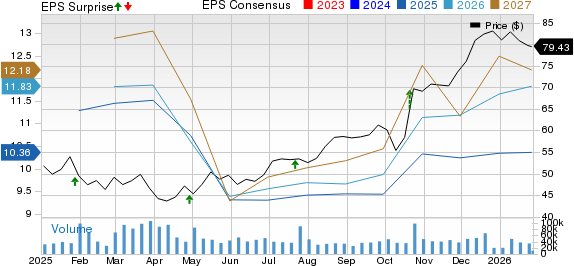

General Motors (GM) reported adjusted earnings of $2.51 per share for the fourth quarter of 2025, surpassing the Zacks Consensus Estimate of $2.20. This performance was bolstered by higher-than-expected revenues across its North America, International, and Financial segments. However, total revenues of $45.29 billion fell short of the estimated $45.4 billion, down from $47.71 billion in the previous year.

GM’s North America segment generated revenues of $36.89 billion—down from $39.5 billion a year earlier—while wholesale vehicle sales declined to 780,000 units from 876,000 units. In contrast, the International segment saw revenues rise to $4.03 billion, leveraging better-than-expected deliveries despite declining sales volumes. As of December 31, 2025, GM reported cash and cash equivalents of $20.94 billion and long-term automotive debt of $15.52 billion.

Looking ahead, GM projects net income attributable to stockholders for 2026 between $10.3 billion and $11.7 billion, compared to $2.7 billion in 2025. The company expects adjusted EBIT of $13 billion to $15 billion, with automotive operating cash flow between $19 billion and $23 billion.