GLJ Research Upgrades SolarEdge Technologies Outlook to Hold

On May 30, 2025, GLJ Research raised its rating for SolarEdge Technologies (LSE:0L7S) from Sell to Hold.

Analyst Price Forecast Indicates Potential Growth

As of May 7, 2025, the average one-year price target for SolarEdge Technologies is 18.67 GBX/share. Targets range from a low of 4.03 GBX to a high of 107.44 GBX, representing an 8.20% increase from its latest closing price of 17.25 GBX/share.

Projected Revenue and Earnings

For the upcoming year, SolarEdge Technologies anticipates annual revenue of 5,943 million, reflecting a 548.42% increase. The projected annual non-GAAP EPS is 14.07.

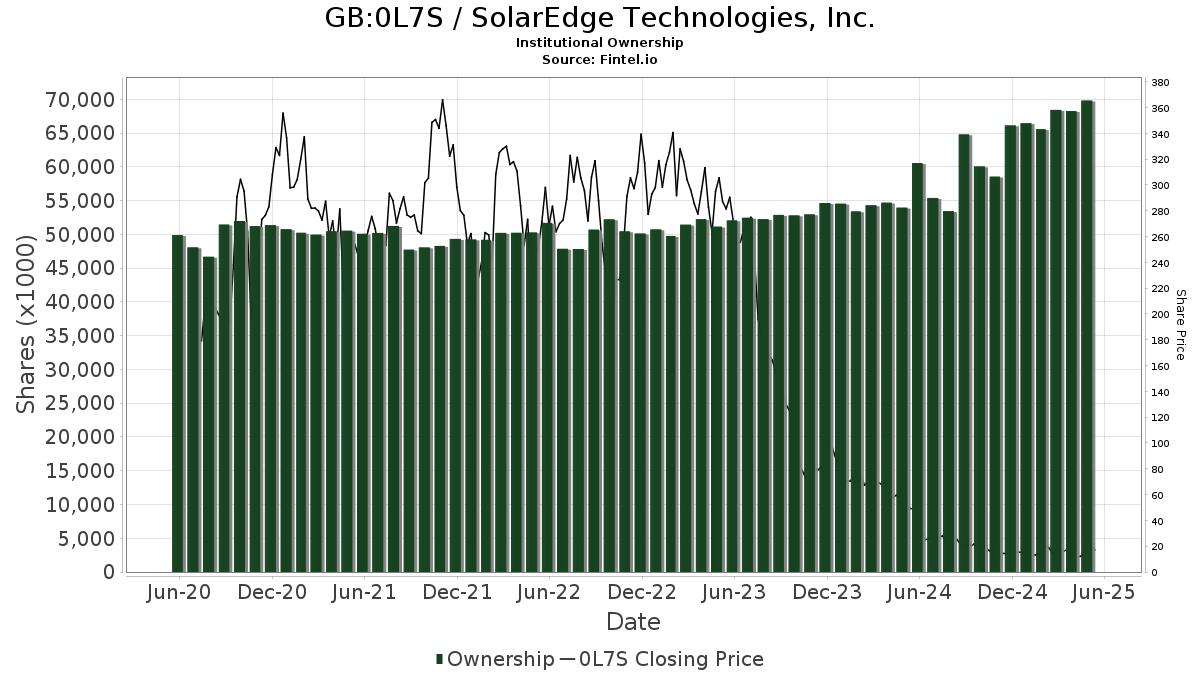

Fund Sentiment Overview

Currently, 443 funds or institutions report holdings in SolarEdge Technologies, a decrease of 52 owners or 10.51% from the previous quarter. The average portfolio weight for these funds is 0.14%, an increase of 27.47%. Institutional ownership has risen by 2.02% to 69,804K shares over the last three months.

Institutional Shareholder Activities

Grantham, Mayo, Van Otterloo & Co. holds 4,577K shares, reflecting 7.75% ownership, down from 4,954K shares, a decrease of 8.23%. Their allocation in 0L7S increased by 6.54% last quarter.

Swedbank AB owns 4,274K shares, or 7.24% ownership, up from 3,292K shares, an increase of 22.97%. They reduced their portfolio allocation in 0L7S by 14.68% last quarter.

IJR – iShares Core S&P Small-Cap ETF holds 3,580K shares, representing 6.06% ownership, down from 3,740K shares, a decrease of 4.46%. They raised their portfolio allocation in 0L7S by 27.17% last quarter.

Ion Asset Management increased its holdings to 2,082K shares (3.53% ownership), up from 883K shares, a rise of 57.61%. Their allocation in 0L7S soared by 95.64% last quarter.

Invesco decreased its holdings to 1,972K shares, or 3.34% ownership, down from 2,445K shares, a drop of 24.02%. They cut their portfolio allocation in 0L7S by 90.94% last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.