In a twist that reverberated across trading floors, shares of Global Payments Inc. shed 6.5% in a single trading session, a bellwether response to its 2025 strategic vision and shift in operational focus. The company has unfurled a plan to harmonize its operational ecosystem, a move aimed at forging a more cohesive business framework. With a resolute eye on the horizon, GPN is postured for a transformational journey through 2025.

Venture deeper into the labyrinth, as we decipher the blueprint behind its outlook and strategic bull’s eye.

Global Payments’ Horizon vs. Street Consensus

Global Payments has honed in on attaining mid-single-digit percentage growth in adjusted net revenue for 2025, sans dispositions – a goal subtly skirting under the Zacks Consensus Estimate, which was perched at an approximate 7% year-over-year growth parapet. Buckling down for resilience, the company visualizes a revenue surge ranging from mid-to-high single digits in the span of 2026-2027.

On the profitability front, the firm has set its sights on achieving an uptick of roughly 10% in adjusted earnings per share for 2025, sailing upstream against the current projecting a 13.1% year-over-year surge for the same epoch. The crust of the biscuit reveals a low teens percentage escalation in the bottom line for the forthcoming 2026-2027 era.

GPN’s optics for 2025 underline an expansion of the adjusted operating margin by over 50 basis points (bps). As the horizon unfolds towards 2026-2027, an augmented margin to the tune of 50-100 bps is on the forecasted canvas.

GPN’s Portfolio Pruning

The company has wielded the divestiture scalpel with a steady hand, excising non-core entities. GPN’s $1 billion handover of the Netspend business to its progenitors last year echoes its aversion to the consumer side of the equation, seeking sanctuary in the business-to-business (B2B) landscape. Peering into its crystal ball, Global Payments has identified potential divestments, wielding a financial axe estimated at annual adjusted net revenues in the ballpark of $500-$600 million. Moreover, selective tuck-in merger and acquisition endeavors are on the docket.

GPN envisions that its metamorphosis and streamlining ballet will deliver over $500 million in run-rate operating income benefits by H1 of 2027. A watershed moment looms large, with 30% of these gains slated for the upcoming year, while the residual bounty earmarked for the 2026-2027 twilight. However, the company anticipates one-time costs to eat up two-thirds of these anticipated benefits.

GPN’s Vision Beyond the Horizon

The compass needle points to a capital expenditure orbit grazing the 7-8% range of its adjusted net revenues.

Investor interests have fixed on the company’s overtures to embolden shareholder value. With a laser focus on share buybacks, GPN is gunning for a northward trajectory with over $2 billion earmarked annually for the purpose. An ambitious game plan is on the cards, intending to shovel back over $7.5 billion in capital over the next triennium. Global Payments unfurled shares worth $900 million into its treasury chest in H1 of 2024.

The wellspring of cash flow brewing within Global Payments’ ecosystem is on standby, greasing the wheels for its shareholder-centric initiatives. The Zacks Rank #3 (Hold) stalwart anticipates a cash flow deluge in the neighborhood of $8.5-$9 billion over the forthcoming three-year epoch. Last year bore witness to a $2.5 billion swell in adjusted free cash flow.

GPN’s Stock Symphony

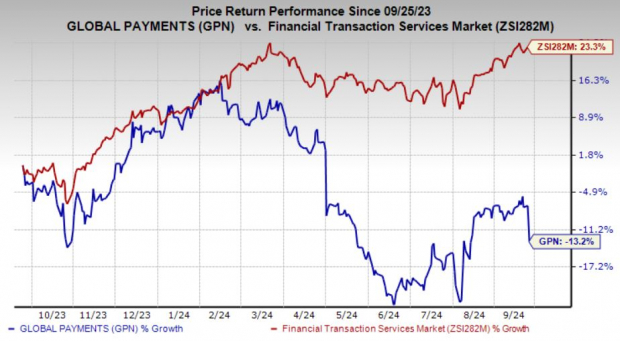

An attentive gaze from investors lingers on the pricing waltz orchestrated by the company amidst this epoch of change. Over the past twelvemonth, Global Payments’ shares have lost 13.2% against the backdrop of the industry’s 23.3% spike.

Image Source: Zacks Investment Research

Top Contenders in the Arena

Fortune favors the proactive! Savvy investors eyeing greener pastures can turn their binoculars towards some prime contenders from the expansive tapestry of the Business Services realm. Keep a watchful eye on Fidelity National Information Services, Inc. FIS, Paysign, Inc. PAYS, and Remitly Global, Inc. RELY, each bearing a unique Zacks Rank distinction. While Fidelity National soars with a Zacks Rank #1 (Strong Buy) badge, Paysign and Remitly Global flaunt a Zacks Rank #2 (Buy) insignia. Explore the complete array of today’s Zacks #1 Rank stocks here.

Eavesdrop on whispers from the grapevine – the Zacks Consensus Estimate for Fidelity National’s current-year earnings heralds a 50.7% surge year-over-year. FIS emerged victorious in eclipsing earnings predictions in two of the last four quarters, with two misses in the mix. The consensus projection for current-year revenues is perched at $10.2 billion.

Paysign is not one to be left idle, with the current-year earnings consensus throwing up an eyebrow-raising 75% crescendo year-over-year. Hovering over the current-year revenue radar, the consensus stance portrays a $58 million outlay, signaling a 22.6% swell year-over-year.

Remitly Global orchestrates a symphony of growth in the current-year earnings arena, trumpeting a 53.9% uphill hike year-over-year. With the melody of past hits reverberating across quarters, RELY boasts a two-hit wonder alongside two missed beats, with an average surprise quotient of 8%. The consensus take on current-year revenues chimes in with a 31.8% uptick year-over-year.

7 Best Bets for the Next 30 Days

Just unveiled: A septet of premier stock picks meticulously plucked from the Zacks Rank #1 Strong Buys roster. These pearls perch atop a pedestal labeled “Most Likely for Early Price Pops.”

Since 1988, this elite lineup has vanquished the market twofold, notching an average yearly gain of +23.7%. Don’t let these handpicked treasures slip under your radar.

The thoughts and sentiments articulated herein express the author’s viewpoints and do not necessarily mirror those of Nasdaq, Inc.