Challenges and Adaptation

The story of General Electric’s decline is one fraught with challenges—a tale of strategy blunders, market adversities, and a struggle to navigate external forces. Decades of over-diversification, vulnerabilities in GE Capital, and missteps under previous leadership led to significant value destruction. The company’s inability to respond to shifting market dynamics and changes in technology amplified its woes, once a beacon of American industrial innovation. GE’s journey to restore its former luster remains arduous, despite its ongoing restructuring efforts and focus on its industrial core.

The Turnaround Narrative

Efforts to alleviate debt, fortify core businesses, and streamline operations have marked (GE)’s strategic shift. Shedding non-core assets, such as the BioPharma division, and bolstering its technological innovation and digital solutions within key industrial segments, (GE) aims to solidify its financial footing. Emphasis on responsible investment, shareholder returns, and efficiency underpins its capital allocation and management principles.

Breaking Up for a Brighter Future

In a strategic move to form more agile and market-responsive entities, (GE) recently revealed plans to split into three distinct organizations. With divisions like GEHC spun off to focus on healthcare and medical technology, (GE)’s intention to establish more targeted and nimble companies underscores a drastic departure from its conglomerate roots. These impending spinoffs, set to drive operational flexibility and consumer-centric focus, present an optimistic prospect for the company’s future. Photo: GE Spin-off Image

An Evolutionary Leadership

Under the leadership of Lawrence Culp Jr., (GE) has witnessed a transformational journey. Overcoming challenges amidst the tumultuous COVID-19 outbreak, Culp orchestrated the separation of GEHC in January 2023, with plans to spin off the power and renewable business, GE Vernova, by April 2024. Culp’s strategic priorities upon assuming the role of CEO in 2018—including debt reduction, divestitures, and turning around loss-making entities—underscore his pivotal role in the company’s resurgence.

Driving the GE Vernova Transformation

The forthcoming spinoff of GE Vernova, comprising the power and renewable energy divisions, captures (GE)’s commitment to reviving and simplifying its operations. The impending spinoff is expected to reinvigorate performance, streamline operations, and foster better financial reporting and capital allocation. CEO Scott Strazik’s pivotal role in reinvigorating the power division and realizing profitability exemplifies (GE)’s staunch commitment to driving its transformative agenda.

General Electric: A Dynamic Transformation

Steam Power and Renewables Revamp

General Electric (GE) has not been immune to the challenges plaguing the worldwide large-turbine market. In response to this predicament, Steam Power has decisively shed unprofitable equipment to refocus on aftermarket parts and services. Despite a 4.3% CAGR dip in revenue from $22,150 million in 2018 to $17,731 million in 2023, segmental profit surged from $808 million to $1,449 million during the same period. The power business is poised to achieve a low double-digit margin by 2024.

However, Renewables encountered setbacks in its offshore operations as it grappled with the complexities of the renewable energy landscape. Inflationary pressure, high rates, and a lack of robust regulatory policies led to the cancellation of unprofitable orders. Nevertheless, GE Vernova is strategically evaluating offshore projects and onboarding efforts as part of its transformative journey.

GE Vernova: A Promising Future

GE Vernova stands on the precipice of transformation, bolstered by a favorable outlook and key drivers such as the 10-year extension of production tax credits for wind projects under the US Inflation Reduction Act (IRA). Additionally, there’s a strong focus on clean energy, a proposal to expand wind installation, and other incentives. Backed by underlying demand, leadership positions, federal incentives, and the proven leadership of Mr. Scott Strazik, GE Vernova is poised to emerge as a stronger and more focused energy player in the upcoming years.

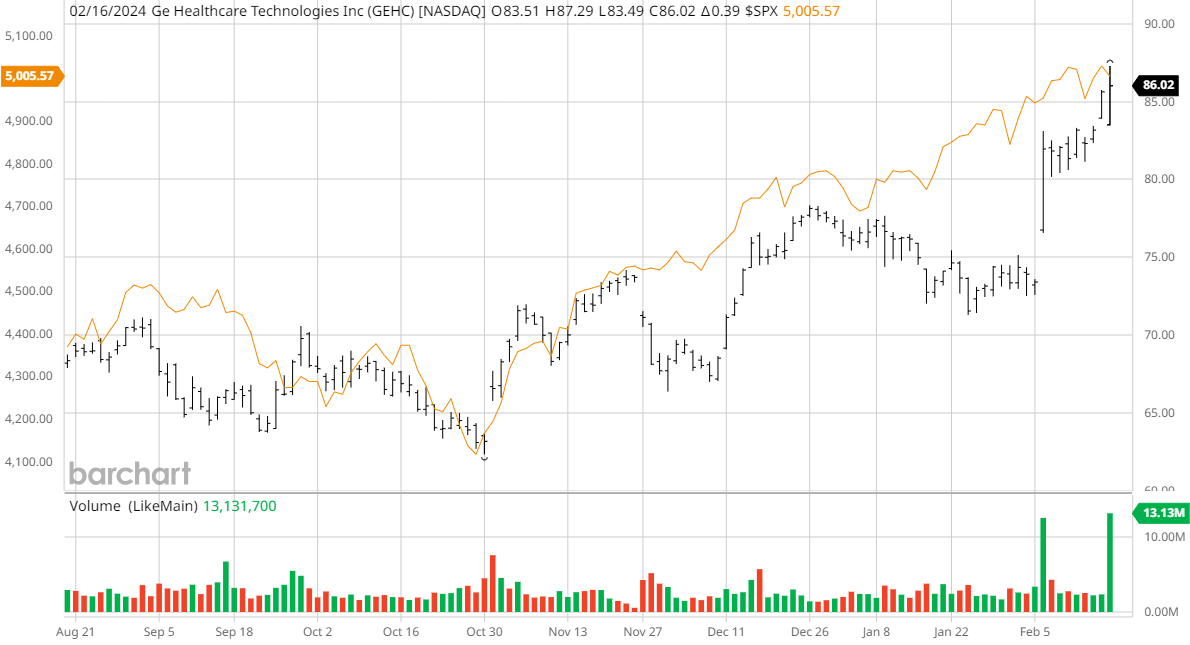

Historical Stock Performance

Tracking the performance of GE over the years yields intriguing insights. From 2000–2010, GE significantly underperformed, generating a CAGR return of -6.05%. The subsequent period from 2010 to March 31, 2018, saw a subdued CAGR return of -0.9%. However, the period from April 1, 2018, to January 30, 2024, bucked this trend, as GE generated a surprisingly positive CAGR return of 10.29%. This shift indicates a compelling turnaround story for GE under the leadership of Mr. Culp, reflecting a perceptible rise in its performance.

Investment Prospects

Amidst its ongoing transformation, General Electric presents an enticing investment opportunity. The strategic divestitures and spinoffs undertaken by GE signify a pivot towards more streamlined operations after enduring market vicissitudes due to strategic missteps. Under CEO Lawrence Culp Jr.’s stewardship, the firm is committed to debt reduction, operational enhancement, and technological innovation. Notable initiatives such as the GE Healthcare spinoff and the impending separation of power and renewable businesses into GE Vernova are slated to bolster financial performance and capitalize on market opportunities.

GE’s progress in the power business and strategic positioning in the renewable energy segment align with global movements toward clean energy, constituting structural and operational transformation. With a more concentrated leadership style, strategic capital allocation, and ongoing reorganization, GE is poised to become an appealing investment prospect. The current spinoffs and restructuring initiatives at GE are pivotal factors that may significantly influence the company’s market standing and financial performance, warranting vigilant observation from prospective investors. Those seeking long-term value creation and market leadership in critical industries may find the anticipated ascension of GE Vernova as a focused energy player, coupled with GE’s historical resilience and strategic pivot, to be a compelling investment narrative.

On the date of publication, Jim Osman had a position in: GE. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.