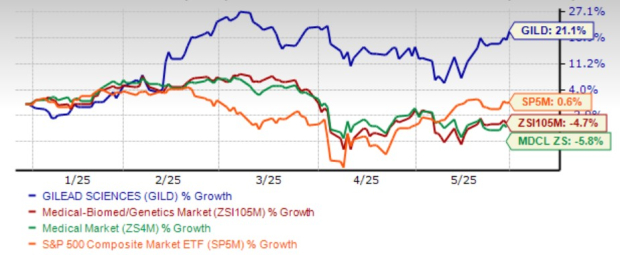

Gilead Sciences, Inc. Sees 21.1% Gains Amid Market Volatility

Gilead Sciences, Inc. (GILD) is performing well despite market fluctuations. Year-to-date, its shares have risen by 21.1%, while the industry has declined by 4.7%. GILD outperformed both the sector and the S&P 500 Index during this period.

Gilead Outperforms Industry and S&P 500 Index

Image Source: Zacks Investment Research

Dominating the HIV market, Gilead offers leading treatments and a diverse portfolio, including medications for liver diseases, oncology, and inflammation/respiratory conditions. Recent approvals and positive trial results have lifted investor confidence, although Gilead’s oncology segment faces challenges.

Leading HIV Franchise Continues to Grow

Biktarvy, Gilead’s primary drug for HIV-1 infection, is the most prescribed option for treatment-naïve and switch patients, capturing over 51% of the U.S. market. The drug is expected to sustain its momentum in coming quarters.

Descovy, which is approved for pre-exposure prophylaxis (PrEP), maintains over 40% market share in the U.S. for that category.

Gilead is innovating its HIV offerings, as seen in the late-stage studies of lenacapavir, which the FDA has prioritized for HIV prevention with a target action date of June 19, 2025.

The European Medicines Agency has also validated the marketing applications for lenacapavir, reinforcing Gilead’s position in the HIV treatment landscape.

FDA Approval of Livdelzi Enhances Liver Disease Portfolio

Recently, the FDA approved seladelpar, branded as Livdelzi, for treating primary biliary cholangitis (PBC). This strengthens Gilead’s liver disease offerings and endorses its CymaBay acquisition.

Oncology Business Faces Challenges

While Gilead’s oncology portfolio, including therapies like Yescarta and Trodelvy, has diversified its business, it is currently under pressure from competition expected to continue into 2025.

Sales of Trodelvy fell short in the first quarter due to inventory issues, but new data from the phase III ASCENT-03 study showed significant improvements in treatment for metastatic triple-negative breast cancer.

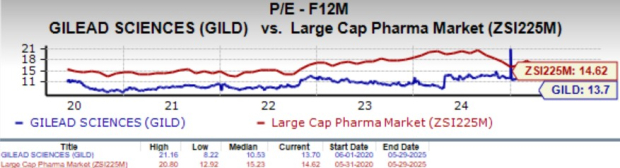

GILD’s Valuation and Estimate Updates

On the valuation front, GILD is currently trading at 13.70x forward earnings, above its historical average of 10.53x but below the large-cap pharma industry’s average of 14.62x.

Earnings projections for GILD have improved over the last two months, with estimates for 2025 rising to $7.91 and for 2026 to $8.39.

Investment Guidance for GILD

Large biotech firms like Gilead are often viewed as safe investments in uncertain markets. GILD continues to lead the HIV market with innovations that could sustain growth despite pressures, particularly from GSK.

Collaborations with Merck to explore new treatment options indicate a positive outlook, especially with potential launches of lenacapavir in 2025.

However, sales of Biktarvy may face challenges due to changes in Medicare, which could affect overall growth projections for the HIV segment.

Investors should consider monitoring Biktarvy’s performance and the oncology division’s response to current market challenges before committing. Current Gilead shareholders benefit from consistent dividend payouts, with a declared dividend of $0.79 per share for Q2 2025. The company reported $7.9 billion in cash reserves as of March 31, 2025, indicating a sustainable yield of 2.91%.

Gilead holds a Zacks Rank #3 (Hold), suggesting investors take a cautious stance before making new investments.

The views and opinions expressed herein are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.