Garmin (GRMN) Experiences Remarkable Growth and Stock Surge

For fans of the outdoors, whether they be anglers, runners, or golfers, Garmin (GRMN) is a familiar name. The company is well-known for producing top-notch navigation and communication gear. Garmin has a wide range of GPS-equipped devices, categorized into five main sectors: Outdoor (32.5%), Fitness (25.8%), Marine (17.4%), Auto (8.1%), and Aviation (16.2%). This mix contributes to a diverse and strong business model.

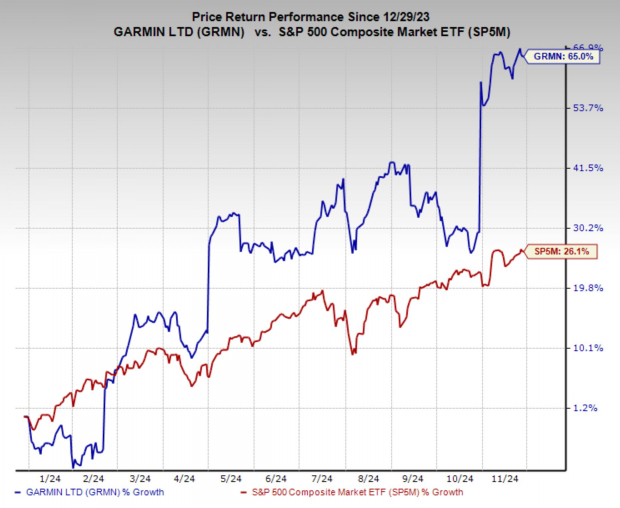

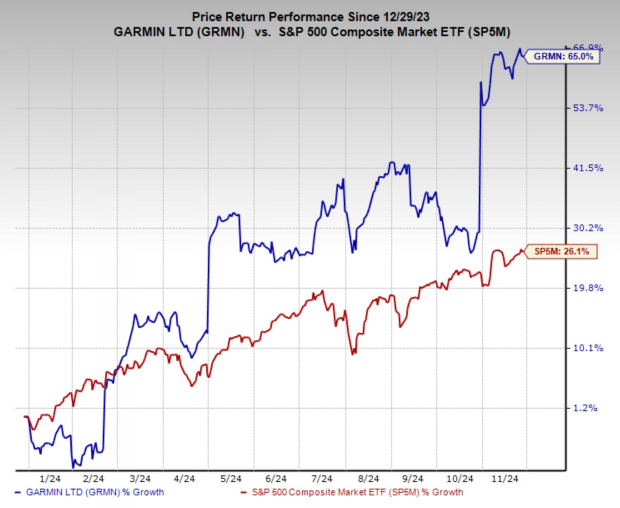

In 2024, Garmin’s stock has had a remarkable performance, jumping 65% year-to-date (YTD) and significantly outperforming the broader market. This success is supported by a top Zacks Rank, which reflects increased earnings revisions. Furthermore, its encouraging technical chart suggests that Garmin stands out in today’s market landscape.

Image Source: Zacks Investment Research

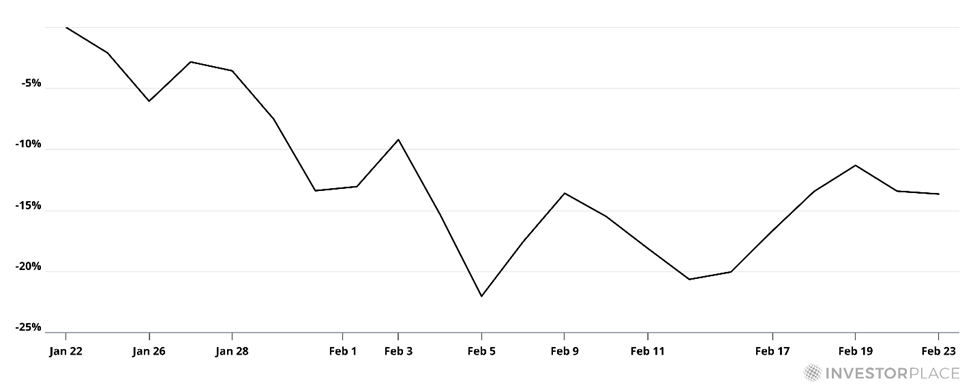

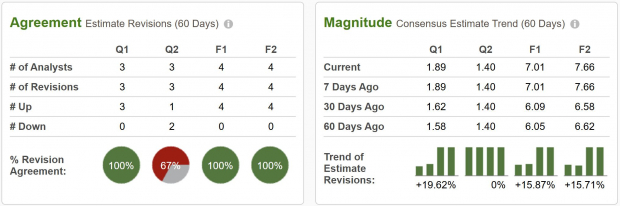

Analysts Raise Earnings Forecasts for Garmin

Garmin’s strong performance is driven by notable increases in earnings estimates, resulting in a Zacks Rank #1 (Strong Buy) rating. In the past two months, analysts have almost unanimously increased their projections, with FY24 estimates rising by 15.9% and FY25 by 15.7%.

A significant factor in Garmin’s success is its Fitness segment, accounting for 25% of total sales. The company leads in the market for wearable devices that cater to runners and fitness enthusiasts, making its products a staple for those monitoring their progress. Garmin’s reputation for high-quality, feature-rich devices helps it maintain its edge in this expanding sector.

Image Source: Zacks Investment Research

Is Garmin Stock Ready for a Breakout?

The technical analysis for Garmin stock is particularly interesting as we head into the holiday season. After a significant jump following its latest earnings report, the stock has been consolidating, forming a bull flag pattern.

Should the stock price surpass the resistance level at $215, this could indicate a breakout, attracting more buyers and potentially driving the stock into another bullish trend.

Image Source: TradingView

Is Now the Right Time to Invest in GRMN Shares?

Investors aiming to benefit from a high-momentum stock with strong fundamentals and promising technical setup may find Garmin to be an appealing opportunity. Its leadership across diverse markets, robust financial outlook, and favorable chart pattern position it as a notable option in today’s investment landscape.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is crucial to our economy. It is a multi-trillion dollar industry that has produced some of the largest and most profitable companies in the world. As technology advances, clean energy sources are on track to surpass traditional fossil fuels in prominence. Investment is flooding into clean energy initiatives, from solar power to hydrogen fuel cells.

Investors interested in emerging leaders in this sector may discover some of the most exciting stocks for their portfolios.

To learn more about the top picks in the clean energy space, download our report on Nuclear to Solar: 5 Stocks Powering the Future, available for free today.

Stay informed with the latest recommendations from Zacks Investment Research. You can download 5 Stocks Set to Double for free.

Garmin Ltd. (GRMN) : Free Stock Analysis Report

For the full article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.