Newmont Corporation’s Dominance in Precious Metals

Newmont Corporation (NYSE:NEM) stands tall as the world’s foremost gold producer, generating a staggering 5.3Moz (million ounces) of gold per year, complemented by 35oz of silver, 100Mlbs of copper, and diverse other byproduct metals like zinc and lead. The total GEO (gold equivalent ounce) production easily surpasses 7 million ounces. Newmont’s prodigious production profile stretches far into the future, with ongoing production assured until at least 2032.

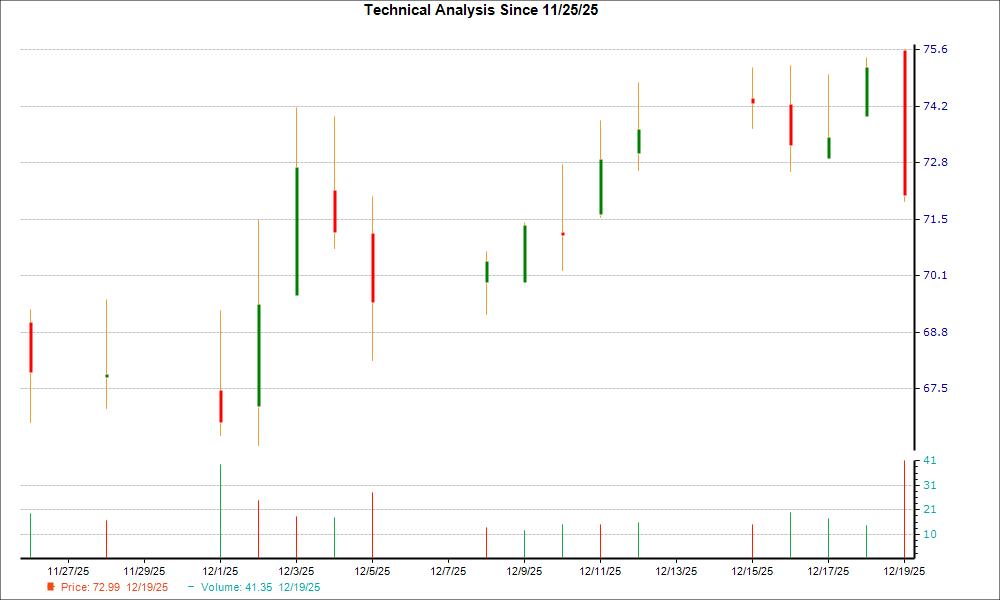

Operating predominantly in politically stable locations such as Canada and Australia, Newmont’s stock price recently underwent a steep decline, plunging by over 50% from its 2022 peak of over $80 per share. Given the current entry point near a 5-year low, Newmont becomes an enticing prospect. For every $100/oz surge in gold prices, Newmont adds a phenomenal $400 million per year to its free cash flow. With the long-term upward trajectory of gold prices lending support to sustained levels and Newmont’s leading production profile combined with metal diversification, the corporation has emerged as a stable source of dividend income and offers substantial potential for capital appreciation.

Assessing the Fair Value

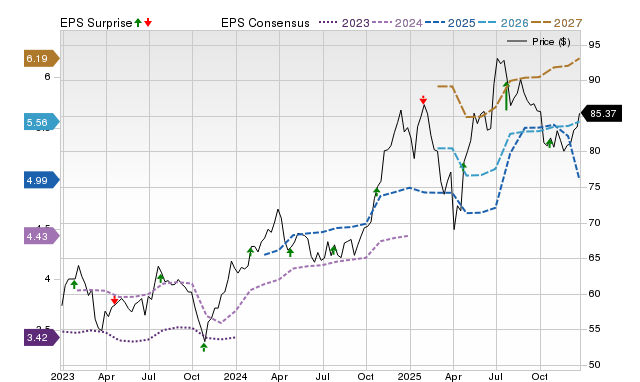

Establishing the Estimated Fair Value (EFV) requires a simple calculation based on E25 EPS (Earnings Per Share) multiplied by P/E (Price/EPS).

EFV = E25 EPS X P/E = $3.10 X 18 = $55.80

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

4.0 |

2.7 |

2.6 |

|

Price-to-Earnings |

17 |

15 |

13 |

Analyzing the Portfolio

|

Quarter ending September |

AISC (all-in sustaining costs) ($/Oz) |

Production (Gold Equivalent kOz) |

|

North America |

$1,712 |

507 |

|

Central and South America |

$1,438 |

71 |

|

Australia/Pacific |

$1,006 |

304 |

|

Africa |

$1,270 |

208 |

|

Total |

$1,426 |

1260 |

With a projected production for the full year 2023 of 5.3Moz of gold, coupled with 100Mlbs of copper, 15Moz of silver, 100Mlbs of lead, and 230Mlbs of zinc, Newmont’s average AISC is estimated to hover around $1,426/oz.

North American production ascended by 3.7%, but AISC surged by 15.5%. Inflationary cost escalations predominantly drove this increase, with the aging assets in North America leading to higher sustaining costs to access deeper or more challenging gold deposits.

Central and South American production dwindled by 71.5%, while AISC shot up by 20.2%. The labor strike at the Peñasquito mine dealt a heavy blow to South American operations. Excluding this, marginal production growth occurred due to enhanced recovery at Cerro Negro. Inflationary pressures drove cost increases in this region.

Australia/Pacific witnessed a moderate 2.7% surge in production, with a mere 4.5% rise in AISC. Notable increases in the production of other metals, mainly copper, were recorded at the Boddington mine in Australia. Anticipated improvements in production for 2024 stem from the waste processing plant, allowing for heightened extraction rates from ore.

Africa suffered an 18.1% drop in production, coupled with a 21.5% surge in AISC. This was due to a temporary closure in Akyem, necessitating road reinforcement. Additionally, a large custom-tooled gear at Ahafo South was damaged, compelling the mill to operate at limited capacity. Newmont forecasts a return to full capacity in the first half of 2024.

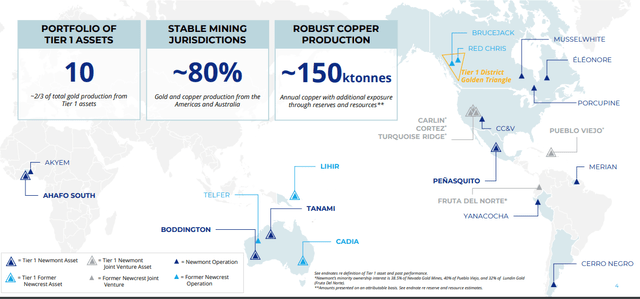

Strategic Expansion Into Copper

In a bold step for this venerated mining giant, Newmont Corporation is making a significant shift toward copper production, a pivotal response to the global energy transition. Copper, a fundamental metal in electrical component manufacturing, currently grapples with a dearth in supply, despite surging demand. According to McKinsey, copper demand is projected to surge by 46% by 2031, with supply lagging by a colossal 6.5 million metric tons. Furthermore, S&P reports that approximately 60% of global copper originates from regions plagued by unstable geopolitical conditions, enhancing the allure of Newmont’s Australian production profile.

The completion of the $16.8 billion acquisition of Newcrest Mining in November 2023 marks a seminal event for Newmont. This monumental transaction, initially announced in March 2023, promises to amplify Newmont’s prowess, infusing ~2.2Moz of gold production and 280Mlbs of copper production. Moreover, Newcrest boasts a considerable reserve profile, significantly broadening Newmont’s asset base and conferring control of over half of the globe’s tier 1 gold deposits. By the close of 2025, the amalgamated entity is anticipated to accrue savings of at least $300 million by harmonizing Newcrest’s assets with Newmont’s management and supply chain.

Immediate expansion into gold encompasses two pivotal projects at Tanami in Australia and Ahafo in Ghana. Long-term expansion initiatives involve life extensions at Porcupine, Cerro Negro, and sulfide extraction in Peru.

The Tanami expansion is predicted to usher in a substantial increase of 175koz in annual production, effectively extending the mine’s operational life.

Newmont Corporation’s Ongoing Growth Strategy and Risk Management

Amid the challenging landscape of the global mining industry, Newmont Corporation is setting the stage for significant expansion and efficiency. The company’s strategic initiatives include an expansive buildout plan and a focus on risk mitigation to ensure a robust and sustained growth trajectory. Let’s delve into Newmont’s expansion plans, risk factors, and the projected outlook for the company.

Newmont’s Expansion Plans

Newmont is set to embark on an extensive expansion plan, aiming to bolster its production capabilities and fortify its market position. The Ahafo North expansion, leveraging the existing infrastructure of the Ahafo South mine, is poised to extend the aggregate life and deliver an extra 300koz of production over 13 years. This expansion is anticipated to drive down the average All-In Sustaining Costs (AISC), marking a pivotal enhancement in the company’s production profile. The projected estimated costs for this expansion stand at $1.2 billion, with around $600 million yet to be expended until its completion.

The Thrust towards Efficiency and Diversification

Newmont’s strategic vision extends beyond gold, as it gears up for a trimetallic mine near its existing operations in Peru. This venture, rich in gold, copper, and silver, illustrates the company’s proactive stance towards diversification and capitalizing on valuable reserves. The planned output of 525,000kGEO, set to extend well beyond 2040, reinforces Newmont’s long-term commitment to sustainable and lucrative ventures. Despite the sophisticated extraction requirements inherent in mining a refractory deposit, which demands considerable capital, Newmont’s bullish approach is indicative of its drive to tap into high-grade resources and secure long-term growth.

Facing Unpredictable Terrain: Risk Mitigation

Mining, by its very nature, is fraught with unpredictability and a multitude of inherent risks. Newmont’s operations have encountered challenges across various fronts such as labor disputes, regulatory shifts, variable costs, mine quality fluctuations, pricing volatilities, and weather-related disruptions. While the company’s predominant operational bases in the stable regions of the Americas and Australia offer relative insulation from geopolitical uncertainties, recent labor disputes at the Peñasquito mine presented a stark reminder of the industry’s fragilities. The reopening of the mine in mid-October 2023 following a protracted labor standoff underscored Newmont’s resilience and commitment to navigating through such setbacks.

The Market Mergers and Future Pathways

Newmont’s acquisition of Newcrest has stirred market sentiments, triggering pertinent debates about the efficacy and eventual payoff of such strategic maneuvers within the gold mining domain. The $19 billion price tag attached to this acquisition has evoked skepticism within the investment sphere regarding the recovery of such formidable investments. The resulting confluence of market uncertainties, coupled with subdued financial results in the latter half of 2023, has exerted pressure on Newmont’s stock prices. The current market flux underscores the complexities inherent in such mergers, holding a mirror to the delicate balance Newmont treads as it charts its course through uncharted terrain.

Charting Future Trajectories

Despite near-term headwinds, Newmont anticipates a turnaround, with the final quarter of 2023 shaping up to be a robust period – a harbinger of sustained momentum carrying forth into the ensuing year. The company’s concerted efforts to alleviate production and cost headwinds, coupled with planned divestitures and a potentially significant dividend, portend favorable fiscal prospects. Moreover, Newmont’s forward-looking trajectory maps a decline in AISC towards the $1,100 range over the next five years, as production is slated for a meaningful upswing by the end of the stipulated period.

Fortified Fiscal Footing and Meliorative Moves

With $3.1 billion in cash reserves, $397 million in quarterly free cash flow, and a commendable debt-to-EBITDA ratio, Newmont’s fiscal fortitude augurs well for its standing in the gold sector. The company’s stringent focus on cost optimization, exemplified by the Full Potential program, is emblematic of its relentless pursuit of sustained savings and efficiency. Furthermore, Newmont’s announced intention to divest approximately $2 billion in assets, with an accentuated emphasis on developing its copper portfolio, reinforces its financial prudence and foresight. This high-caliber strategic realignment speaks volumes about Newmont’s commitment to fortifying its financial bedrock.

Calibrating Value and Market Stance

Newmont’s resolve to recalibrate its asset portfolio and hone its focus on the burgeoning copper domain reverberates the company’s ethos of resilience and adaptability. The forthcoming offloading spree, encompassing tier-2 operations sans growth potential, reflects Newmont’s shrewd tactics in shoring up its financial bulwark. The infusion of cash stemming from these divestitures is earmarked to augment Newmont’s balance sheet, fortifying its financial moorings for the long haul.

Concluding Insights: Navigating Newmont’s Trajectory

Newmont Corporation stands as a fulcrum entity in the global mining sphere, not only as the foremost torchbearer in gold production but also as an emergent force in the copper domain. The company’s unwavering dedication to operational efficacy, coupled with its judicious investment in growth avenues, underscores a harmonious blend of shareholder value creation and market fortification. As Newmont charts its onward trajectory through an ever-evolving landscape, its strategic blueprint is distinguished by a prudently calibrated approach, cementing its stature as a stalwart in the mining echelon.