Tesla’s Stock Price Prediction Now Depends on Management Outlook

On Monday, Gary Black, managing partner at The Future Fund LLC, shared insights regarding Tesla Inc.‘s TSLA share price, which will be influenced by the company’s first-quarter earnings report scheduled for Tuesday. He emphasized the importance of management’s outlook and comments during the call.

Management Insights Matter Most

Black voiced his thoughts on X, previously known as Twitter. He highlighted, “Tesla’s Stock price after the upcoming earnings will depend significantly on management discussions about the more affordable vehicle, the timing of the Austin unsupervised autonomous test market, Elon Musk’s involvement with DOGE, and guidance on FY’25 delivery growth, more than on the actual numbers,” he stated.

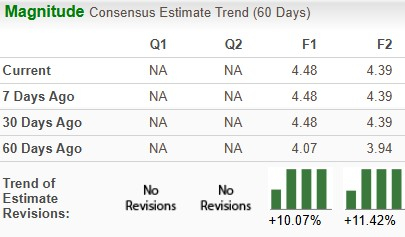

Comparing Predictions with Wall Street Estimates

Black also shared his predictions for Tesla’s first-quarter and full-year 2025 results, comparing them with Wall Street expectations:

| Metric | Gary Black’s Estimate | Wall Street Estimate |

|---|---|---|

| Q1 Adjusted EPS | $0.37 | $0.44 |

| Q1 Auto Gross Margin (ex-reg credits) | 12.6% | 12.3% |

| Q1 Revenue | $20.0 billion | $21.4 billion |

| 2025 Deliveries | 1.7 million (-5% YoY) | 1.809 million (+1.1% YoY) |

| 2025 Adjusted EPS | $2.60 | $2.64 |

He noted that Wall Street consensus might be outdated. Analysts often don’t adjust their models until after the actual results are announced, leading to potentially overly optimistic forecasts. In contrast, Black believes that the estimates compiled by Tesla’s Investor Relations (IR) survey are more realistic.

| Metric | Tesla IR-Compiled Estimate | Wall Street Consensus |

| Q1 Adjusted EPS | $0.38 | $0.44 |

| 2025 Deliveries | 1.731 million (-3% YoY) | 1.809 million (+1.1% YoY) |

| 2025 Adjusted EPS | $2.29 | $2.64 |

Significant Company Developments

Recently, it was reported that Tesla has postponed the U.S. launch of a more affordable version of its Model Y SUV, codenamed “E41,” which was initially set to launch in the first half of the year.

Furthermore, Tesla has hinted at the introduction of its Cybercab autonomous ride-hailing service in Austin, Texas, although this plan has met skepticism from industry experts.

Musk is also under scrutiny from investors concerned about his focus on the company. His attention appears to be increasingly drawn toward his role in President Donald Trump’s Department of Government Efficiency (DOGE), prompting criticism.

This political involvement has led to protests at Tesla’s showrooms and facilities, with actions ranging from peaceful demonstrations to vandalism.

Additionally, Musk’s controversial statements on international relations have provoked backlash, particularly in Europe, where Tesla properties have faced attacks and sales have declined.

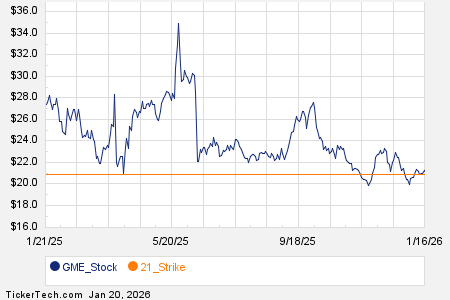

Recent Stock Performance

Tesla’s Stock fell by 5.96% on Monday, contributing to a wider trend that has seen shares decline by 40.04% year-to-date, according to Benzinga Pro.

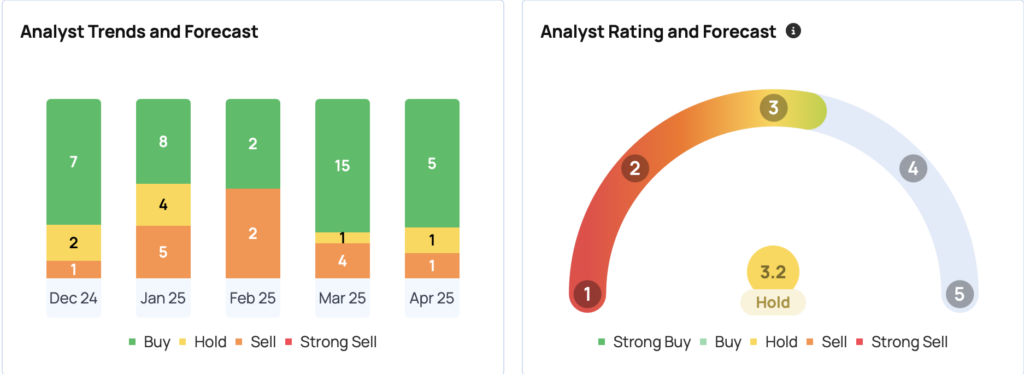

Currently, 29 analysts monitored by Benzinga have established a consensus price target for Tesla at $298.14. However, the latest ratings from Piper Sandler, UBS, and Mizuho suggest a higher average price target of $321.67, indicating a potential upside of 41.17% based on these assessments.

The company has a growth score of 67.59% according to Benzinga Edge Stock Rankings.

Photo Courtesy: Ti Vla On Shutterstock.com

Next Steps

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs