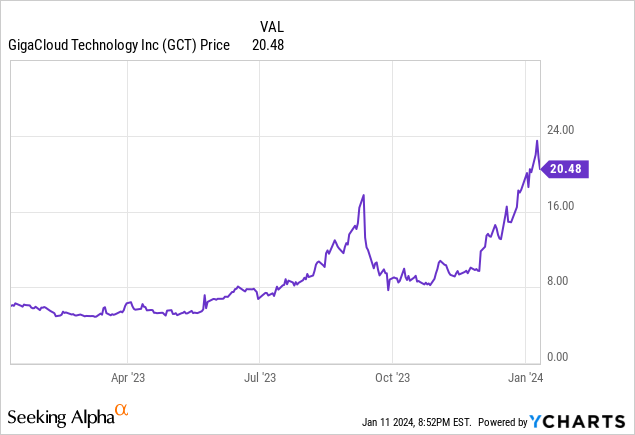

Let’s start with the basics. GigaCloud Technology (NASDAQ:GCT) stands apart from traditional public cloud providers, instead touting an online marketplace linking Asian manufacturers with resellers worldwide. Specializing in big-ticket items, think furniture and sprawling merchandise ferried across oceans, the company has seen a meteoric rise, with its stock surging over 200% in the last year, currently trading around $20.44, after peaking at $23.5. Tempting as it may be to dive in, seeing as the stock has been tagged as a buy by Quants, tread carefully. Amid the allure of its robust profitability and valuation metrics, the forecast is soured by looming Red Sea-related risks that could gnaw into its profits. Hence, prudence dictates waiting.

Now, let’s delve into how GCT rakes in the moolah.

Driven by the Supplier-Fulfilled Retailing Business Model and AI

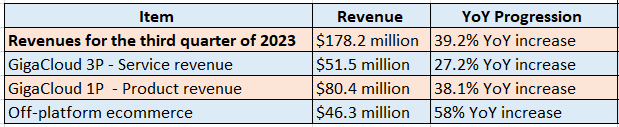

The company’s business spans three primary domains, two of which are platform-based – GigaCloud 3P for service revenue generation, and GigaCloud 1P for product sales. The third sector encompasses off-platform eCommerce. Third-quarter progress in all three segments culminated in a robust 39.20% overall revenue growth in FQ3-2023.

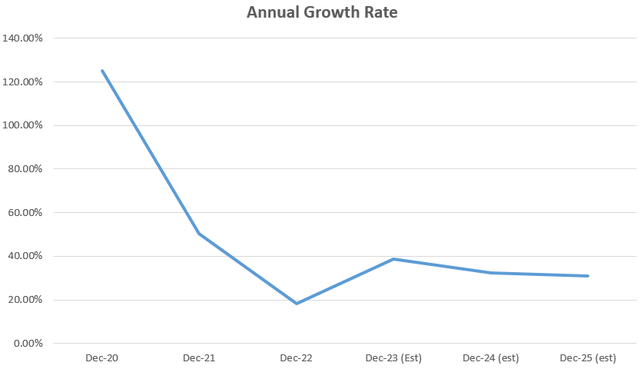

In the grand scheme, the following chart outlines the accelerated double-digit annual growth rate, a stark upswing post the COVID-19 slump of 2021-2022, accentuated by the prolonged lockdowns in China – a key source of GCT’s merchandise.

In terms of figures, with revenues poised to cross the $1 billion milestone in FY-2025 from $490 million in fiscal 2022, the allure of GCT’s supplier-fulfilled retailing business model is undeniable. Here’s how it rolls – once orders for a product stream in, GCT takes the wheel with sourcing and delivering items straight from suppliers to customers. Its platform directly links resellers of furniture and home appliances in developed nations with Chinese manufacturers, bolstered by strategically located warehouses near ports that oil the supply chain, axing middlemen to trim delivery times and costs. In parallel, GCT furnishes logistics support – think transportation – to buyers, placing it head-to-head with heavyweights like United Parcel Service (UPS) and FedEx (FDX).

Delving deeper, its AI algorithms are the unsung heroes, pooling orders, pinging the shortest routes drawing from clients’ history, and optimizing container use, all bucketing down to cost savings for customers. In this groove, GCT has notched up a reputable name in the big-merchandise arena, its GigaCloud marketplace boasting a GMV (Gross Merchandise Value) of $684.8 million by FQ3-2023, marking a staggering 41% YoY surge. The U.S. is the prime market, with thriving partnerships embracing Walmart (WMT) and Amazon (AMZN) as of end-2022.

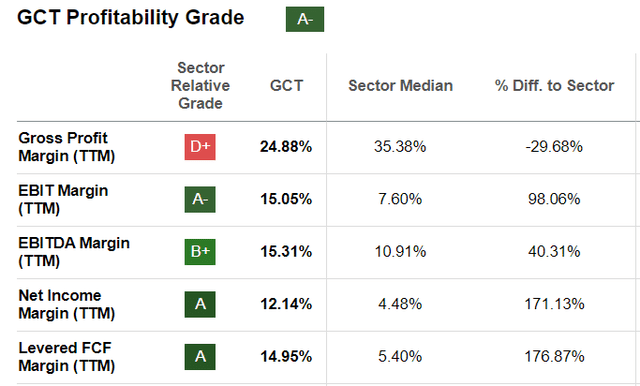

What’s more, with $214 million cash-on-hand versus a puny $164.5 million in debt, its balance sheet is brawny, boasting an A- in the growth stakes. However, mirroring the sparkling growth is the lurking specter of rising geopolitical tensions in the Middle East, gnawing at its profitability grade of A-

Aftershocks from the Red Sea Swell

In FQ3-2023, gross profit margins perked up to 27.4%, a whopping 55.68% YoY hike owed principally to stabilized shipping rates, carving fixed expenses. Yet, teetering on the flip side, lies the threat of an abrupt tumble, cast by Red Sea ripples, where Houthi militias have laid siege to cargo vessels. As shipping goliaths like Maersk suspended navigation after an onslaught on its Hangzhou container ship, ocean freight rates swelled by over 50% along crucial routes, including from Asia to the U.S. East Coast, divulges Supply Chain Dive.

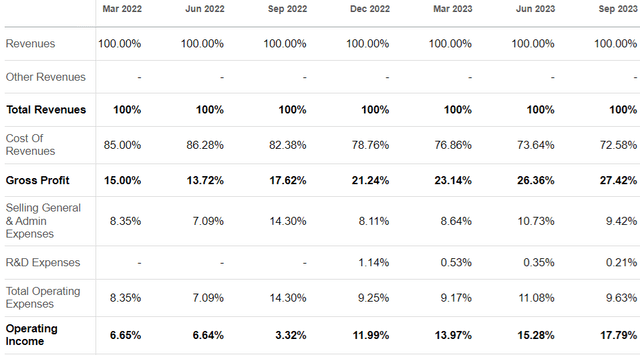

Though we steer clear of the doomsday ambiance of yesteryears, with entombing lockdowns and ports in limbo, the prospect of a short to mid-term rate spike looms large. Such tremors could deal GCT’s profits a hefty blow, reminiscent of the 2022 stint when the cost of revenues clambered to 85% and 86.3% of total sales in the initial two quarters, illustrated below.

Plunging shipping costs to nadir yawed gross profit and operating income margins to sub-14% and 7% respectively. Though they have staged a rebound, to over 27% and 17% respectively, other strings pull taut.

The last-reported quarter witnessed a sales and marketing campaign

GCT Company Analysis: Revenue, Earnings, and Risk

Gigantic Cloud Technologies (GCT) has witnessed a substantial 61.8% jump in expenses on a year-over-year (YoY) basis. This surge suggests increased staff hours dedicated to driving sales perhaps due to rising competition from B2B marketplaces like Alibaba Cloud (BABA). The company could also be spending more time as a middleman dealing with Chinese suppliers and customers seeking discounts against the backdrop of a sluggish U.S. economy with inflation remaining above 3%—not an ideal environment for sustained consumer spending. On top of that, one of GCT’s key markets, Europe, teeters on the edge of a recession.

Moreover, additional expenses were incurred for the GigaCloud platforms to support the upsurge in the number of transactions, and more fees were paid to third-party eCommerce websites. However, despite this, operating expenses decreased by 6% year-over-year, largely due to a significant reduction in share-based compensation.

Projected Impact on Earnings and Potential Valuation Implications

Considering the potential impact of higher shipping costs on profits, it is crucial to note that in addition to linking customers through the GigaCloud 3P platform, GCT also derives product revenue as indicated in the tables. Consequently, based on my calculation, 47% and 45% of product revenues were derived from the GigaCloud 1P online platform in FY-2022 and FQ3-2023 respectively.

In a scenario where shipping rates are increased and the company is unable to pass on the additional costs to its customers for fear of losing market share, GCT may experience a decline in profits. Estimating the potential impact on FY-2024’s earnings due to higher shipping rates, a 45% reduction based on the product constituent of sales for FQ3-2023 is projected. This figure is substantially lower than the anticipated 227% growth in earnings per share (EPS) for FY-2023 over 2022—a growth largely based on an expected normalization of shipping costs. Hence, a 45% decline due to disturbances related to the Red Sea elongating shipping routes appears to be a reasonable estimate.

Applying a 45% reduction, the EPS would decrease from $2.07 to $1.14 (2.07 x 0.55). Consequently, the forward price-to-earnings (P/E) ratio would rise to approximately 15.2x (10.48 x 1.45), deviating from the expected 10.48x. As a result, the stock would lose its current 35% discount relative to the sector, placing it into overvaluation territory.

GCT is a Hold Amid Risks; Urgent Management Update Needed

Based on the estimated P/E of 15.2x, the stock price, currently at $20.44, could potentially decline by 45% to $11.42, indicating that GCT appears more like a hold. Consequently, the stock should be subject to a higher degree of volatility if there is an escalation of the Red Sea attacks.

However, the pessimistic outlook could shift if GCT manages to swiftly chart a less costly route from Asia to the U.S. East Coast or utilizes its AI algorithms to consolidate client orders, offsetting the increased expenses of shipping goods to Europe through the Cape of Good Hope in South Africa. Conversely, downside risks may be mitigated if the company absorbs some of the higher costs internally, as evidenced by the drastic reduction in stock-based compensation—from $8.9 million in the third quarter of 2022 to only $317,000.

In light of the current U.S.-China tensions, diversification is imperative. With the bulk of its products “Made in China,” GCT appears overly reliant on the country’s manufacturing capabilities. It seems that management recognizes the need for more geographical diversity in the supply chain, evident in the FY-2022 SEC filings mentioning product sourcing from Vietnam, throughout Asia, and the opening of an office in Malaysia. Furthermore, India has recently become a new sourcing origin following the acquisition of Noble House in November last year. While these actions serve as risk mitigation measures, additional steps are warranted—a detailed update on the proportion of merchandise to be procured from sources other than China, especially as GCT is on the path to reaching $1 billion in revenue.

Lastly, given the risks associated with the Red Sea, it is prudent to refrain from buying the dip and await management comments during the upcoming quarter’s earnings around March 15. Key areas of interest include details regarding shipping rates and supplier diversification.