“`html

GE Vernova (GEV) is acquiring the remaining 50% stake in Prolec GE, strengthening its position in the global grid infrastructure market to enhance its manufacturing capabilities and expand in North America, where demand for grid technologies is increasing. GEV, with cash and cash equivalents totaling $7.95 billion as of September 30, 2025, holds a strong solvency position, with no current or long-term debt.

The AES Corporation (AES) has approximately 4.2 gigawatts (GW) of power purchase agreements (PPAs) operational for data centers, with a total of 8.2 GW in signed agreements. However, AES reported long-term debt of $26.46 billion and current debt of $4.39 billion as of the same date, resulting in a weaker solvency position compared to GEV.

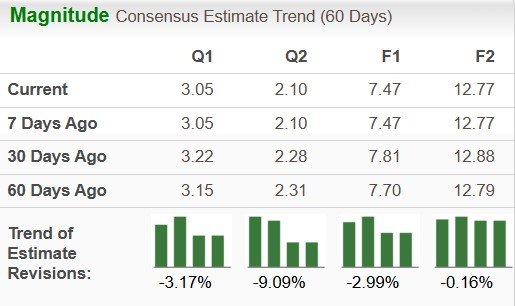

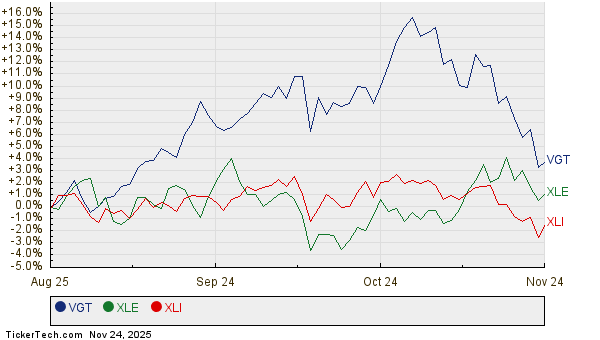

In the past year, shares of GEV have risen by 69%, contrasted with a 4.5% increase for AES. Both companies hold a Zacks Rank of #3 (Hold) currently, with status updates on their earnings estimates showing a decline for GEV and stability for AES.

“`