Investors in GFL Environmental (NYSE:GFL) have reason to celebrate as the average one-year price target for the company has received a substantial boost to $37.77 per share, marking a significant 5.09% increase from the previous estimate of $35.94 reported on January 18, 2024.

This price target represents the collective viewpoint of various analysts, with individual estimates ranging from a low of $25.48 to a high of $49.08 per share. Overall, this average price target reflects a remarkable 6.06% surge from GFL’s latest closing price of $35.61 per share.

The Pulse of Fund Sentiment

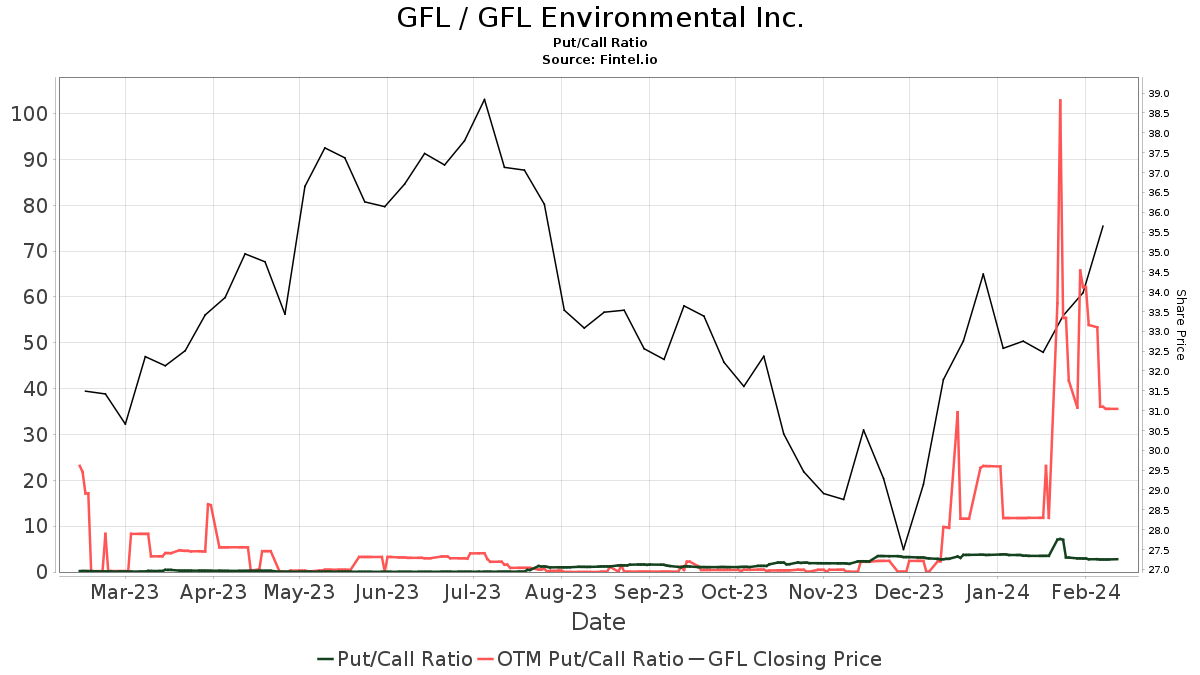

What do the numbers reveal about fund sentiment towards GFL Environmental? Well, 434 funds or institutions now report holdings in the company, showcasing an uptick of 11 owners or 2.60% in the last quarter. The average portfolio weight across all funds dedicated to GFL has now settled at 0.70%, marking a slight decrease of 5.08%. Over the last three months, institutions have collectively increased their ownership stakes by 3.94%, amounting to a total of 290,832K shares. The put/call ratio for GFL stands at 2.19, painting a somewhat bearish picture for the company’s outlook.

Insights into Shareholders’ Actions

Taking a closer look at specific institutional investors, BC Partners Advisors retains a sizable 48,476K shares, representing 13.06% ownership of GFL. Notably, there have been no changes in their holdings in the last quarter. Moving on, the Ontario Teachers Pension Plan Board holds 39,352K shares, constituting 10.60% ownership, with no alterations reported in the recent quarter.

Capital Research Global Investors now possess 16,916K shares, accounting for 4.56% ownership. In its previous filing, the firm disclosed ownership of 14,550K shares, signaling an impressive uptick of 13.98%. The company augmented its portfolio allocation in GFL by a noteworthy 12.86% over the last quarter.

Meanwhile, Massachusetts Financial Services boasts 13,022K shares, representing 3.51% ownership, with recent reports indicating a 3.67% increase from their prior holdings. In contrast, their portfolio allocation in GFL has notably dipped by 83.97% during the last quarter.

Pictet Asset Management Holding has also upped its game, now holding 9,658K shares or 2.60% ownership, following a substantial 43.81% rise from their previous holdings of 5,427K shares. This indicates a robust 63.87% increase in portfolio allocation towards GFL over the last quarter.

Unveiling GFL Environmental

GFL, headquartered in Vaughan, Ontario, stands as the fourth-largest diversified environmental services company in North America. The organization offers a wide array of non-hazardous solid waste management, infrastructure, soil remediation, and liquid waste management services across Canada and 27 states in the U.S. With over 13,000 employees, GFL caters to more than 135,000 commercial and industrial clients, along with providing solid waste collection to over 4 million households.

Fintel emerges as a vital investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds. Our extensive data includes fundamentals, analyst reports, ownership details, fund sentiment, options sentiment, insider trades, options flow, unusual options activities, and much more. To further enhance your investing strategies, our exclusive stock picks leverage sophisticated backtested quantitative models, aiming to boost profitability.

For more insights and expert analysis, dive deeper into the offerings on Fintel.

Remember, the views and opinions articulated here solely represent the author’s perspective and may not necessarily align with those of Nasdaq, Inc.