“`html

GM Lowers 2025 Earnings Forecast Amid Tariff Concerns

General Motors (GM) has revised its 2025 earnings outlook downward, estimating that new U.S. auto tariffs could cost the company between $4 billion and $5 billion. This updated guidance was released yesterday, just two days after GM’s first-quarter results were made public, which did not account for the impact of tariffs. In light of this uncertainty, GM has also temporarily suspended its share buyback program. These actions reflect the growing pressure from global trade tensions, particularly with tariffs aimed at foreign-built vehicles and parts.

Implications for Competitors

Ford Motor Company (F) is expected to release its earnings next week, and analysts predict it may also adjust its 2025 forecast downward. Like GM, Ford’s prior outlook did not consider tariffs. The company’s CEO has previously warned that tariffs could destabilize the auto industry. Additionally, U.S. motorcycle manufacturer Harley-Davidson (HOG) has also withdrawn its earnings guidance due to similar macroeconomic uncertainties.

General Motors’ Revised Financial Projections

GM now anticipates adjusted EBIT for 2025 to be between $10 billion and $12.5 billion, a decline from its previous guidance of $13.7 billion to $15.7 billion. The forecast for net income attributable to shareholders is now expected to range from $8.2 billion to $10.1 billion, down from an earlier estimate of $11.2 billion to $12.5 billion. Furthermore, adjusted automotive free cash flow is projected to be between $7.5 billion and $10 billion, lower than the prior guidance of $11 billion to $13 billion.

Significantly, one key factor in this downward revision is a projected $2 billion hit from South Korea. Models such as the Buick Encore GX, Buick Envista, Chevrolet Trailblazer, and Chevrolet Trax are assembled there and accounted for nearly 18% of GM’s vehicle sales in the first quarter. GM also noted ongoing exposure to manufacturing facilities in Canada and Mexico.

As of the end of the first quarter of 2025, GM reported a remaining share repurchase capacity of $4.3 billion. However, the company has opted to freeze further repurchases until it gains more clarity on the tariffs’ financial impacts.

Analysts have begun revising their EPS forecasts for General Motors downward, and further cuts may follow.

Image Source: Zacks Investment Research

GM’s Strategy Against Tariffs

General Motors aims to counteract around 30% of expected tariff-related costs through “self-help initiatives,” which are already reflected in the updated guidance. These initiatives involve increasing U.S.-based vehicle and battery module production, as well as enhancing compliance with USMCA sourcing requirements.

CEO Mary Barra highlighted GM’s long-term strategy towards a more U.S.-centric manufacturing footprint. Since 2019, the company has increased its U.S. direct purchases by 27%, with over 80% of U.S.-built vehicle content now meeting USMCA standards. Additionally, GM has significantly reduced reliance on China for direct materials, dropping to under 3%, to align with changing trade dynamics.

Price Performance and Valuation

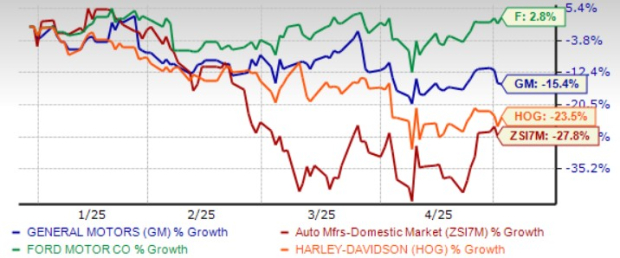

So far this year, General Motors shares have decreased by 15%, yet the decline is less steep than that of the industry. In comparison, Harley-Davidson has seen a 23% drop, while Ford has experienced a modest increase of 2.8% within the same timeframe.

YTD Price Performance Comparison

Image Source: Zacks Investment Research

From a valuation perspective, General Motors appears relatively undervalued. The stock has a forward price-to-sales (P/S) ratio of just 0.25, significantly lower than the industry average of 2.19. GM has a Value Score of A, indicating its investment appeal. In contrast, Harley-Davidson’s P/S ratio stands at 0.69, while Ford matches GM at 0.25.

GM’s P/S Compared to HOG & F

Image Source: Zacks Investment Research

Investment Outlook for General Motors

GM is currently dealing with short-term hurdles, yet its long-term strategy remains on course. The company is progressing in its electric vehicle (EV) strategy, having secured the position of the second-largest EV seller in the U.S., with Chevrolet emerging as the fastest-growing EV brand.

Notably, GM’s EV lineup turned “variable profit positive” by late 2024, indicating it now covers its production costs, and the company anticipates further reductions in EV-related losses this year.

Financially, GM is in a robust position, concluding the first quarter with $20.7 billion in cash and cash equivalents. Its restructuring efforts in China are showing promising results, with the company aiming for a return to profitability in those regions.

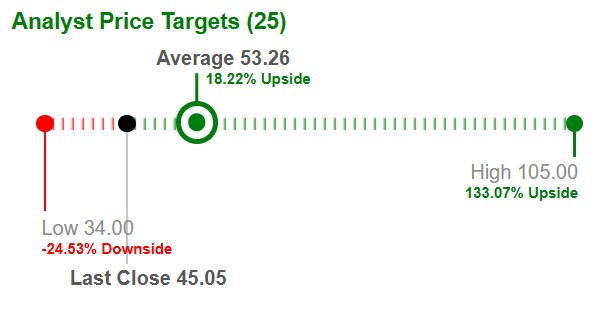

While GM continues to generate strong cash flow, escalating tariff pressures and the cessation of stock buybacks may impact investor confidence. Lowered earnings estimates could also affect public sentiment in the near term. However, for long-term investors, GM’s fundamentals and strategic direction remain solid. The current assessment suggests that it may be premature to sell, as GM retains its potential for future growth. At this moment, GM carries a Zacks Rank #3 (Hold), and Wall Street’s average target price is $53.46, indicating an anticipated upside of 18.2%.

Image Source: Zacks Investment Research

“`