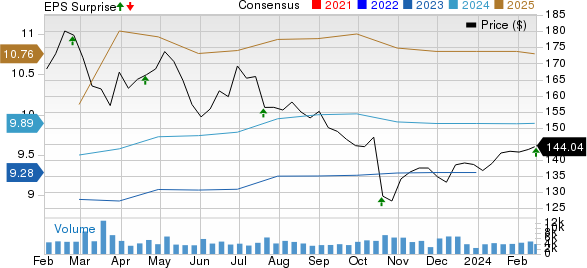

Genuine Parts Company (GPC) delivered fourth-quarter 2023 adjusted earnings of $2.26 per share, marking a 10.2% increase from the previous year. This exceeded the Zacks Consensus Estimate of $2.20 per share, signaling higher-than-expected profit from the Industrial Parts segment.

Steady Earnings, Slight Revenue Miss

The reported net sales of $5.59 billion slightly missed the Zacks Consensus Estimate of $5.63 billion, yet demonstrated a 1.2% year-over-year increase. The rise in revenues was primarily attributed to enhanced comparable sales in the Industrial Parts segment, coupled with positive impacts from acquisitions and foreign currency translation.

Segmental Performance: Mixed Bag

The Automotive segment witnessed a 0.8% year-over-year revenue increase, but failed to match the estimated value. Contrastingly, the Industrial Parts segment achieved a 1.7% year-over-year rise in net sales, albeit slightly below the projected value. Notably, operating profit for the Industrial Parts segment surged by 19.3% from the prior year, outdoing the forecasted figures.

Robust Financials and Positive Outlook

As of December 31, 2023, Genuine Parts held cash and cash equivalents worth $1.1 billion, compared to $653.5 million a year prior. Despite an increase in long-term debt, the company’s total liquidity climbed to $2.6 billion at the end of the fourth quarter. Looking ahead to 2024, the company projects year-over-year upticks in automotive and industrial sales, alongside adjusted earnings per share of $9.70-$9.90.

Analyst Projections and Stock Picks

While Genuine Parts carries a Zacks Rank #3 (Hold), other noteworthy players such as Modine Manufacturing Company (MOD), NIO Inc. (NIO), and Oshkosh Corporation (OSK) offer promising investment opportunities. These insights can guide investors in identifying favorable openings within the automotive sector.

To read this article on Zacks.com click here.