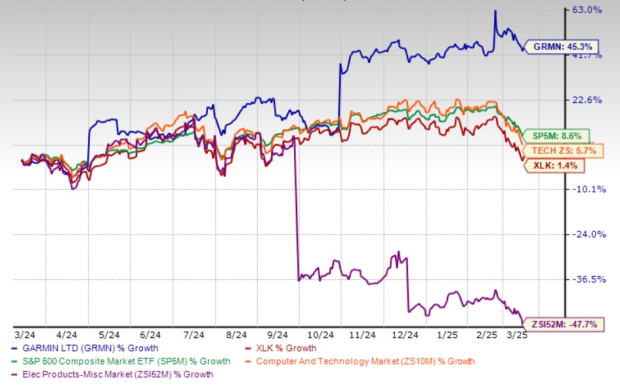

Garmin Stock Surges 45.3% in a Year: Should Investors Buy?

Garmin (GRMN) has seen a remarkable gain of 45.3% over the past year, significantly outperforming the Zacks Computer and Technology Sector and the broader market, including the Technology Select Sector SPDR Fund (XLK) and the S&P 500 index, which returned 5.7%, 1.4%, and 8.6%, respectively. Furthermore, it has surpassed the Zacks Electronics – Miscellaneous Products Industry, which faced a decline of 47.7% during the same timeframe.

This strong performance highlights investor confidence in Garmin’s solid product lineup and financial stability. However, it raises a key question: Should investors consider purchasing Garmin shares in anticipation of ongoing stock price momentum?

Garmin’s 1-Year Price Return Performance

Image Source: Zacks Investment Research

Fitness Products Propel Growth at Garmin

Garmin is a leading player in the decidedly fragmented fitness technology market, which includes competitors such as Coros, Huawei, Oura, Polar, Samsung, Suunto, Whoop, and major tech firms like Apple (AAPL) and Alphabet (GOOGL).

Flagship products such as the Apple Watch Series 10, Apple Ultra 2, and Google’s Fitbit Charge 6 compete closely with Garmin’s own line of fitness watches and wearables, including heart rate monitors.

What sets Garmin apart is its focus on fitness wearables designed for specific activities including swimming, diving, multisport, and golf. These specialized features provide athletes with more accurate performance metrics than those offered by many competitors.

Garmin further distinguishes itself by offering smart scales and handheld blood pressure monitors, making its products a top choice among fitness enthusiasts.

Over the past decade, the fitness segment has become the second-largest contributor to Garmin’s total revenues. In 2024, revenues from the Fitness segment soared by 32% year-over-year. Projections indicate that this segment will experience a CAGR of 8.4% from 2025 to 2027.

Strong Outdoor and Marine Business Bolsters Garmin

Garmin’s Outdoor division boasts a robust lineup, including bike computers, smart biking trainers, bike radars, golf launch monitors, and various sport-specific technologies. This segment showcases Garmin’s flagship watch series, including Fenix, Instinct, and Tactix.

Additionally, Garmin’s Marine portfolio features SONAR systems, diving computers, trolling motors, sensors, marine apps, and first responder solutions. In 2024, revenues from the Marine segment topped $1 billion for the first time, alongside the Fitness and Outdoor segments.

In conjunction with hardware, Garmin offers subscription-based services for its connected devices. Services like Garmin’s inReach Satellite solution, Navionics for marine navigation, Garmin Connect Premium, and Outdoor Maps+ contribute significantly to its recurring revenue.

The success across Garmin’s three primary segments—Fitness, Outdoor, and Marine—has prompted the company to provide a 2025 revenue guidance of approximately $6.80 billion. The Zacks Consensus Estimate for Garmin’s 2025 revenues currently stands at $6.87 billion, suggesting a year-over-year growth of 9%.

Recovery in Garmin’s Aviation and Auto OEM Segment

Recovery is underway in Garmin’s Auto OEM market segment, which has struggled with operating losses for the past five years. However, securing additional contracts with its largest automotive client, BMW Group, has resulted in a remarkable 44% year-over-year increase in Auto OEM revenue, narrowing the operating loss.

In the aviation sector, Garmin has established a strong presence with integrated flight decks, portable GPS units, electronic flight instruments, runway occupancy awareness technology, and emergency auto-land systems. The company anticipates a revenue growth of approximately 5% in the aviation market by 2025.

Garmin’s 2025 Earnings Estimates Show Positive Outlook

The Zacks Consensus Estimate for Garmin’s 2025 earnings is $8.25 per share, reflecting an upward revision over the past week. This estimate represents a year-over-year increase of 11.6%.

Garmin has consistently exceeded Zacks Consensus Estimates in the last four quarters, boasting an average surprise of 28.85%.

Garmin Ltd. Price, Consensus, and EPS Surprise

Garmin Ltd. price-consensus-eps-surprise-chart | Garmin Ltd. Quote

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

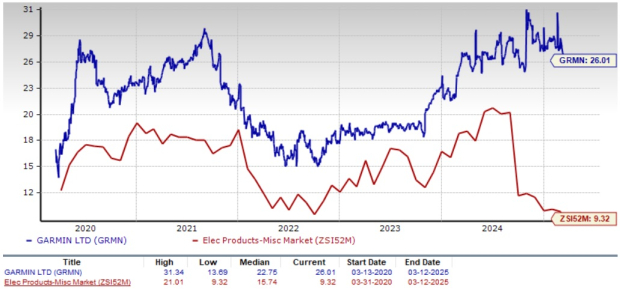

Garmin Shares Currently Trade at a Premium

Garmin is currently trading at a premium, as indicated by a Value Score of F.

With a 12-month forward P/E ratio of 26.01X, Garmin significantly surpasses the industry average 12-month forward P/E ratio of 9.32.

Garmin 12-Month Forward P/E Ratio

Image Source: Zacks Investment Research

Conclusion: Is Now the Right Time to Buy Garmin Stock?

Garmin’s solid performance in its Fitness, Outdoor, and Marine segments is likely to drive growth for GRMN in the coming quarters. Additionally, the company is noticing a recovery in its Auto OEM and Aviation sectors.

Presently, Garmin holds a Zacks Rank #1 (Strong Buy), suggesting it could be an opportune time for investors to accumulate the stock.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 elite stocks from the current pool of 220 Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Pops.”

Historically, this comprehensive list has outperformed the market more than twice, with an average annual gain of +24.3%. Be sure to give these 7 stocks your immediate attention.

Interested in the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click for your free report

Apple Inc. (AAPL): Free Stock Analysis report

Garmin Ltd. (GRMN): Free Stock Analysis report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.