enhancing its market position by integrating advanced AI and machine-learning capabilities to improve security and transaction efficiency.

As a leading figure in fintech, PayPal seems well-positioned as a long-term investment.

No. 3

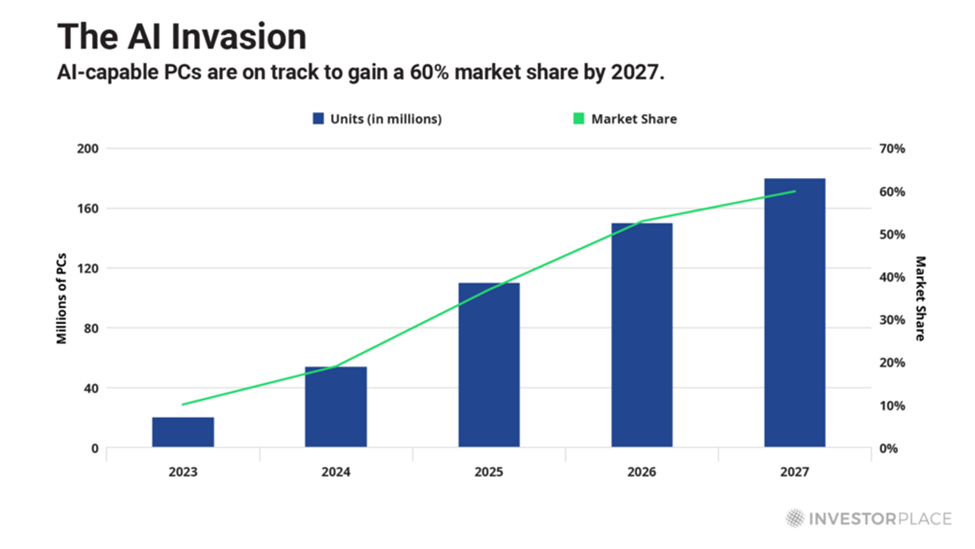

Finally, we see an evolving trend in the upgrade from traditional PCs to AI-powered machines.

Many AI PC models have yet to hit the market, representing a significant opportunity ahead.

Pioneers like Dell Technologies Inc. (DELL) are already utilizing Nvidia Corp.’s (NVDA) advanced Blackwell GPUs.

However, companies entering the market later, like HP Inc. (HPQ), are also set to benefit as sales ramp up.

Despite a challenging landscape with PC sales dropping 16.6% in 2022 and 13.8% in 2023, a 3.3% increase in Q4 of 2023 signals potential recovery.

IT research firm Canalys predicts a 10% growth for the U.S. personal computer market in 2025, driven by the anticipated AI PC boom and the transition to Windows 11.

HP has longstanding roots in the PC industry, with enterprise and consumer products making up about two-thirds of revenue, and printers accounting for the rest. Despite being a technology leader, its stock garners less investor enthusiasm than peers like DELL.

Investment Insights: Dell vs. HP and the AI Boom

Both Dell and HP sell nearly the same number of PCs, around 53 million each year. However, Dell’s market cap stands at $87 billion, nearly three times that of HP. This notable gap could signal a promising buying opportunity for investors.

As HP starts to leverage its position as a second mover in the market with new AI PC products, analysts expect its current single-digit valuation multiple to grow into double digits.

Building a Strong Portfolio for 2025

In 2025, three stocks are poised to enhance your investment portfolio. For a more in-depth review of these companies, as well as four additional stocks, read my complimentary report on 7 Stocks for 2025.

However, these aren’t the only stocks with strong potential. It’s crucial to highlight recent trends driven by artificial intelligence, a megatrend that has greatly influenced the market in the past few years.

Colleagues at InvestorPlace, including Louis Navellier, Luke Lango, and I, recently collaborated on an AI Appliers Portfolio. This collection features stocks that stand to gain significantly from AI innovations.

We anticipate a significant change with “AI Day One,” a milestone that will introduce artificial intelligence systems capable of sophisticated reasoning and decision-making. This evolution will enable various industries, especially technology, to adopt AI more effectively, leading to increased efficiency and profitability.

Given the rapid developments in AI, it’s important to stay informed and prepared. While the future remains uncertain, the acceleration of AI growth is undeniable.

To discover more about our selected AI stocks, I encourage you to view our recent broadcast.

Regards,

Eric Fry

Editor, Smart Money

P.S. If you aim to make a strong start in the New Year, consider the recent findings from our affiliates at TradeSmith. They meticulously analyzed over 2 billion data sets dating back to 1991 to determine optimal buying and selling times for stocks. The result is an innovative tool designed to aid your investment decisions.

On Wednesday, January 8, TradeSmith CEO Keith Kaplan will explain how this tool functions and how it can assist you in profiting this year. Plus, if you sign up for this free event, you’ll have the chance to use the tool firsthand.

Click here to register for the event and gain free access to the TradeSmith tool now.