General Mills, Inc. , the renowned titan of breakfast cereals, has unveiled its third-quarter fiscal 2024 report, showcasing figures that outperformed the Zacks Consensus Estimate. The company witnessed a surge in bottom-line metrics year over year. However, this euphoria was dimmed by a downward trajectory in overall sales compared to the corresponding period in the previous year. While acknowledging this ambiguity in performance, the management of General Mills affirmed their fiscal 2024 guidance, a testament to their tenacity in the face of fluctuating market landscapes.

Quarterly Triumphs

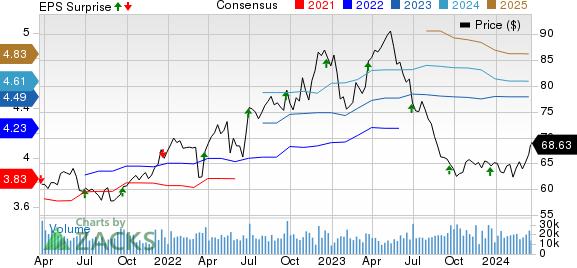

General Mills reported adjusted earnings of $1.17 per share, sailing past the Zacks Consensus Estimate of $1.04. This remarkable achievement signified a 22% boom in the bottom-line on a constant-currency basis year over year. The surge was primarily attributed to an increase in adjusted operating profit, a reduction in net shares outstanding, and a decline in taxes. Nevertheless, this triumphant ascension was slightly shadowed by escalated net interest expenses.

Despite the thrilling performance on the earnings front, General Mills reported a net sales figure of $5,099.2 million, which managed to surpass the Zacks Consensus Estimate of $4,954.3 million. However, this jubilation was tamed by a 1% decline in the top line compared to the corresponding quarter in the prior year due to decreased pound volume, offset somewhat by positive net price realization and mix. The organic net sales also mirrored this downtrend, slipping by 1%.

The adjusted gross margin exhibited a growth spurt of 20 basis points (bps), reaching 34%. This flourishing margin expansion was fueled by the commendable performance of the Holistic Margin Management (HMM), yielding cost savings and a positive net price realization. However, challenges loomed in the form of input cost inflation, escalated supply chain costs, and supply chain deleverage. Despite these hurdles, General Mills managed to marginally exceed the adjusted gross margin estimate by clocking in at 34.1%.

Segmental Scenarios

North America Retail witnessed revenues stagnating at $3,242.1 million, as positive net price realization and mix were offset by dwindling pound volume. Concomitantly, organic net sales remained flat year over year, with the segment’s operating profit taking a slight dip of 4% to $752.2 million.

International revenues nosedived by 3% to $680.1 million, with China and Brazil experiencing a slowdown. This slump also reflected in the 3% decline in organic net sales, reeling from softened sales dynamics in these regions. The segment’s operating profit took a heavy blow, plunging by a staggering 57% to $18.2 million.

Pet division revenues faltered by 3% to $624.5 million due to reduced pound volume while a silver lining in the form of a positive net price realization and mix offered some solace. The operating profit for this segment stood at $128.3 million, marking a 25% uptick from the comparative year-over-year figures.

The revenue landscape in the North America Foodservice arm painted a brighter picture with a 1% surge to $551.7 million. Similarly, organic net sales mirrored this growth trajectory at 1%, but the operating profit declined marginally by 1% to $81.7 million owing to increased other supply chain costs and SG&A expenses.

Financial Outlooks and Beyond

General Mills wrapped up the quarter with $588.6 million in cash and cash equivalents, while shouldering a long-term debt burden of $11,015.1 million. The company’s balance sheet displayed total shareholders’ equity of $9,691.3 million, signifying their robust financial standing amidst turbulent market conditions.

The tenacity and strategic agility of General Mills were further underscored by their operational excellence in the nine months ended Feb 25, 2024. The company orchestrated cash flows of $2,438.9 million from operating activities during this period, allocating $486 million to capital investments.

Amidst this financial ballet, General Mills disbursed dividends worth a staggering $1 billion and repurchased nearly 23.5 million shares, amounting to a whopping $1.6 billion in the first nine months of the fiscal year, showcasing their commitment to shareholder value enhancement.

Embracing Challenges and Navigating Growth

As General Mills forges ahead, navigating the ever-changing tides of consumer demand and market stability, the company is gearing up for the challenges and opportunities that lay ahead in fiscal 2024. Anchored by a strategic vision and a customer-centric approach, General Mills expects a slightly adverse outlook on organic net sales, projecting a 1% decline to flat compared to the prior year. Adjusted operating profit growth at cc is slated to oscillate between 4-5%, with adjusted EPS growth hovering around 4-5% as well. The company envisions a free cash flow conversion pegged at a minimum of 95% of adjusted after-tax earnings, solidifying their financial foundations as they charter new growth trajectories.

The market echoes this sentiment as General Mills’ shares have soared by 6.9% in the past three months, outpacing industry benchmarks, showcasing investor confidence in the company’s strategic moves and operational prowess amidst a volatile market environment.

Charting a Path of Excellence

In a market bustling with opportunities, other stocks have also emerged as potential beacons of growth. The Chef’s Warehouse (CHEF), dealing in specialty food products, holds a Zacks Rank #2 (Buy) with a stellar track record of a trailing four-quarter earnings surprise of 3.2% on average, highlighting its growth potential and operational excellence.

Similarly, Vital Farms Inc. (VITL) and Utz Brands Inc. (UTZ) are poised for growth, carrying a Zacks Rank #2. VITL boasts an impressive trailing four-quarter average earnings surprise of 155.4%, while UTZ has clocked a respectable earnings surprise of 5.5% on average, underlining the diverse growth avenues available for investors amidst a dynamic market ecosystem.

The market hums with excitement as investors seek out the hidden gems poised for growth and value creation, presenting a tableau of opportunities for those keen on riding the wave of financial prosperity and operational excellence in the ever-evolving marketplace.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence.

Revolution in Semiconductor Industry Sparks Unprecedented Growth

The semiconductor industry, the bedrock of technological progress, is on the brink of a monumental transformation. Propelled by the nexus of Machine Learning and the Internet of Things, global semiconductor manufacturing is set to skyrocket from $452 billion in 2021 to a staggering $803 billion by 2028.

A Paradigm Shift in Tech Landscape

This surge in semiconductor manufacturing signifies a seismic shift in the technological landscape. With Machine Learning and the Internet of Things at the helm, the industry is witnessing unprecedented evolution at a rapid pace, heralding a new era of innovation and connectivity.

Investment Opportunities Galore

For astute investors attuned to the pulse of this transformation, opportunities abound. Companies such as General Mills, Inc. (GIS), The Chefs’ Warehouse, Inc. (CHEF), Vital Farms, Inc. (VITL), and Utz Brands, Inc. (UTZ) are poised to ride the wave of this revolution, offering promising prospects for growth and profitability.

Historical Context and Future Projections

Reflecting on the historical trajectory of the semiconductor industry, marked by breakthrough innovations and technological leaps, the current exponential growth trajectory represents a culmination of decades of progress. As we gaze towards the future, the projected surge to $803 billion by 2028 showcases the industry’s resilience and capacity for innovation amidst rapidly evolving technological landscapes.

Significance of Collaboration and Innovation

Collaboration and innovation stand as the cornerstones of this revolution. Companies that prioritize research and development, foster collaboration across disciplines, and embrace cutting-edge technologies are set to spearhead the transformation of the semiconductor industry, paving the way for groundbreaking advancements in the realms of Machine Learning and the Internet of Things.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.