Garmin Shares Surge 68.9% as New Smartwatch Launches

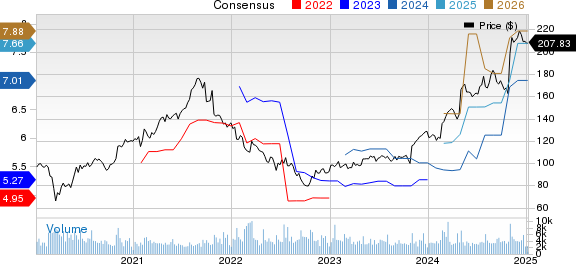

Garmin GRMN has seen impressive growth, with its stock increasing by 68.9% over the past year. This performance shines compared to the Electronics – Miscellaneous Products sector, which fell by 28.3%, and the Zacks Computer and Technology sector, which grew by 38.1%.

Garmin also outperformed competitors such as Electrovaya ELVA, Greenland Technologies GTEC, and Kopin KOPN in the last year. Shares of ELVA, GTEC, and KOPN have dropped by 39%, 28.7%, and 28.3%, respectively.

Such strong stock performance signals investor confidence in GRMN’s diverse product lineup and solid financial results. The recent launch of the Instinct 3 Series aims to keep this positive trend going and strengthen Garmin’s position in the market.

The Instinct 3 Series, Garmin’s latest rugged smartwatch, is equipped with an eye-catching AMOLED display and a solar-powered option for extended battery life. It features a built-in flashlight and a metal-reinforced bezel designed for durability, making it perfect for outdoor enthusiasts.

This smartwatch supports various sports, including hiking, running, cycling, golfing, and fishing. Additionally, it comes loaded with applications for sports such as basketball, pickleball, cardio, HIIT, and track running. The solar model starts at $399.99, while the AMOLED version costs $449.99, making it appealing to a broad range of consumers.

Garmin’s Growing Market Presence

Focusing on expanding its product offerings has helped Garmin cater to the increasing demand for health and fitness wearables. The Instinct 3 Series boosts Garmin’s reputation in the outdoor and adventure segment and enhances its ability to rival brands like Apple and Fitbit. By combining durability, modern features, and affordability, the Instinct 3 Series positions Garmin for potential revenue growth in 2025.

Garmin has built a reputation for its consistent technological advancements through frequent product launches. This includes the Venu, Lily, and Vivoactive smartwatch series, which provide enhanced sleep tracking and health features.

Wall Street’s Positive Outlook for Garmin

Garmin has a solid track record of strong quarterly earnings, consistently exceeding the Zacks Consensus Estimate for four consecutive quarters, with an average surprise of 28.5%. Analysts are optimistic about Garmin’s growth in the near future.

The Zacks Consensus Estimate for Garmin’s earnings in 2025 has been adjusted upward by 9.1%, now projected at $7.66 per share, reflecting a year-over-year growth of 9.3%. Expected revenue is at $6.53 billion, indicating an increase of 6.3% compared to the previous year.

Conclusion: Consider Buying GRMN Stock

As the Instinct 3 Series is set to draw consumer interest, Garmin heads into 2025 with significant momentum. The company’s emphasis on innovation and market expansion makes it an attractive investment for those wanting to capitalize on the growth of the wearables industry. GRMN’s history of adaptability and innovation positions it for continued success in the coming year.

Currently, GRMN holds a Zacks Rank #1 (Strong Buy), suggesting that existing investors should hold their positions, while new investors are encouraged to consider buying. You can find the complete list of today’s Zacks #1 Rank stocks here.

5 Stocks with Huge Growth Potential

Five stocks have been handpicked by Zacks experts as top candidates to gain over 100% within the next year. While not every selection will succeed, previous recommendations have seen increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Most featured stocks are currently under the radar, presenting a unique buying opportunity.

Discover Today’s 5 Potential High-Growth Stocks >>

Garmin Ltd. (GRMN): Free Stock Analysis Report

Kopin Corporation (KOPN): Free Stock Analysis Report

Greenland Technologies Holding Corporation (GTEC): Free Stock Analysis Report

Electrovaya Inc. (ELVA): Free Stock Analysis Report

Read more about this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.