New Auto Tariffs Impact U.S. Industry: GM vs. Tesla Investment Analysis

A fresh wave of auto tariffs is shaking the U.S. auto industry, now targeting imported parts instead of fully assembled vehicles. Previously, American-made cars were largely spared from tariffs; however, this new measure impacts almost every vehicle produced in the United States. No car of the 10 million made last year was free of foreign components. As these duties take effect, manufacturers face potential costs in the tens of billions, which may lead to increased prices for consumers.

The auto industry, already at the mercy of economic cycles, now grapples with heightened uncertainty. Investors should approach this landscape with caution. Two industry giants—General Motors (GM) and Tesla (TSLA)—provide insight into investment choices amid these challenges. This analysis will cover their fundamentals, growth prospects, and associated risks to determine which automaker presents a more favorable investment opportunity right now.

General Motors: Resilient Yet Cautious

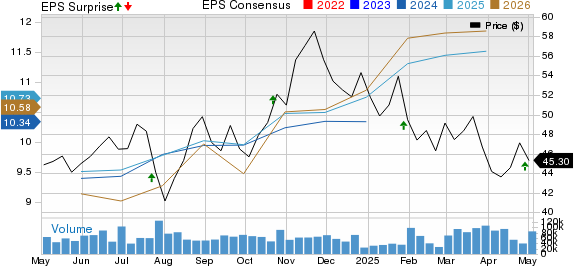

General Motors stands as the nation’s top-selling automaker, bolstered by strong demand for its popular pickups and SUVs. In its recent first-quarter 2025 results, GM upheld its record of exceeding earnings expectations, showcasing resilience in challenging conditions.

General Motors Company Price, Consensus, and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

Nonetheless, GM is not shielded from these tariffs. The company recently reduced its full-year guidance due to ongoing uncertainties. It now anticipates adjusted EBIT between $10 billion and $12.5 billion, down from a previous range of $13.7 billion to $15.7 billion. Additionally, net income forecasts have been adjusted downward to $8.2 billion–$10.1 billion, compared to earlier estimates of $11.2 billion–$12.5 billion. Free cash flow expectations have declined as well, prompting GM to pause its share buyback program until the full impacts of the tariffs are understood.

Earnings Estimates for GM

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Despite these immediate challenges, GM’s long-term prospects remain robust, particularly with its transition to electric vehicles (EVs). It ranked as the second-largest seller of EVs in the latest quarter, with Chevrolet emerging as the fastest-growing EV brand. Notably, GM’s EV lineup achieved “variable profit positive” status by the end of 2024, indicating it now covers production costs. The company aims to further decrease losses this year.

Strategic partnerships with companies such as Vianode, LG Chemical, and Lithium Americas have strengthened GM’s EV supply chain. Cost reduction is also a central focus; GM met its $2 billion cost-cutting goal in 2024 and aims for an additional $1 billion in annual savings by exiting its robotaxi program.

Financially, GM is positioned well, ending the first quarter with $20.7 billion in cash. The company is also making headway in restructuring its operations in China, targeting a return to profitability there this year.

In conclusion, while GM faces short-term hurdles, its strong internal combustion engine (ICE) and EV portfolios, improving cost structure, and a solid balance sheet underscore a promising long-term potential.

The Challenges Facing Tesla

Once considered the benchmark in the electric vehicle sector, Tesla is currently navigating a challenging phase. The company is experiencing declining deliveries across key markets amid increasing competition from traditional automakers and new EV entrants. Coupled with this, its brand image has taken a hit as CEO Elon Musk’s political activities have diverted attention from core business operations. In the first quarter of 2025, Tesla failed to meet its earnings expectations.

Tesla, Inc. Price, Consensus, and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Musk has recently pledged to decrease his role in the U.S. government’s Department of Government Efficiency (DOGE) to focus more on Tesla, but it’s uncertain if this will mitigate the existing issues. To maintain sales, the company has resorted to significant discounts, which is squeezing its automotive profit margins. With the current uncertainty surrounding tariffs and challenges in China, Tesla intends to reevaluate its 2025 delivery volume guidance in the next quarterly update.

Earnings Estimates for TSLA

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

A bright spot for Tesla is its fast-growing energy generation and storage segment, which has become more profitable. However, this growth isn’t sufficient to offset the challenges facing its EV operations.

Financially, Tesla remains solid, with $37 billion in cash as of March 31, 2025, slightly up from the previous quarter. Its long-term debt is low, yielding a debt-to-capital ratio of just 7%, providing flexibility for new investments.

Looking ahead, Tesla aims to capitalize on self-driving technology. Plans are underway for robotaxi services in Austin this June, alongside developments on the humanoid robot Optimus and a two-seat autonomous vehicle called the Cybercab, expected to enter mass production in 2026. However, these projects are still in early stages and carry inherent execution risks.

At present, Tesla’s core business—selling electric vehicles—is under pressure. The company’s future hinges on its ability to fulfill ambitious projects while stabilizing its existing operations.

Investment Outlook: GM vs. Tesla

Tesla is currently trading at a forward sales multiple of 8.75X, above its five-year median of 7.72X, signifying a Value Score of F. Conversely, General Motors boasts a Value Score of A, with a forward sales multiple of 0.25X, below its five-year average of 0.32.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

GM vs. Tesla: Navigating Challenges in the EV Market

Current Challenges for Tesla

Tesla, once the leader in electric vehicles (EVs), is currently grappling with declining sales and shrinking profits. Distractions from CEO Elon Musk further complicate matters. Although the company has ambitious plans related to robotaxis and humanoid robots, these initiatives remain largely unproven, putting pressure on their core automotive business.

GM’s Steady Performance Amidst Challenges

General Motors (GM) is facing its own obstacles, particularly in light of rising tariffs and a reduction in guidance. However, GM appears to be maintaining a stronger position than Tesla at this moment. The company continues to perform well in the truck and SUV markets, while its electric portfolio approached breakeven on variable profit in the last reported quarter. Additionally, GM is actively cutting costs and forging strategic partnerships to support its long-term objectives.

Investment Outlook: GM vs. Tesla

In an economic landscape characterized by uncertainty, tariffs, and changing consumer preferences, GM may offer a more stable investment option compared to Tesla. While Tesla retains a powerful brand image and ambitious vision, GM currently presents a more balanced approach and grounded execution strategy for investors.

Market Rankings

As it stands, Tesla holds a Zacks Rank of #5 (Strong Sell), while GM enjoys a #3 Rank (Hold).

In summary, both companies are managing significant challenges, but GM’s current stability may appeal to investors looking for a more secure position in the automotive sector.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.