GE Vernova’s Stock Soars as Earnings Beat Expectations

An Overview of GEV’s Performance and Analyst Opinions

Headquartered in Cambridge, Massachusetts, GE Vernova Inc. (GEV) is a global energy company dedicated to advancing sustainable energy solutions. With a substantial market presence and a focus on innovative technologies, GEV boasts a market cap of $94 billion. The company offers a wide range of products and services across power generation, renewable energy, and energy management, serving clients that include utilities, governments, and industries.

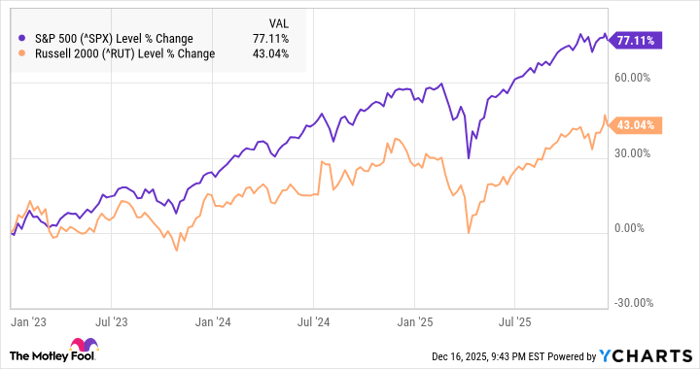

Over the past six months, GEV’s shares have outperformed the wider market, climbing by 108% in contrast to the S&P 500 Index ($SPX), which has gained 15.6%.

However, a closer look reveals that GEV has lagged behind the iShares Global Clean Energy ETF (ICLN), which saw a decline of about 10.6% during the same period.

After the company announced its strong Q3 earnings report on October 23, shares of GE Vernova surged by more than 6%. GEV surpassed analysts’ expectations for both earnings and revenue, projecting full-year revenue between $34 billion and $35 billion. On October 21, the stock gained over 1% following Deutsche Bank’s initiation of coverage with a “Buy” rating and a $354 price target.

For the fiscal year ending in December, analysts predict GEV’s EPS to decline 99.8% from the previous year, hitting $2.53 on a diluted basis. Historically, the company has shown a mixed performance in terms of earnings surprises, beating expectations in two of the last three quarters but falling short once.

Among 22 analysts covering GEV stock, the consensus rating is now a “Strong Buy,” a notable upgrade from the previous “Moderate Buy” just two months ago. This rating is supported by 16 “Strong Buys,” one “Moderate Buy,” and five “Holds.”

This positive sentiment has strengthened compared to three months ago when only eight analysts recommended a “Strong Buy.”

On November 4, Andrew Obin of Bank of America Securities reaffirmed a ‘Buy’ rating on GE Vernova, setting a price target of $320, indicating that the stock is currently trading at a premium. While this stock exceeds the average price target of $301.05, the highest target on the Street, which stands at $374, suggests an upside potential of 9.6%.

More Stock Market News from Barchart

On the date of publication, Rashmi Kumari did not hold positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.