General Motors Surpasses Ford in Electric Vehicle Sales: What Investors Need to Know

The automotive industry is experiencing remarkable change as driverless technology and electric vehicles (EVs) gain popularity over traditional gasoline cars. In a noteworthy development, General Motors (NYSE: GM) has recently moved ahead of Ford Motor Company (NYSE: F) in a critical area. This shift could be significant for those thinking about investing.

Pacing the Market

October saw a notable increase in the U.S. new light-vehicle market, which jumped 12%. This increase was largely driven by strong retail sales, providing a welcome change for investors who faced lackluster results earlier. However, for Ford investors, the news was less encouraging regarding the company’s position in EV sales, where Ford fell to No. 2. The company sold 6,264 EVs in October, an 8.3% drop from last year, totaling 23,509 EVs for the third quarter—numbers that cannot compete with General Motors. GM achieved record sales of 32,095 EVs in the same quarter, a remarkable 60% increase year-over-year and a 46% rise compared to the previous quarter.

“GM’s EV portfolio is expanding quicker than the market as we provide an all-electric vehicle for every type of driver,” explained Rory Harvey, GM’s executive vice president and president of global markets, in a recent press release.

For GM investors, more than 50% of their EV purchasers are new customers. The company is also focusing on boosting profitability, noting that new combustion engine vehicles are proving to be more profitable than older models due to effective cost-cutting and simplified options. GM forecasts it could reduce EV losses by $2 billion to $4 billion by 2025.

GM’s rise over Ford in EV sales during the third quarter highlights its strong performance. It led U.S. sales with nearly 660,000 deliveries, achieving nine consecutive quarters of year-over-year retail sales growth. GM also improved its market share with strategic pricing, efficient inventory management, and minimal incentives, while also seeing better conditions in China compared to the previous quarter.

The Bigger Picture

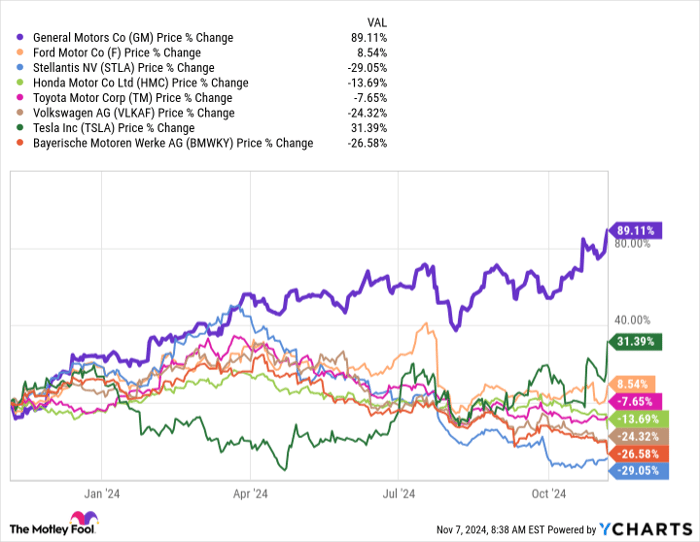

General Motors surpassing Ford in EV sales marks a significant turning point for the company, showcasing its growing strength in the industry, clearly reflected in its stock performance.

GM data by YCharts

The current trajectory for General Motors indicates it is effectively delivering value to its shareholders, illustrated through significant share buybacks and dividend distributions. Its focus on building more profitable vehicles and cutting costs in the EV sector aligns with a vision for a driverless future, driven by its Cruise operations.

Interestingly, even after its surge in 2024, GM’s stock carries a low price-to-earnings ratio of 5.8, suggesting it may represent a strong investment opportunity. General Motors could now stand as the leading Detroit automaker for potential investors.

Should You Invest $1,000 in General Motors Right Now?

Before deciding to buy stock in General Motors, here are some considerations:

The Motley Fool Stock Advisor team has recently named what they believe are the 10 best stocks to invest in right now—and General Motors is not on that list. The selected stocks are anticipated to deliver substantial returns in the coming years.

Consider Nvidia, which made the list on April 15, 2005. If you had invested $1,000 at that time, it would now be worth $904,692!*

Stock Advisor offers investors straightforward strategies for success, featuring guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of November 4, 2024

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.