Investors Consider Put Selling Strategy for CVS Health Shares

For investors looking to acquire shares of CVS Health Corporation (Symbol: CVS) but hesitant about the current market price of $67.28 per share, selling puts may present an attractive alternative strategy. One noteworthy put contract is the January 2027 put with a $47.50 strike price, which has a bid of $3.45 at the time of writing. Collecting this premium represents a 7.3% return based on the $47.50 commitment, translating to a 4.1% annualized rate of return, a concept we refer to as YieldBoost at Stock Options Channel.

However, selling a put does not grant the investor access to the upside potential of CVS shares as owning them would. The put seller only acquires shares if the contract is exercised. Importantly, the contract is likely to be exercised only if the market price falls below the strike price of $47.50, necessitating a 29.4% decline from the current price. Should this occur, the cost basis would be $44.05 per share after accounting for the $3.45 premium collected.

Interestingly, the annualized return of 4.1% surpasses the 4% annualized dividend paid by CVS Health, based on today’s stock price. This presents a compelling consideration for investors: buying shares to secure the dividend involves greater risk since the stock would need to drop significantly to hit the $47.50 strike price.

It’s also crucial to acknowledge that dividend amounts can fluctuate and are often tied to the company’s profitability. Reviewing CVS Health’s historical dividend chart can provide insights into whether the most recent dividend is likely to be sustained, and hence, whether a 4% dividend yield is a reasonable expectation.

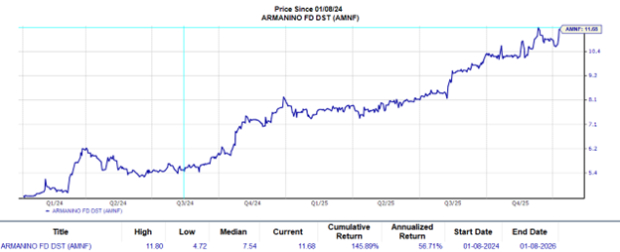

Additionally, the following chart illustrates CVS Health’s trading history over the past twelve months, highlighting the $47.50 strike in green relative to its price movements:

The above chart, coupled with CVS’s historical volatility, is a valuable tool for assessing whether the January 2027 put at the $47.50 strike for a 4.1% annualized return offers a satisfactory risk-reward scenario. Presently, the trailing twelve-month volatility for CVS Health, calculated from the last 251 trading days and the current price of $67.28, stands at 41%. For more put option ideas across different expiration dates, visit the CVS Stock Options page on StockOptionsChannel.com.

On Wednesday afternoon, put volume among S&P 500 components reached 1.09 million contracts, while call volume was at 1.39 million, resulting in a put-to-call ratio of 0.78. This is considerably high when compared to the long-term median ratio of 0.65. In other words, there are significantly more put buyers in today’s options trading than historically observed. To learn more about the most commonly discussed call and put options, visit this link.

![]() Top YieldBoost Puts of Stocks with Insider Buying »

Top YieldBoost Puts of Stocks with Insider Buying »

Also see:

- Top Ten Hedge Funds Holding BAMY

- Live Nation Entertainment Average Annual Return

- WP Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.