“`html

Corning Incorporated (GLW) is experiencing significant growth due to investments from major clients, notably Apple Inc., which is set to invest $2.5 billion in Corning’s Kentucky facilities to produce cover glass for iPhones and Apple Watches. This investment forms part of Apple’s broader $600 billion multiyear investment plan in the U.S. Corning is also expanding its Kentucky facility to support this demand.

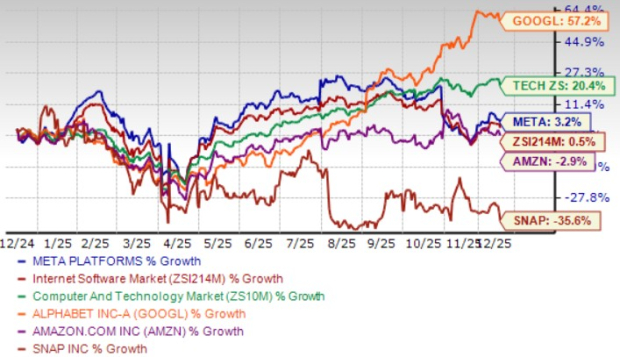

Additionally, Corning is supplying next-generation fiber optic cables to Lumen and AT&T for network expansion in the U.S. In another collaboration, Broadcom Inc. will integrate Corning’s optical components into its systems to meet connectivity needs for AI Clusters. Corning’s stock has surged 81.3% over the past year, with earnings estimates for 2025 and 2026 rising by 5.11% and 5.88% respectively.

Corning is capitalizing on its strong domestic manufacturing footprint amid increasing geopolitical uncertainties, as companies seek reliable local supply chains. The company’s shares currently trade at a price/earnings ratio of 29.46, significantly lower than the industry average of 33.18.

“`