New Options Trading Opportunities for GEO Group Inc

Investors Eye February Contracts with Unique Potential

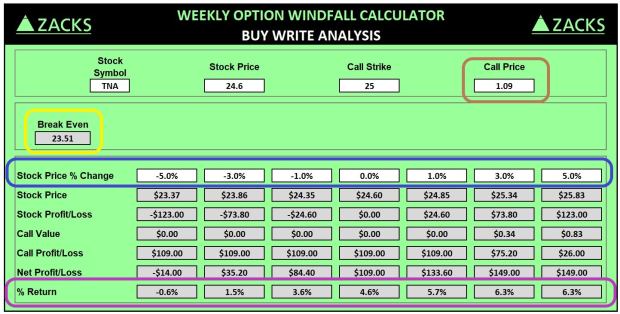

Investors in GEO Group Inc (Symbol: GEO) are exploring new options, specifically for contracts expiring on February 14th. The Stock Options Channel’s YieldBoost formula has identified two noteworthy contracts: one put and one call.

The put contract priced at a $28.00 strike has a current bid of 55 cents. If an investor sells to open this put contract, they commit to purchasing GEO stock at $28.00 while collecting the premium of 55 cents. This lowers their effective cost basis to $27.45 (excluding broker commissions). For those already interested in acquiring shares, this approach offers a financial advantage compared to the current share price of $28.61.

With the $28.00 strike representing about a 2% discount to the current stock price, there’s potential for the put contract to expire without value. Current analytical data suggests a 58% probability of this occurring. The Stock Options Channel will monitor these odds over time and publish updates on their website. If the contract does expire worthless, the premium collected would yield a 1.96% return on the cash commitment—or an impressive 16.67% annualized, which we refer to as the YieldBoost.

Below is a chart showcasing GEO Group Inc’s trading history over the past twelve months, highlighting where the $28.00 strike price sits relative to this data:

On the call side of the options chain, there’s a call contract at the $29.00 strike price with a current bid of 35 cents. If an investor buys shares at the present price of $28.61 and sells to open this call as a “covered call,” they commit to selling the shares at $29.00. With the premium included, this could lead to a total return of 2.59% if the stock is called away at expiration (before broker commissions). Investors must also consider that they might miss out on greater gains if GEO shares surge significantly. Therefore, examining the twelve-month trading history and business fundamentals is essential. Below is the chart depicting GEO’s trading history, with the $29.00 strike marked in red:

Since the $29.00 strike price mirrors roughly a 1% premium to the current stock price, there’s a chance that the covered call could expire worthless. In this case, the investor retains the shares and the premium collected. Current data indicates a 48% probability of this happening. Tracking these odds over time and charting the trading history of the option contract will be available on the Stock Options Channel website. Should this contract expire worthless, the premium would translate into a 1.22% extra return for the investor, or an annualized 10.38%—also part of our YieldBoost formula.

The implied volatility for the put contract stands at 73%, while the call contract’s implied volatility is 67%. Meanwhile, we have calculated the actual trailing twelve-month volatility, based on the last 251 trading days and the current price of $28.61, to be 57%. For further ideas regarding put and call options, visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

Largest BDCs by Net Assets

MVCB Historical Stock Prices

Funds Holding POST

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.