U.S. stocks traded lower midway through trading, with the Nasdaq Composite falling over 1% on Tuesday.

The Dow traded down 1.05% to 38,389.76 while the NASDAQ fell 1.16% to 15,757.13. The S&P 500 also fell, dropping, 1.01% to 4,970.94.

Check This Out: Snap, American Express And 2 Other Stocks Insiders Are Selling

Market Performance

Utilities shares rose by 1.1% on Tuesday.

In trading on Tuesday, information technology shares fell by 0.8%.

Coca-Cola’s Triumph

Coca-Cola Company KO posted better-than-expected sales for its fourth quarter.

Coca-Cola reported fourth-quarter 2023 sales of $10.8 billion, up 7% Y/Y, beating the consensus of $10.67 billion. The adjusted EPS of $0.49 came in line with the consensus estimate.

For fiscal year 2024, Coke forecasts organic revenue growth of 6%-7% and an increase in comparable EPS of 4%-5%.

Surging Equities

Beamr Imaging Ltd. BMR shares shot up 55% to $15.43 after rallying more than 370% on Monday. Beamr Imaging priced $12 million public offering of 1,714,200 ordinary shares at $7 per share.

Shares of Whole Earth Brands, Inc. FREE got a boost, surging 35% to $4.75. Whole Earth Brands signed a definitive agreement to be acquired by affiliates of Sababa Holdings FREE, LLC for $4.875 per share in an all-cash transaction.

Digital Brands Group, Inc. DBGI shares were also up, gaining 206% to $8.78. Digital Brands reaffirmed its 2024 guidance revenue of $27 million to $30 million and committed to no equity offerings for 2024.

Declining Equities

Sunshine Biopharma, Inc. SBFM shares dropped 65% to $0.0667 after the company announced pricing of $10 million underwritten public offering.

Shares of BIOLASE, Inc. BIOL were down 66% to $0.1536 after the company announced pricing of $7 million public offering of 16 million units at a price of $0.44 per unit.

Sientra, Inc. SIEN was down, falling 69% to $0.1806 after the company announced plans to pursue a strategic sale of its business through a voluntary Chapter 11 process.

Commodity Performance

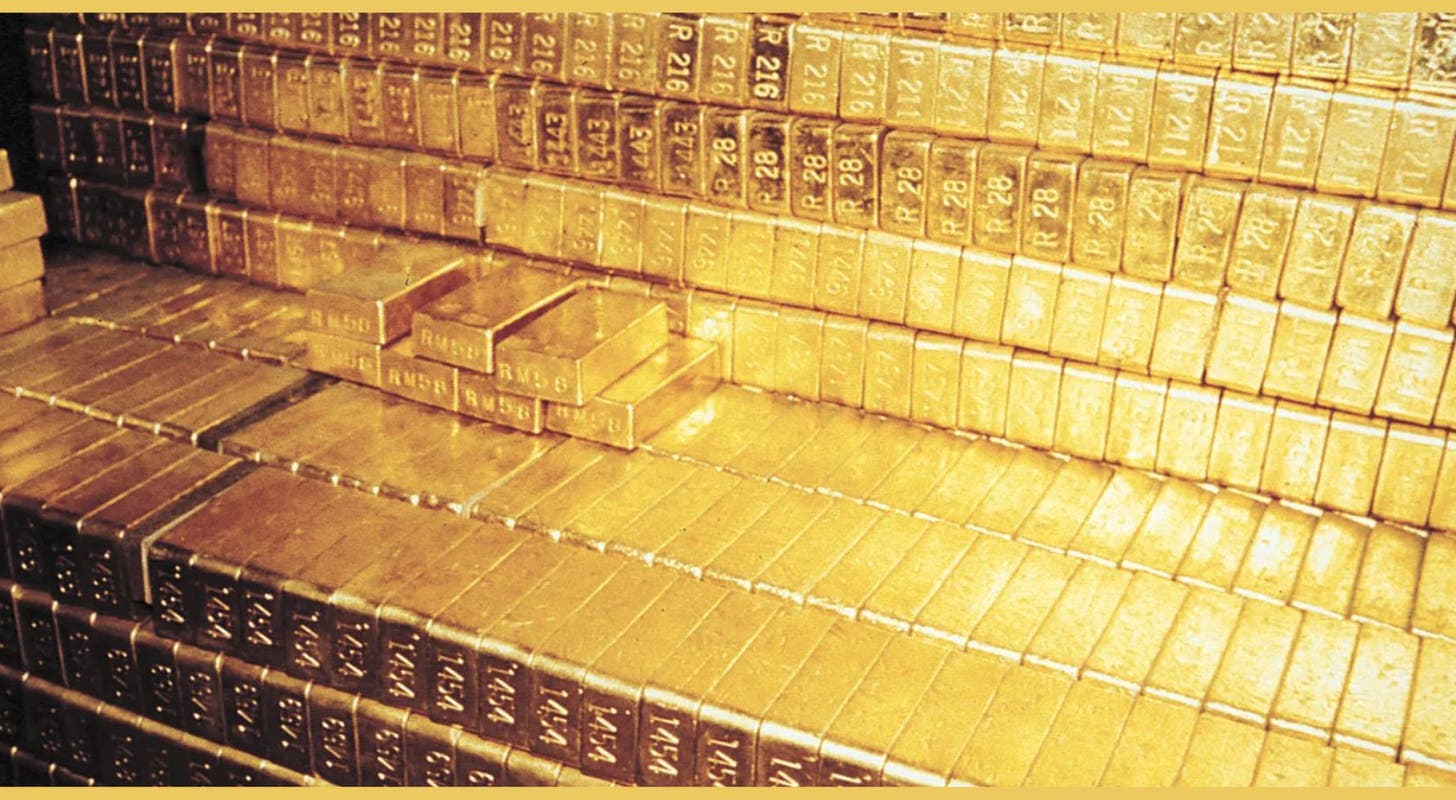

In commodity news, oil traded up 0.8% to $77.52 while gold traded down 1.4% at $2,004.70.

Silver traded down 3.1% to $22.055 on Tuesday while copper rose 0.1% to $3.7250.

Global Markets and Economic Indicators

European shares closed lower today. The eurozone’s STOXX 600 fell 1.04%, London’s FTSE 100 fell 0.97% while Spain’s IBEX 35 Index fell 0.69% The German DAX fell 0.96% French CAC 40 fell 0.98% while Italy’s FTSE MIB Index fell 0.97%.

Average weekly earnings including bonuses in the UK rose 5.8% year-over-year to GBP 669/week during the three months to December, while UK’s unemployment rate fell to 3.8% in the fourth quarter. The unemployment rate in France came in steady at 7.5% during the fourth quarter.

Asia Pacific markets closed mostly higher on Tuesday, with Japan’s Nikkei 225 gaining 2.89%, India’s S&P BSE Sensex gaining 0.70% and Australia’s S&P/ASX 200 falling 0.15%.

Producer prices in Japan increased by 0.2% year-over-year in January, while Japan’s machine tool orders fell 14.1% year-over-year to JPY 110,881 million for January.

Economic Indicators and Analysis

The NFIB Small Business Optimism Index declined to 89.9 in January from 91.9 in December.

The annual inflation rate in the U.S. eased to 3.1% in January from 3.4% in December, but came higher than market estimates of 2.9%.

Now Read This: ZoomInfo Technologies To Rally Around 50%? Here Are 10 Top Analyst Forecasts For Tuesday