Fidelity MSCI Utilities ETF Hits Oversold Territory; What Investors Should Know

On Monday, shares of the Fidelity MSCI Utilities Index ETF (Symbol: FUTY) traded as low as $46.4508, entering oversold territory. This status is determined using the Relative Strength Index (RSI), a popular momentum indicator that ranges from zero to 100. A stock is classified as oversold when its RSI falls below 30.

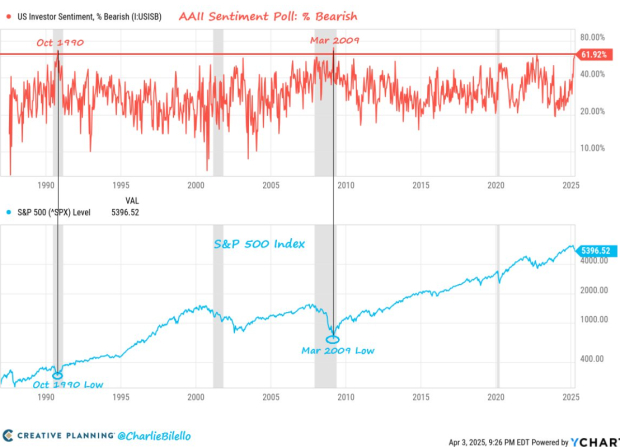

Currently, the Fidelity MSCI Utilities Index has an RSI reading of 29.8. In comparison, the S&P 500 Index sits at a lower RSI of 21.2, indicating a potentially heightened level of selling pressure affecting the market. A bullish investor might interpret FUTY’s 29.8 RSI as a signal that the selling momentum is weakening, presenting a possible opportunity to enter the market on the buy side.

Examining FUTY’s annual performance, the ETF has a 52-week low of $40.34 per share and a high of $53.65. The most recent trade has seen shares priced at $47.38, marking a decline of approximately 1.6% for the day.

![]()

Click here to discover nine additional oversold dividend stocks worth noting.

Also see:

- Funds Holding IVN

- GLV Dividend History

- Funds Holding ROCG

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.