GE HealthCare Prepares to Release Q4 2024 Earnings: Insights Ahead of the Announcement

GE HealthCare Technologies Inc. (GEHC) is set to reveal its fourth-quarter 2024 results on February 13, just before the market opens.

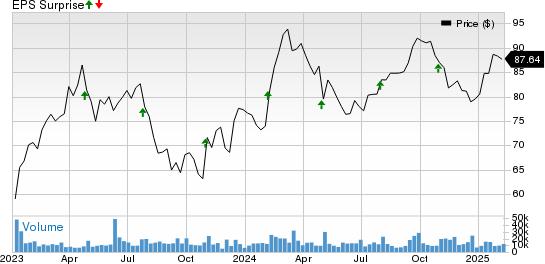

In the previous quarter, GEHC reported adjusted earnings per share of $1.14, surpassing the Zacks Consensus Estimate by 7.55%.

Stay updated on quarterly releases: Access the Zacks Earnings Calendar.

Let’s explore the potential factors that may have influenced GEHC’s performance leading into this announcement.

Key Influencers of GEHC’s Q4 Performance

GE HealthCare entered the fourth quarter of 2024 with a cautious yet positive outlook, having achieved 1% organic revenue growth in the prior quarter, aligning closely with expectations. Performance for this quarter is anticipated to be mixed but generally improving. While weakness in China undermines growth, robust demand in the U.S., efficient backlog management, and ongoing product innovation are likely to have fueled steady performance. Efforts to expand margins and enhance operational efficiency should contribute to sustained profitability.

Growth in the U.S. and international markets probably mitigated the impact of declines elsewhere. The company’s strategy focusing on multiyear enterprise agreements, especially in imaging and service contracts, is expected to bolster revenue. The ongoing growth in service backlogs suggests continued stability in recurring revenue streams. Additionally, cost optimization measures, including product platforming and improvements in the supply chain, likely supported margin progress.

However, macroeconomic challenges remain, particularly persistently weak market conditions in China, which significantly hamper capital equipment sales. Delays in coordinating stimulus funding have led to prolonged purchasing slowdowns, further complicating the situation in that crucial market.

During Q3 2024, GE HealthCare unveiled several innovative products that are expected to generate additional sales in the fourth quarter. Notably, the company received FDA clearance for a groundbreaking software tool aimed at standardizing and automating radiation dose measurement in theragnostic treatments. This advancement is anticipated to enhance clinical efficiency and patient safety, especially given the increasing focus on molecular imaging for cancer diagnosis and treatment. Furthermore, GE HealthCare announced new research partnerships in both Europe and the U.S. to broaden the application of theragnostics, reinforcing its leadership in precision medicine.

GE HealthCare Technologies Inc. Price and EPS Surprise

GE HealthCare Technologies Inc. price-eps-surprise | GE HealthCare Technologies Inc. Quote

Overview of GEHC’s Business Segments

Imaging is likely to have remained a primary revenue driver, although it may face short-term pressures from weak demand in China. Last quarter, this segment experienced a 1% organic revenue decline, despite a robust U.S. market and continued investments in PET and CT systems. The company is banking on strong U.S. demand for imaging upgrades and replacements, as well as expansion in theragnostics— a rapidly growing area that combines diagnostics and treatment. Despite challenges in China, effective backlog management and strategic pricing should help stabilize performance in this segment.

Advanced Visualization Solutions, formerly part of the ultrasound division, reported flat organic revenues last quarter, with gains in the U.S. countered by declines related to China. This sector’s performance in Q4 is likely influenced by the increased adoption of AI-driven imaging solutions and improvements in cost productivity. New product launches and digital enhancements could yield positive impacts, although shifts in product mix may pose challenges.

Patient Care Solutions recorded 2% organic revenue growth in the last quarter, benefitting from efficient backlog management and increased capacity for fulfilling orders. The reduction of past-due orders has provided more flexibility for the upcoming quarter. Ongoing adoption of monitoring solutions and improvements in lean manufacturing practices should have continued to support this segment’s performance.

Pharmaceutical Diagnostics emerged as a strong performer, boasting 7% organic revenue growth last quarter driven by rising procedure volumes. The company appears well-positioned for further growth in the current quarter, especially with the anticipated launch of Ocado, a newly FDA-approved PET tracer for coronary artery disease planned for Q1 2025. The earnings call may feature updates about the Ocado launch, as favorable trends in reimbursement for diagnostic imaging, particularly in PET diagnostics, are expected to further enhance revenue in this high-margin area.

Q4 Financial Estimates

The Zacks Consensus Estimate for GEHC’s revenues stands at $5.33 billion, indicating a projected growth of 2.4% year-over-year.

Additionally, the Zacks Consensus Estimate for earnings per share is set at $1.26, suggesting an increase of 6.8% compared to last year.

Insights from the Zacks Model

Our established model indicates that GEHC is unlikely to report an earnings beat this time. A combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) is generally favorable for predicting earnings beats. Unfortunately, this scenario does not apply here.

Earnings ESP: The Earnings ESP, which reflects the disparity between the Most Accurate Estimate and the Zacks Consensus Estimate, registers at 0.00%. You can explore top stocks to buy or sell ahead of earnings announcements using our Earnings ESP Filter.

Zacks Rank: Currently, the company holds a Zacks Rank of #4 (Sell).

GE HealthCare Technologies: Navigating Challenges and Opportunities in 2025

Assessing GEHC’s Growth Prospects

GE HealthCare Technologies (GEHC) is gearing up for an important year in 2025, fueled by strategic actions and adapting to market hurdles. The introduction of new products, particularly in imaging and pharmaceutical diagnostics, is expected to significantly influence GEHC’s growth. The recent FDA approval of Ocado, a PET tracer designed for coronary artery disease, marks a pivotal moment for the company, potentially enhancing its presence in the lucrative pharmaceutical diagnostics market. Furthermore, the incorporation of AI-driven imaging technology is set to increase operational efficiency, placing GEHC in a leading position within healthcare innovations.

Enhancing profit margins and optimizing costs will remain critical for GEHC. To maintain profitability, the company has rolled out several initiatives, including product platforming and improvements in supply-chain processes. These strategies should help ease the financial impacts arising from the fluctuating demand for capital equipment, especially across international markets. While capital equipment integrating AI—especially in imaging and advanced visualization—should enhance workflow efficiency, the overall value proposition for healthcare providers will also improve.

The pharmaceutical diagnostics segment stands out as a strong area for growth, with an increase in procedure volumes likely to bolster revenue. Positive trends in reimbursements, especially for PET diagnostics, might further accelerate the segment’s adoption. Additionally, sustained investments in AI and digital tools are expected to support capital equipment sales, improving efficiency and helping GEHC grow its market share.

Despite these optimistic developments, challenges in the Chinese market pose a notable risk. Economic difficulties and postponed stimulus funding have affected spending behaviors, which could hinder revenue growth in 2025. Nonetheless, GEHC’s diverse global footprint and robust performance in the U.S. market provide a buffer. By effectively managing costs, insisting on innovation, and balancing its approach to international operations, GEHC seems well-positioned for steady growth in the years to come.

Evaluating GE HealthCare Technologies

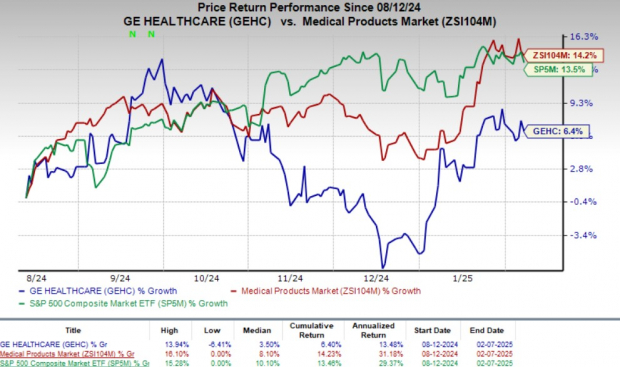

GEHC’s stock has seen a 6.4% increase over the last six months, which falls short compared to the industry’s growth of 14.2%. This underperformance can primarily be linked to ongoing challenges in China’s market that are pressuring overall revenue growth.

Image Source: Zacks Investment Research

Looking ahead, the company may face mixed performance. According to Zacks Style Score, GEHC is moderately valued (Value Score: C), but holds a strong chance for growth (Growth Score: B). However, momentum appears sluggish (Momentum Score: F).

As the Zacks Rank combined with the Style Score indicates uncertainty about GEHC meeting earnings projections this reporting cycle, potential investors should tread cautiously. Those already holding shares might consider reducing their positions to take profits.

Other Investment Opportunities

In light of these considerations, here are several medical stocks that may have the potential to outperform and deliver an earnings beat this reporting cycle:

Natera (NTRA) shows an Earnings ESP of +61.91% and is currently rated #2 by Zacks. You can seethe complete list of today’s Zacks #1 Rank stocks here. NTRA has exceeded earnings estimates for the last four quarters, delivering an average surprise of 36.37%. The Zacks Consensus Estimate for its fourth-quarter EPS indicates a 34.4% increase from last year’s results.

Masimo (MASI) has an Earnings ESP of +4.05% and holds a Zacks Rank #2 at this time. The company plans to announce its fourth-quarter results on Feb. 25. It has consistently surpassed earnings estimates over the trailing four quarters, with an average surprise of 17.10%. The Zacks Consensus Estimate for MASI’s EPS indicates a 14.4% rise compared to the previous year’s figures.

Maravai LifeSciences (MRVI) possesses an Earnings ESP of +10.00% and is also rated #2 by Zacks. MRVI is expected to report its fourth-quarter results in February. It has shown a remarkable average earnings surprise of 116.67% over the last four quarters, although the Zacks Consensus Estimate for its fourth-quarter EPS shows a significant expected decline of 400% from last year.

Discover the Top 10 Stocks for 2025

Don’t miss your chance to invest early in our top ten stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has consistently outperformed expectations. From its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio demonstrated a remarkable gain of +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies under the Zacks Rank framework to select the best ten stocks to focus on in 2025. You can still be one of the first to access these newly identified stocks with significant potential.

Masimo Corporation (MASI) : Free Stock Analysis Report

Natera, Inc. (NTRA) : Free Stock Analysis Report

Maravai LifeSciences Holdings, Inc. (MRVI) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.